Midstream is seeing robust M&A activity, a trend East Daley Analytics expects to continue in 2024. In this year’s annual Dirty Little Secrets report, we look at the drivers behind consolidation and the commercial potential for further tie-ups.

Public midstream companies have been on an acquisition spree in 2023. Recent deals include Williams’ (WMB) acquisition of Cureton Midstream and the remaining 50% stake in Rocky Mountain Midstream, and Kinder Morgan’s (KMI) purchase from NextEra Energy Partners (NEP) of South Texas natural gas pipeline assets.

As the midstream sector transitions into a lower-growth environment with increasing regulations, we expect M&A to continue. Companies will use mergers to gain scale, better position themselves to take advantage of growing export markets, and optimize their existing assets in the ground.

Larger companies will need to source volumes to keep long-haul transportation assets highly utilized, while small-to-midcap (SMID) companies need downstream exposure to extract more fees as production growth slows. Enterprise (EPD) and Targa’s (TRGP) acquisitions of Navitas and Lucid highlight this trend, as the two companies can leverage dominant Permian G&P positions to drive volume growth through their integrated NGL businesses.

Dirty Little Secrets will also highlight EDA’s positive outlook on Tier 2 basins. While the Permian and Haynesville continue to be the main source of production growth, assets in those basins are fully valued. Midstream has an opportunity to bargain hunt in Tier 2 basins that could benefit from higher natural gas and LNG demand. The recent acquisitions by WMB in the Denver-Julesburg and KMI in the Eagle Ford indicate that some are already pursuing this strategy.

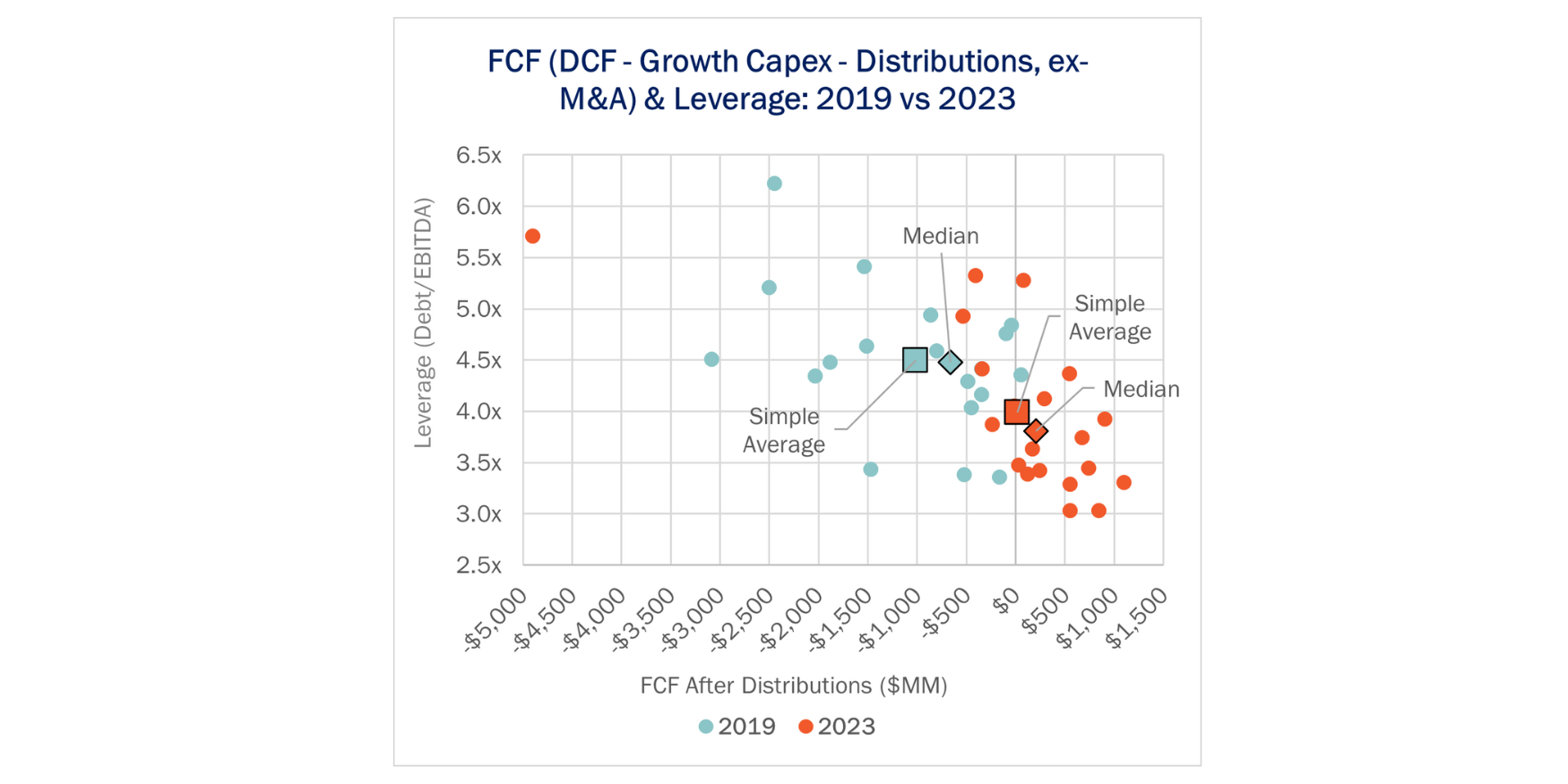

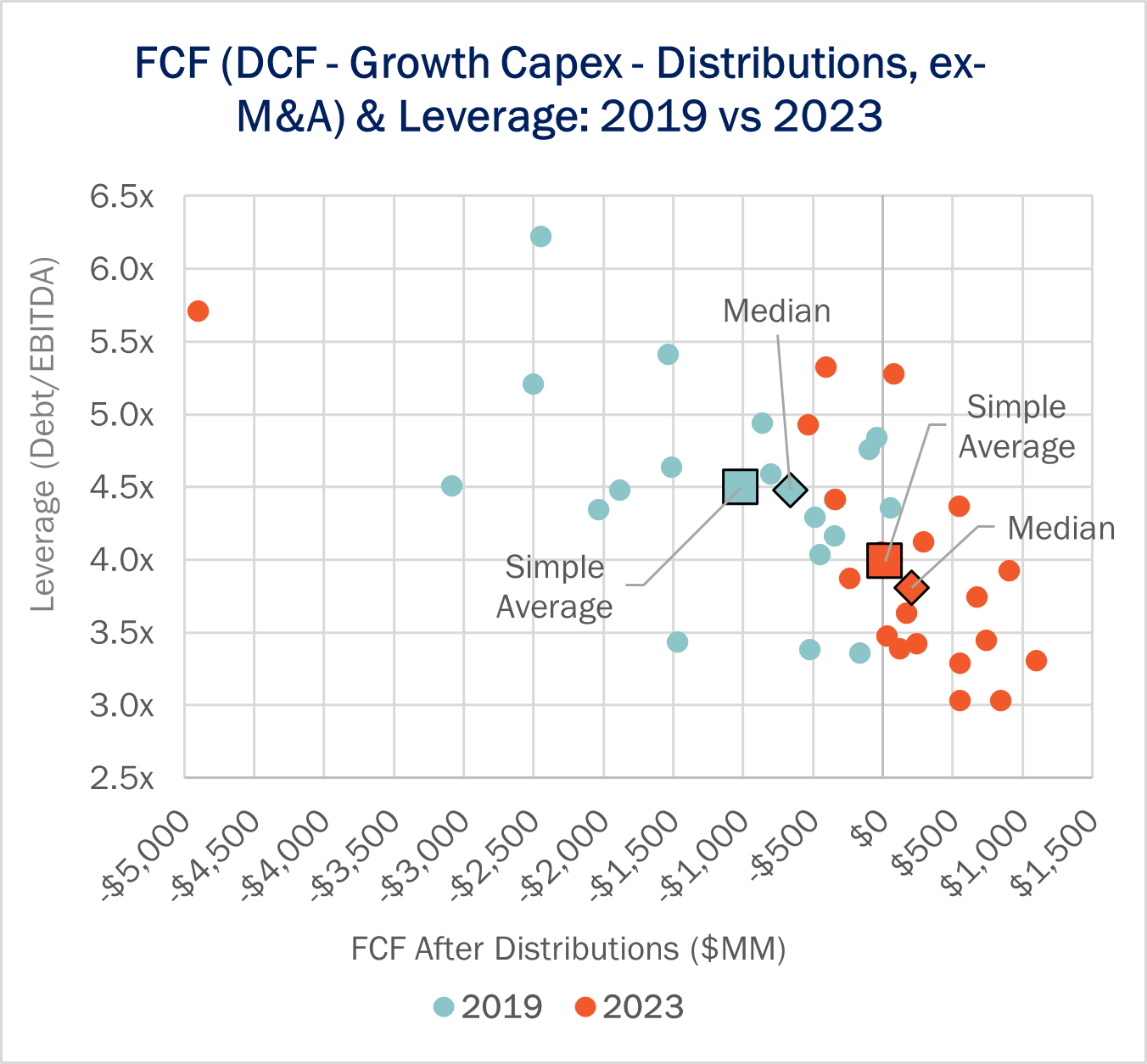

One thing is certain: midstream is in a position where it can afford to go on a buying spree. Growth capex (ex-M&A) has declined 30% from 2019 to 2023, from $42B to $29B. Free cash flow after distributions has swung from negative to positive, and leverage has trended below 4.0x across EDA’s coverage (see figure). With excess free cash flow and a reduced need for large greenfield projects, companies can look to M&A to drive growth and improve their competitive positioning.

In Dirty Little Secrets on December 13, EDA will expand on this analysis by exploring specific public midstream company combinations that catch our eye and the commercial opportunities they bring to the table. — Ajay Bakshani, CFA Tickers: KMI, EPD, ET, NEP, TRGP, WMB.

Dirty Little Secrets is Coming December 13

Join East Daley on December 13 at 10 am MST for our Dirty Little Secrets annual webinar. In “Volatility Will Continue Until Morale Improves,” we will dive into the dynamics likely to drive volatility ahead in energy markets. We review commodity drivers in oil, natural gas and NGL and the midstream outlook. Our seasoned experts will dissect the key elements shaping the industry across multiple commodities. RSVP here to join us.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.