East Daley: Bringing Transparency to All NGL Commodities

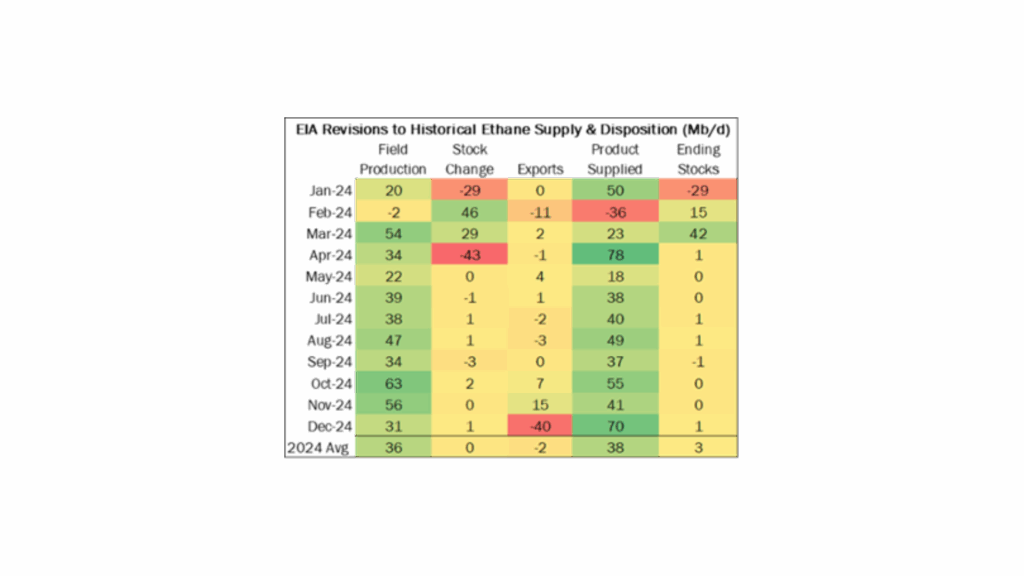

We combine publicly available data and proprietary models to explore not only the shifting market conditions surrounding natural gas liquids, but also NGL commodities such as ethane across the entire NGL lifecycle value chain. You receive all of the historical supply and demand data you need, as well as data-driven near-term forecasts on ethane production and supply—all easily accessible and easy for you and your fellow stakeholders to understand.

Make Informed Decisions Across the NGL Value Chain

Anticipate Market Changes and Mitigate Risks

Ensure Timely Decision-Making and Strategic Planning

Don’t Miss Opportunities in the Ethane Market

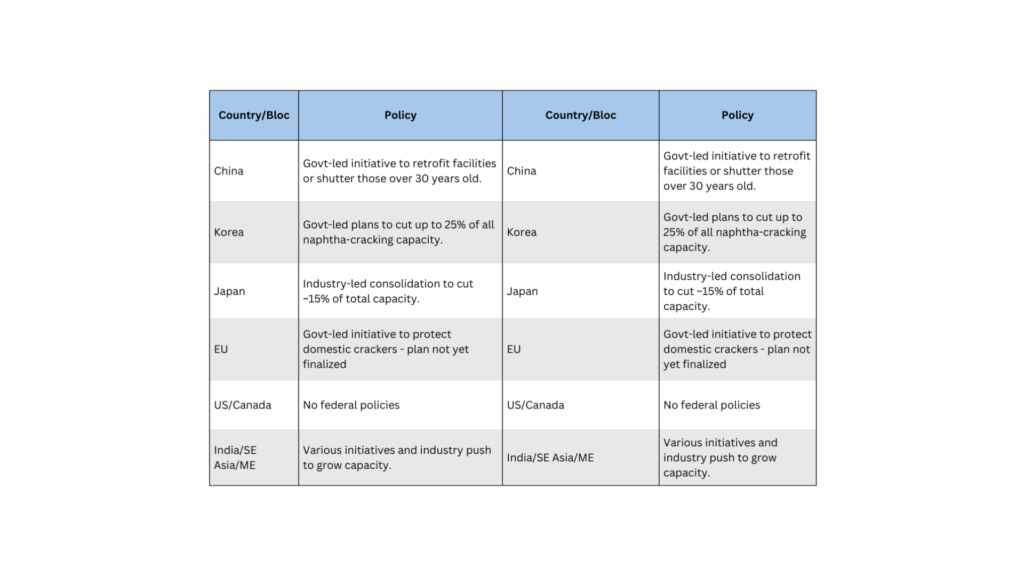

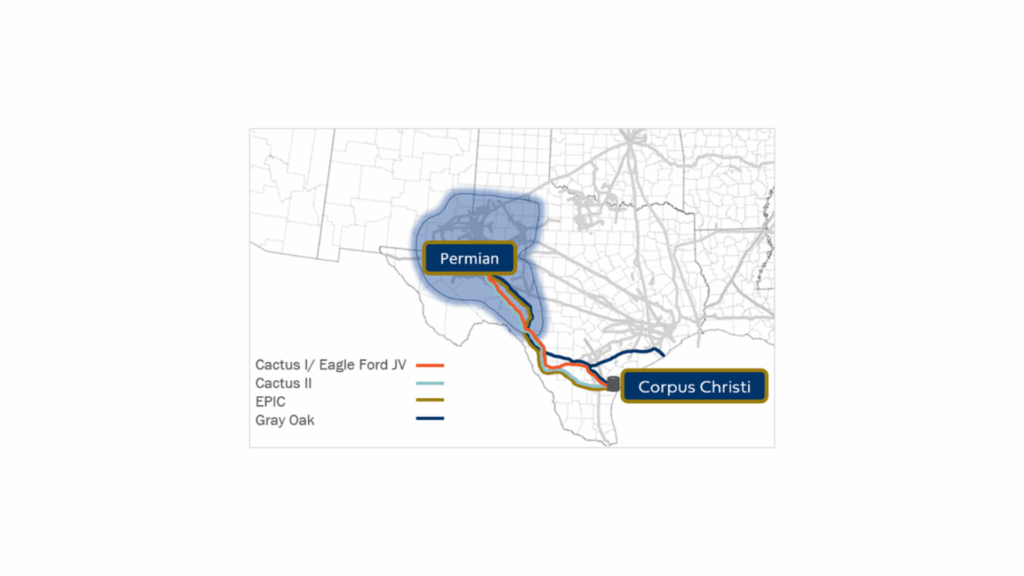

Ethane is an important NGL commodity, but in spite of its importance, the effects of variables such as growth across the Permian and Marcellus regions, domestic demand, and international demand on storage and price are often glossed over by energy market players—leading to missed opportunities surrounding this commodity in the fast-paced energy market.

Understanding Ethane Supply and Demand with East Daley Analytics

Ethane is a key petrochemical feedstock for the chemicals and plastics used in industrial and consumer products, offers potential as a cleaner alternative to other hydrocarbons, and exerts often-overlooked influence on the brader market. With East Daley Analytics, you gain insights into production, demand, and exports to help you understand where and when to invest in this crucial NGL commodity.

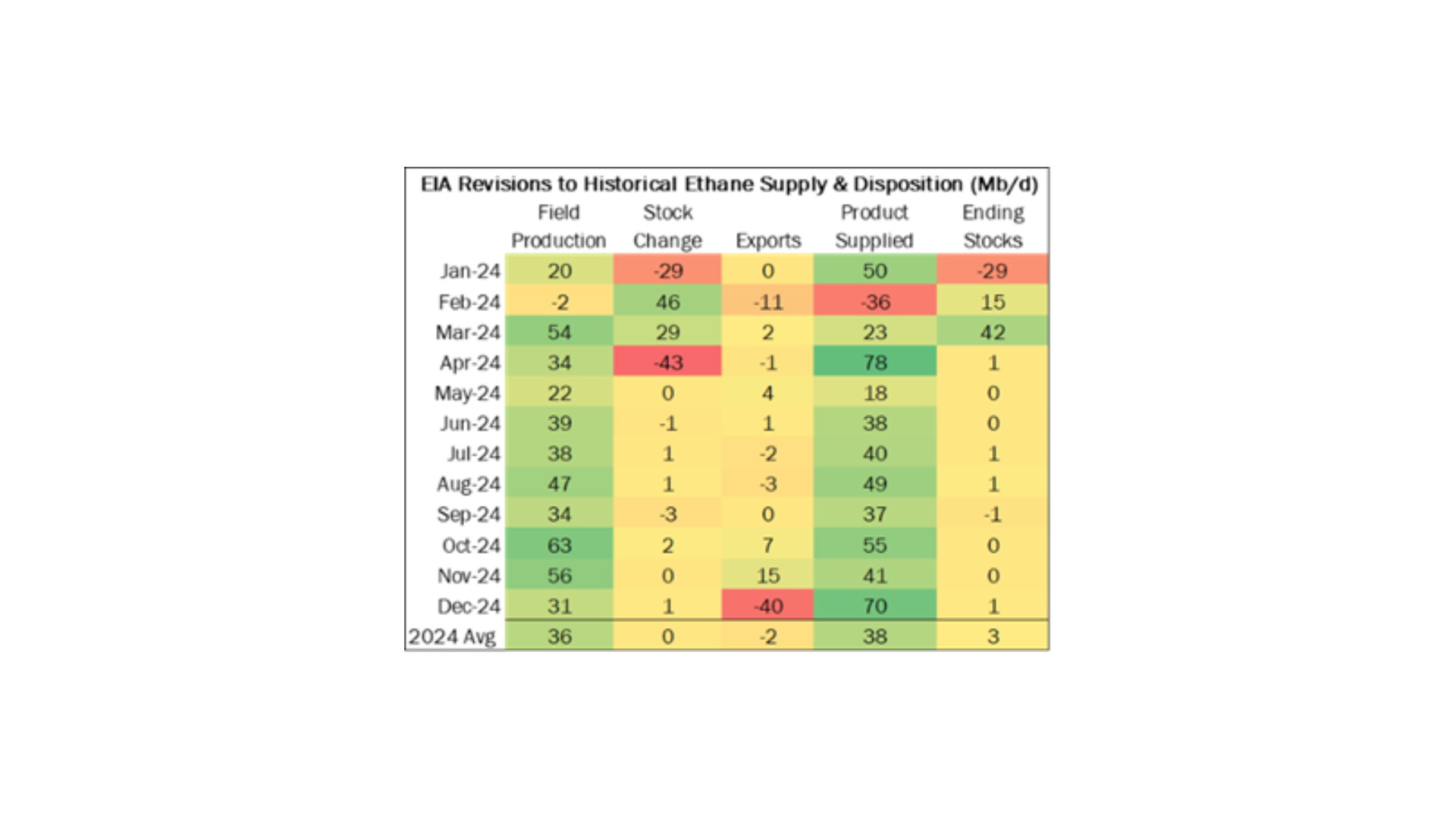

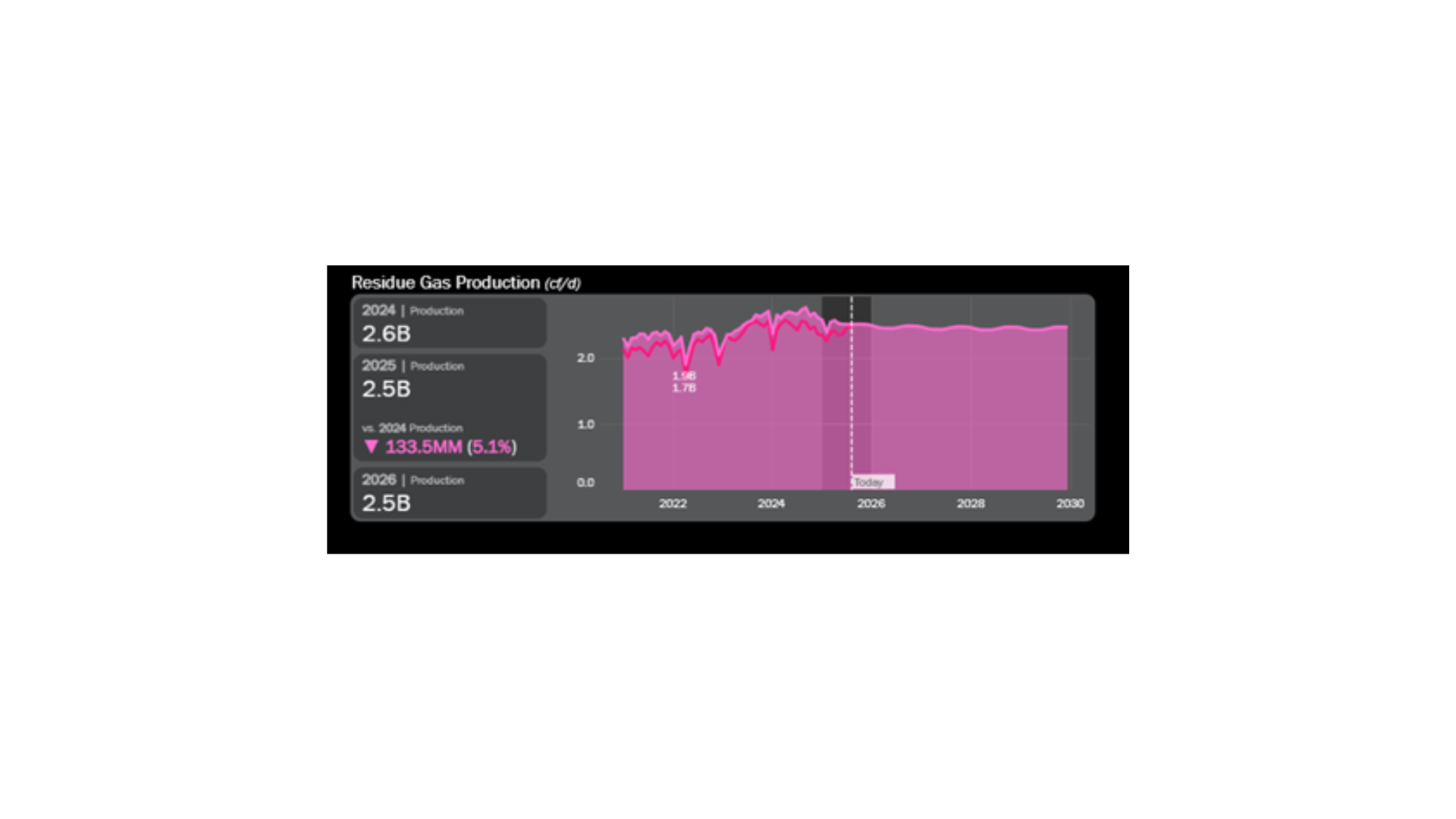

Gas Plant Ethane Production

Get insights into ethane at its source with historical data on and forecasts for the amount of ethane extracted from natural gas at processing plants across the continental US.

Refinery Ethane Production

Track and forecast the production of ethane as a byproduct of crude oil refining to fully understand the factors contributing to ethane supply in the NGL commodity market.

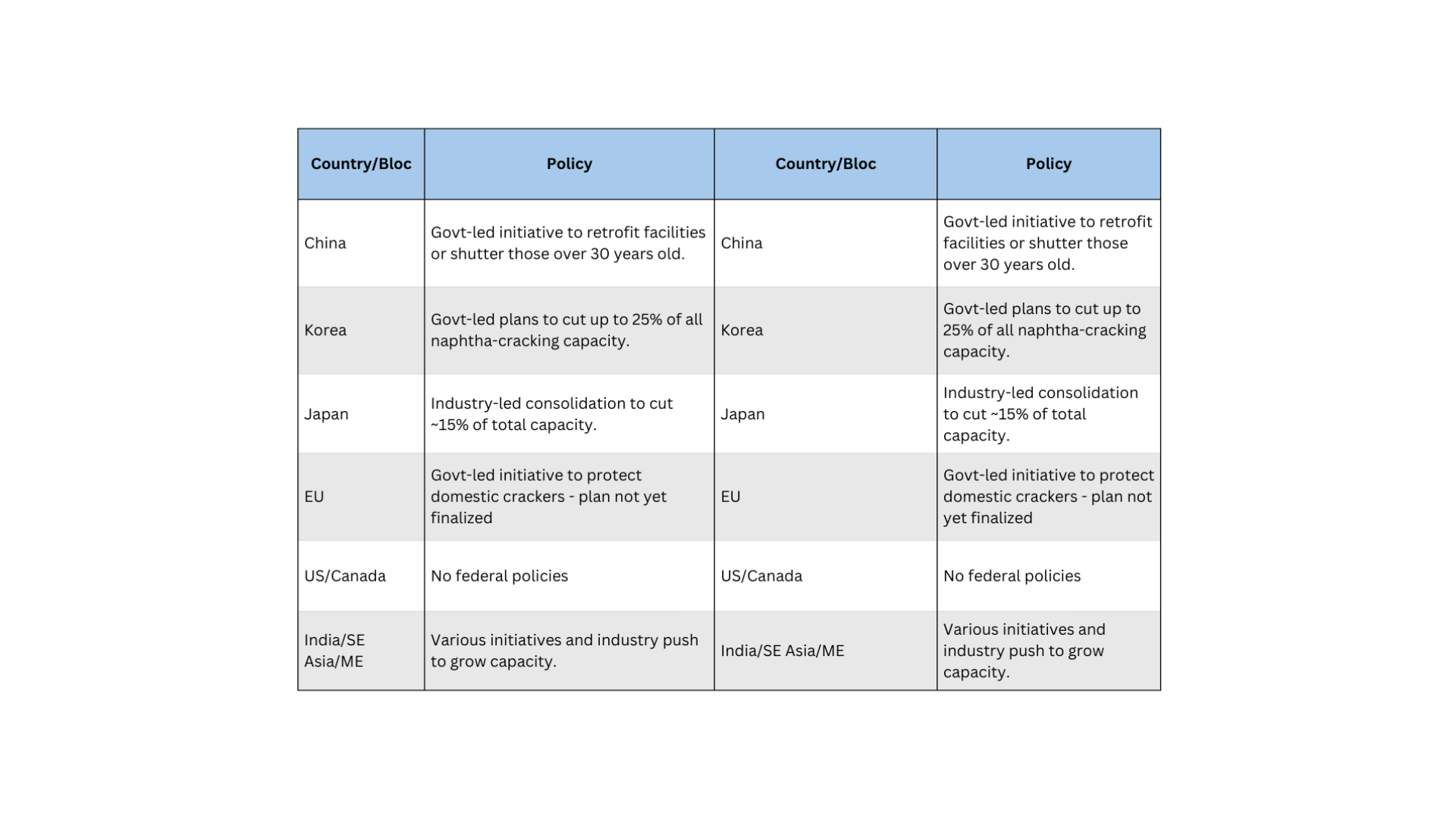

Domestic Demand from Ethylene Steam Crackers

Keep tabs on who’s using ethane and where for better strategic operations by analyzing the shifts in ethane consumption by US ethylene producers.

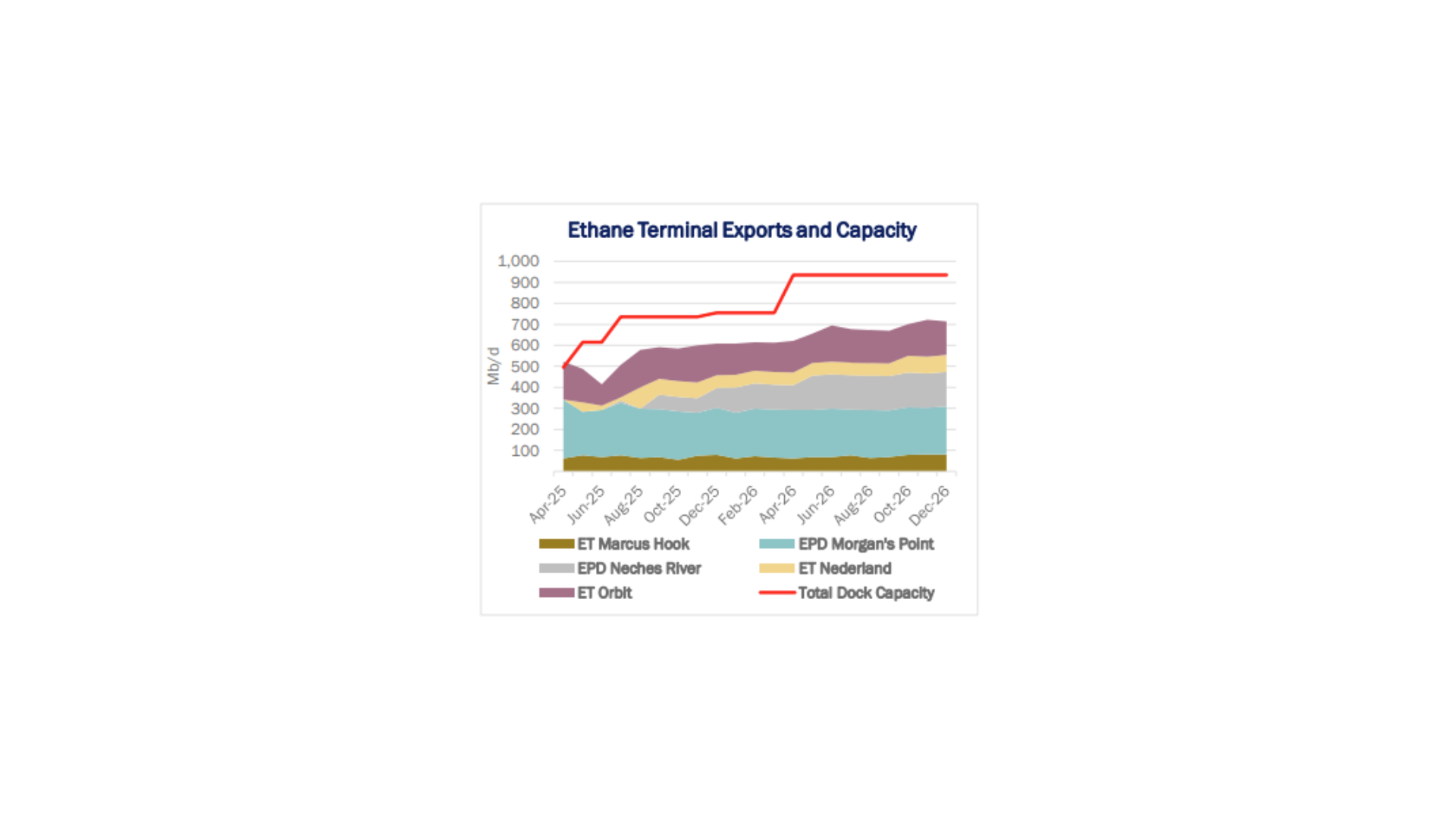

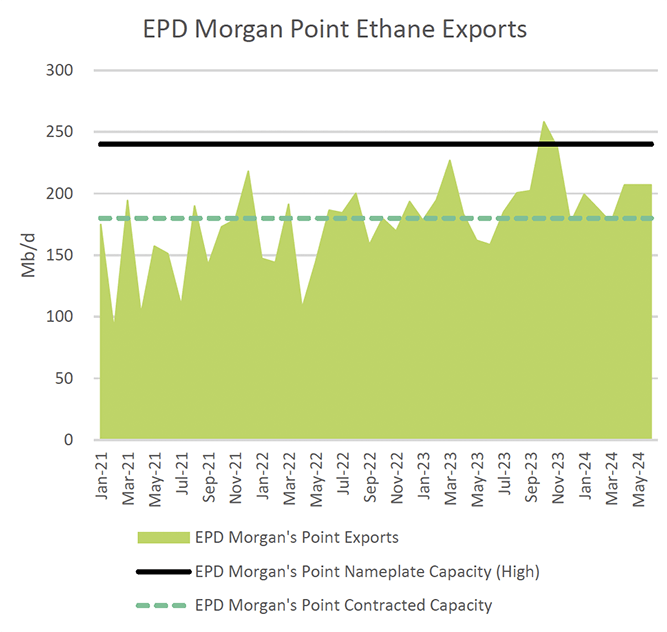

International Ethane Exports

Get a handle on foreign ethane market dynamics and anticipate demand shifts with forecasts based on historical volumes and rates of ethane exiting the domestic supply.