The Daley Note: December 19, 2022

Williams (WMB) reached an agreement to acquire MountainWest Pipelines Holding from Southwest Gas (SWX) for $1.5 billion in cash and debt. The acquisition gives WMB further midstream reach in the Rocky Mountains, and in our view is a long-term play on Rockies gas supply growth.

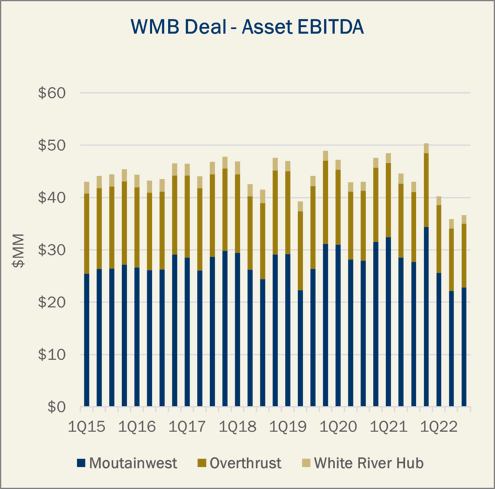

In a press release, WMB reported the transaction was priced at an 8x multiple on 2023 EV/EBITDA, implying expected EBITDA of ~$188 million next year. The package includes a mix of assets regulated by the Federal Energy Regulatory Commission (FERC) with predictable cash flows and others with more risk-reward potential. East Daley maintains financials for the assets included in the WMB-SWX transaction in our US Gas & Liquids Pipeline Financial Data Set.

East Daley makes FERC financial data easy. We track 500+ natural gas and liquids pipelines through our US Gas & Liquids Pipeline Financial Data Set. Pipeline data is organized by income statements, balance sheets, and statements of cash flows for all FERC-regulated pipelines. Save time and money. Reach out for more information on East Daley's FERC financial data.

The MountainWest Pipeline, the largest asset in the package, connects Rockies natural gas basins to markets in the West and Midwest. The ~2,000-mile interstate pipeline can ship up to 2.5 Bcf/d of gas. MountainWest has stable cash flow and generates over 70% of its revenue from gas transportation services, with another ~25% of revenue from the Clay Basin storage facility. The pipeline earned $123 million EBITDA in 2021, according to FERC financial data, while EBITDA for the trailing twelve months (TTM) was $105 million.

The second-largest asset in the deal, Overthrust Pipeline, is a smaller and riskier asset. Overthrust includes 260 miles of pipeline connecting Rockies gas supply to long-haul transmission lines (Ruby, Rockies Express, Kern River, Wyoming Interstate, and Questar). The Overthrust system can move up to 2.4 Bcf/d. Overthrust earned ~$56 million in EBITDA in 2021 while earning $51 million EBITDA on a TTM basis, according to FERC financial data.

Over 50% of current contracts on Overthrust are held by marketers and producers. Overthrust has legacy contracts with Occidental (OXY), Wyoming Interstate Gas, and BP that roll off in the next five years. In addition, Rockies Express Pipeline holds a 625 MMcf/d lease on Overthrust for west-to-east service that expires in 2028. This contract accounts for $29 million in annual revenue. All of these contracts could be at risk if production does not recover in the region.

East Daley makes FERC financial data accessible. We’ve scraped and organized historical FERC Form 2 and 6 filings as far back as 2005 for 500+ filers, tagging each by unique owners and public tickers. The US Gas & Liquids Pipeline Financial Data Set can be used directly in models or browsed through East Daley’s Energy Data Studio. The data is available in a consolidated format and updated quarterly. Contact us for information on FERC financial data.

But there are also reasons to expect upside from the Overthrust system. Overthrust connects the Colorado Interstate Gas (CIG) and Opal market hubs, and transport capacity on Overthrust has been extremely valuable recently given the blowout in West Coast gas prices. WMB noted the acquisition provides further reach into the Salt Lake City market, which is priced off Opal. Opal day-ahead gas traded last week (Dec. 12-16) over $47/MMBtu as below-normal temperatures blanketed the West.

Totaling all the assets, 2021 EBITDA on the package equates to $186 million, assuming WMB consolidated the White River Hub. On a TTM basis, total asset EBITDA is $163 million, with MountainWest EBITDA declining into 2022 (shown in Figure). With WMB’s upstream joint venture and other gathering and processing (G&P) assets, we see the purchase as a long-term bet by WMB on supply growth from the Rockies basins.

East Daley agrees the Rockies could become a key part of long-term gas supply as demand grows for LNG exports. We explore the long-term outlook for natural gas and several key gas basins in our 2023 Dirty Little Secrets report. - Zack Van Everen Tickers: BP, OXY, SWX, WMB.

Dirty Little Secrets 2023 is Now Available!

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

The Russia-Ukraine conflict has pushed commodity prices higher and spurred greater global demand for US energy products. Meanwhile, more disciplined growth from the upstream has infrastructure finally filling up across commodities. Will exports power the next infrastructure boom?

Dirty Little Secrets is East Daley’s annual report on energy markets and the road ahead for Midstream. We share our macroeconomic outlooks for US oil, natural gas and NGLs, highlight key infrastructure opportunities, update on the state of the Energy Transition, and share our view on Midstream’s future role in energy.

To receive the 2023 Dirty Little Secrets report, please click here.

3Q22 Earnings Previews and Earnings Reviews Now Available

East Daley has published a complete group of 3Q22 Earnings Previews and Blueprint Financial Models for midstream companies within our coverage. We also are publishing 3Q22 Earnings Reviews as companies report comparing our forecasts vs results. Quarterly Earnings Previews and Blueprints are now available for Antero Midstream (AM), Crestwood Equity (CEQP), Enbridge (ENB), EnLink Midstream (ENLC), Enterprise Products (EPD), Energy Transfer (ET), Equitrans Midstream (ETRN), Kinder Morgan (KMI), Kinetik Holdings (KNTK), Magellan Midstream (MMP), MPLX (MPLX), ONEOK (OKE), Plains All American (PAA), Summit Midstream (SMLP), Targa Resources (TRGP), TC Pipelines (TRP), Western Midstream (WES) and Williams (WMB).

Our Earnings Previews include quarterly earnings forecasts compared to Street consensus, a detailed list of the top assets that will impact the quarter, analysis of near- and long-term risks to future earnings, along with forecasts for Adj. EBITDA by segments. Please log in to access these reports.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)