East Daley Analytics breaks out the ArkLaTex Basin covering Haynesville shale development into two geographic regions: the Louisiana Haynesville, and East Texas. Strong performance on the Texas side of the basin has been driving unexpected growth recently.

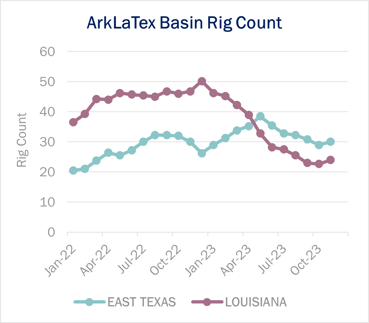

In the ArkLaTex Supply and Demand Forecast, EDA has been calling for basin production to decline since July ‘23 based on low natural gas prices and falling drilling activity. Rig counts on the Louisiana side of the Haynesville have fallen over 50% in 2023, from 50 rigs in December ‘22 to just 24 rigs in November. East Texas rig counts have been more resilient, increasing to 39 in May before falling to a low of 28 in October (see figure).

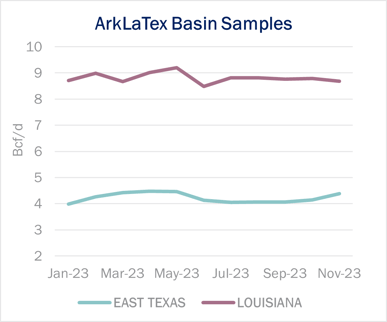

Pipeline samples in the ArkLaTex Basin averaged 13.1 Bcf/d in November, up ~130 MMcf/d over October and the highest volumes we’ve seen since the sample peaked in May ‘23 at 13.7 Bcf/d. However, if we dig deeper, we see that all the M-o-M growth has come from East Texas (see figure).

Our latest ArkLaTex Forecast predicts wellhead production to fall to 17.4 Bcf/d by March ‘24 from a recent peak of 18.2 Bcf/d in May ‘23. Rig counts overall averaged 52 in November, down from 75 rigs at the start of the year. We model ArkLaTex production to continue declining through March ‘24, with significant rig adds starting in January ‘24 in anticipation of stronger gas prices next year.

Based on the latest rig trends, EDA forecasts a larger decline in the Louisiana Haynesville, with production bottoming out as late as June ’24. However, these declines are partially offset by growth in East Texas.

Leading Haynesville producers are guiding to a similar outlook. On the company’s 3Q23 earnings call, Southwestern Energy (SWN) executives said they expect overall Haynesville production to decline “at least into early next year,” noting strip prices were not high enough to incentivize growth.

Chesapeake Energy (CHK) guided to a steady drilling program of 5 rigs in the Haynesville, with the option to add a rig in the back half of 2024 if prices improve from new LNG demand. Management also predicted Haynesville supply will be lower in 2024 vs 2022 and the beginning of 2023, when production was running into midstream constraints. Those constraints have mostly been alleviated through additional interconnects between gathering systems and treating capacity expansion.

Comstock Resources (CRK), the only major public producer active in East Texas, is focused on developing its Western Haynesville acreage. CRK is currently running 2 rigs in East Texas and plans to add a rig in 2024 and another in 2025, keeping its overall basin rig count at 7. CRK expects to grow the Western Haynesville to 0.5 Bcf/d by 2025, and up to 2 Bcf/d by 2028.

Regarding legacy acreage production, management says it will be hard to hold production flat with just 4 rigs. The guidance suggests the Louisiana production should decline, even if Comstock is able to balance it with East Texas growth. – Oren Pilant Tickers: CHK, CRK, SWN.

CTA Button: Request Crude Data – Link to: https://share.hsforms.com/1INpOOnRYTO6iwh1Yye_JoQ4x9p7?__hstc=226329541.ccc27a321b0dcd84313005f5b84beb50.1683769911263.1690991429559.1690993826934.179&__hssc=226329541.33.1690993826934&__hsfp=2357319386

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy's journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA's deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley's Energy Data Studio tools for natural gas predictive analytics with Hart Energy's Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)