The Daley Note: October 4, 2022

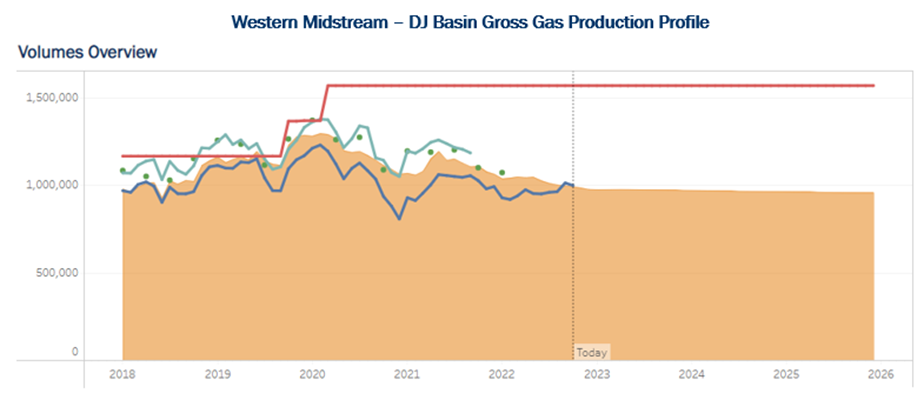

While business is booming in the Permian, Western Midstream (WES) could face a reduction in cash flow due to flattening or even declining Denver-Julesburg volumes.

Western’s DJ Basin G&P assets produce the largest margins for the company by a significant gap, heightening the cash flow risk from declining volumes on this system. East Daley currently estimates WES receives $2.44/Mcf for gathering and processing services on its DJ Basin system, compared to $1.40/Mcf for G&P services on its DBM system in the Delaware Basin. These rates are inclusive of fixed-fee and percent-of-proceeds (POP) contracts.

Click here to read a new Hart Energy story highlighting East Daley analysis presented during “America’s Natural Gas Conference” in early September. Senior Capital Markets Analyst Zack Van Everen spoke about our forecast for a significant amount of dry gas to hit the U.S. markets from now until the end of December 2023.

The vast rate discrepancy is largely due to the lack of midstream competition in the DJ; WES and DCP Midstream (DCP) collect most of the gas produced in the basin. Nearly two-thirds of WES DJ volumes come from Occidental (OXY), with Chevron (CVX) and Civitas Resources (CIVI) comprising most of the rest.

WES has seen a sharp recovery in the Permian as commodity prices have increased. Our latest Midstream Activity Tracker monitors 16 rigs on its DBM system for the Sept. 18 week, up 3 rigs since mid-August. But activity remains subdued for WES in the DJ, where we are tracking only 3 rigs on the DJ system.

East Daley projects 5 rigs on the WES DJ system for the foreseeable future, a drilling level that isn’t sufficient to hold volumes flat in our model. At 5 rigs, production on the WES system averages ~965 MMcf/d through 2024, down from 1.03 Bcf/d so far in 2022 and 1.11 Bcf/d in 2021. This would result in a 9% decrease in EBITDA for the DJ Basin G&P segment next year based on current Henry Hub strip prices. - James Taylor Tickers: CIVI, CVX, DCP, OXY, WES.

Webinar: Dissecting U.S. Natural Gas Production

Join us at 12 p.m. ET on Wednesday, October 12 for a webinar discussion of U.S. natural gas supply and demand. In this 30-minute webinar, East Daley analysts will go behind the curtain and share our unique production methodology. Click here to register and for more information. For those interested in a deeper dive into natural gas market dynamics, we published an updated monthly Macro U.S. Supply & Demand Forecast Report and Dataset this past week (Sept. 26). Please contact Zack Van Everen to request a copy.

Speaking Event: LDC Gulf Coast Energy Forum

East Daley is participating in the 4th annual LDC Gulf Coast Energy Forum this coming week, Oct. 12-14 in New Orleans. Vice President of Analytics Rob Wilson will join a panel discussion titled, “State of the Gulf and Beyond: LNG Export Updates, Supply and Demand Fundamentals and the Effect on the World,” at 10:30 a.m. CT on Oct. 12 in New Orleans. Please click here for event registration and more information.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

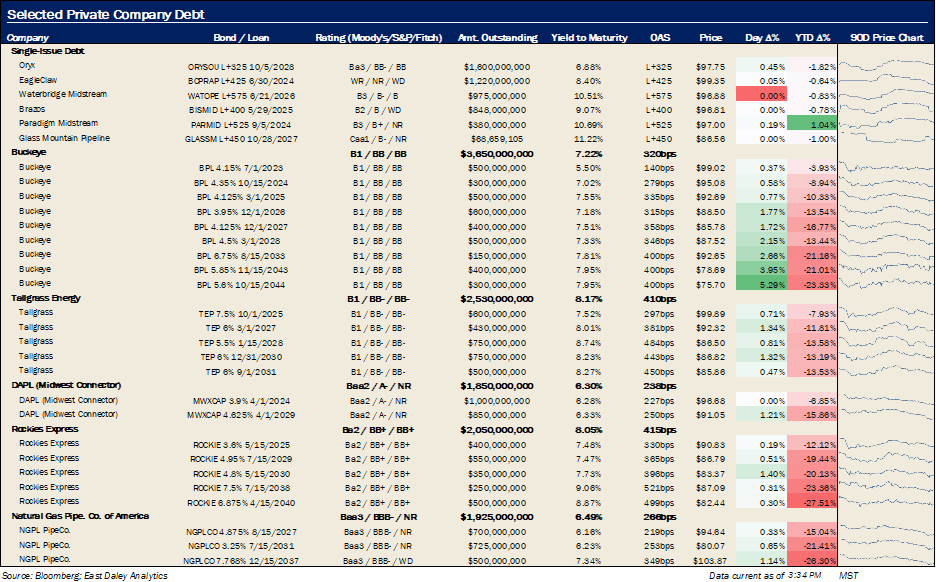

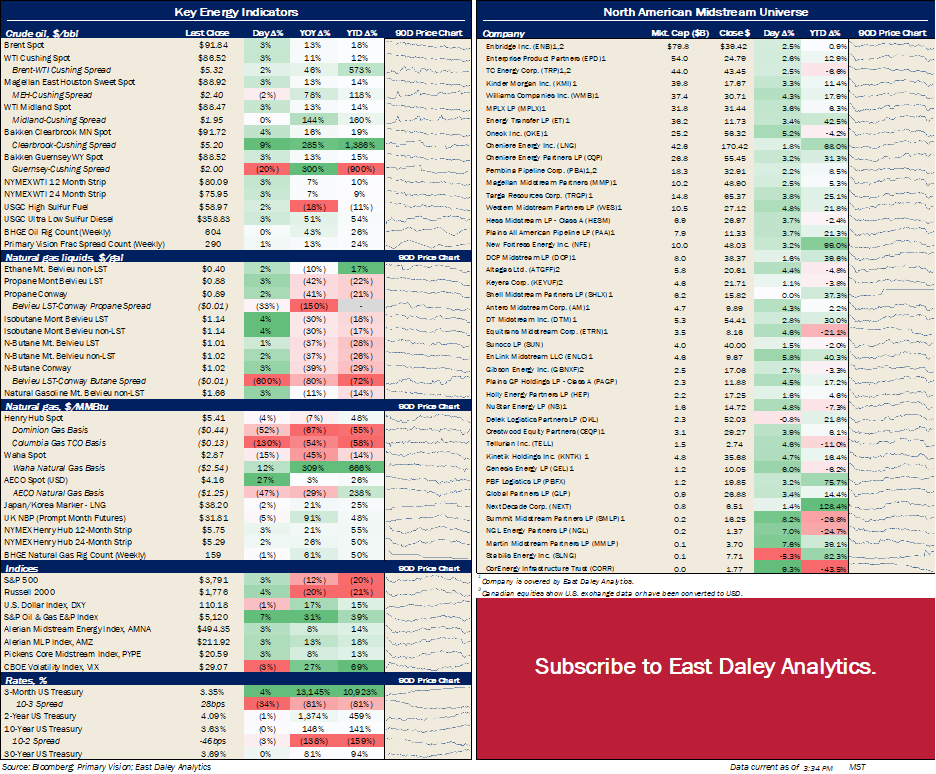

North American Energy Indicators and Equity Prices

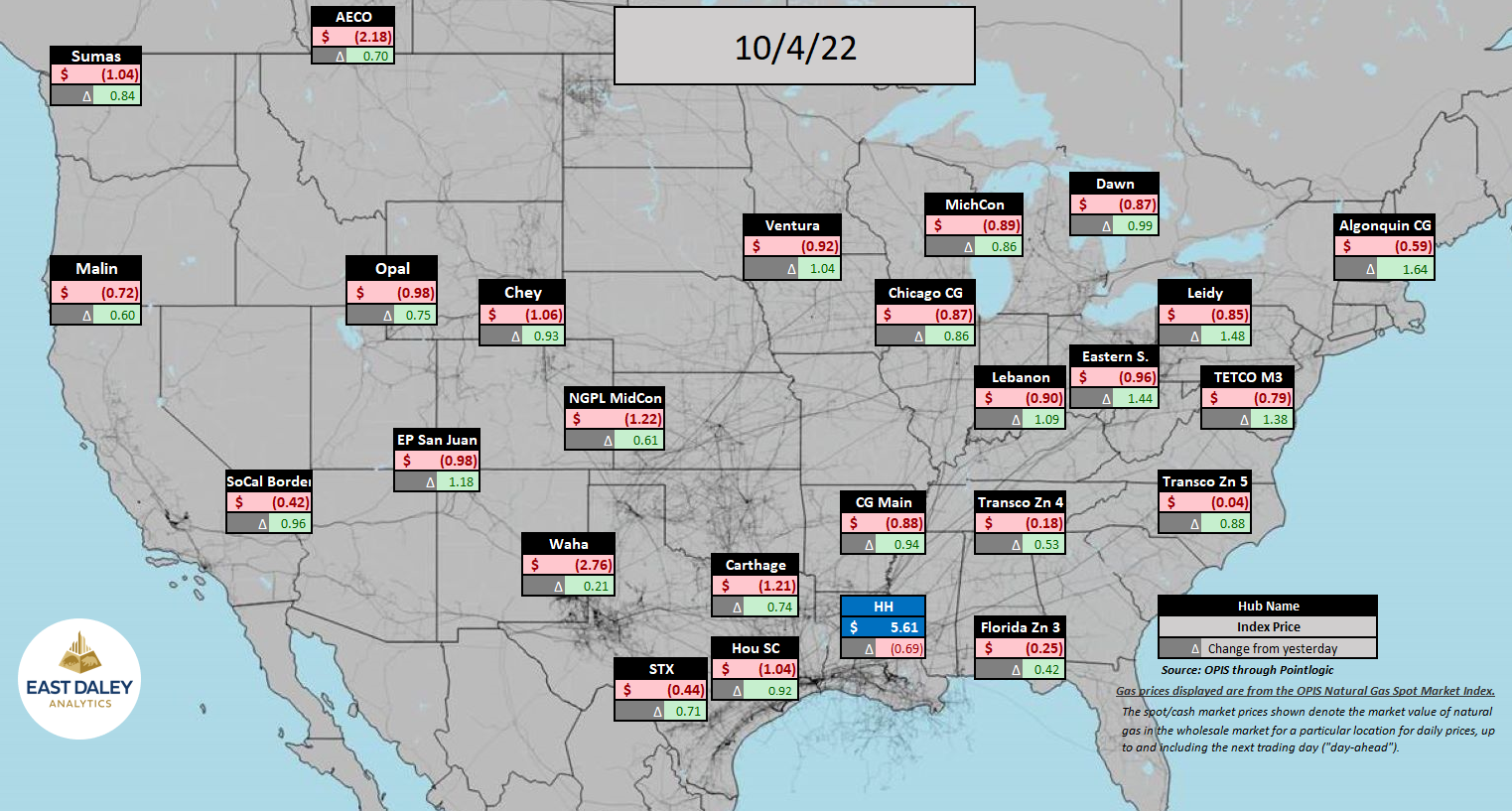

North American Natural Gas Prices

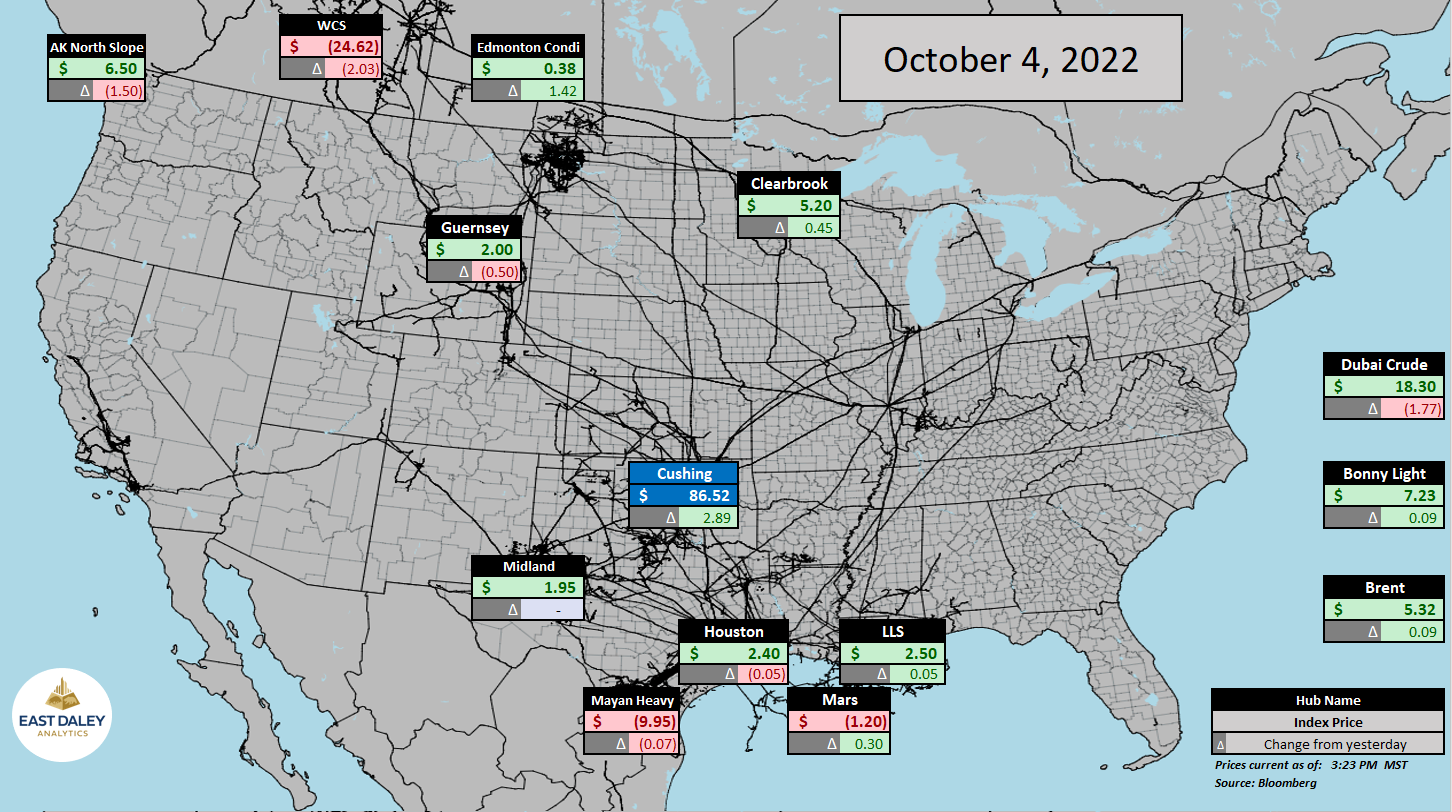

North American Crude Oil Prices

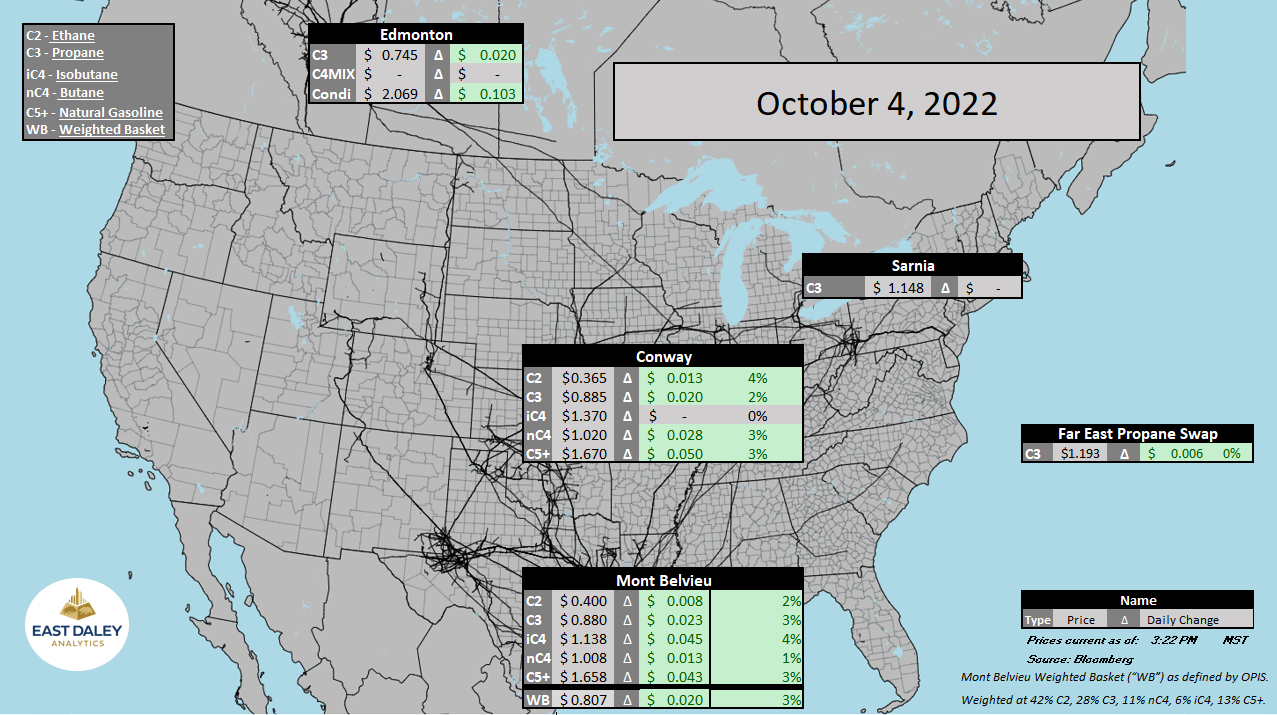

North American Natural Gas Liquids Prices

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)