Executive Summary: Rigs: The total US rig count decreased by 2 W-o-W for the September 15 week, down to 564 from 566. Infrastructure: Diamondback Energy (FANG) and Kinetik Holdings (KNTK) have acquired a joint 30% equity stake in EPIC Crude Pipeline. Storage: East Daley expects a 600 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 27.

Rigs:

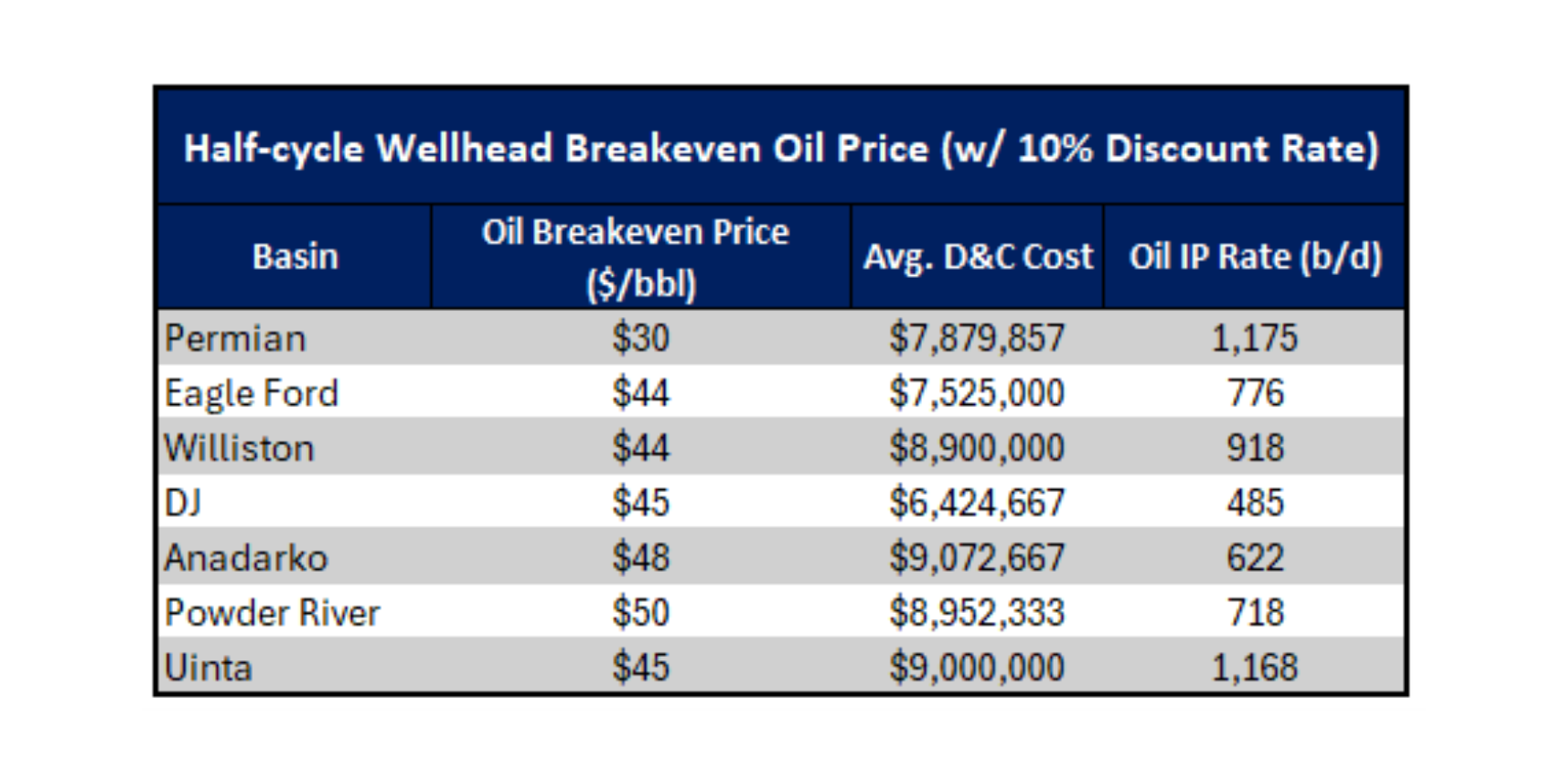

The total US rig count decreased by 2 W-o-W for the September 15 week, down to 564 from 566. Liquids-driven basins decreased by 1 rig W-o-W to 455. The Bakken, Eagle Ford, Permian, and Powder River basins each lost 1 rig. Within the Permian, the Delaware lost 2 and the Midland gained 1 W-o-W. The Anadarko added 2 rigs W-o-W, while the Uinta added 1.

In the Anadarko, operators American Warrior and Freedom Operating Company add 1 rig to their systems W-o-W. In Permian – Delaware, Occidental removed 1 rig from KNTK – Raptor and Devon Energy removed 1 from ET – Delaware. In Permian – Midland, Endeavor Energy added 1 rig to ET – Midland.

Infrastructure:

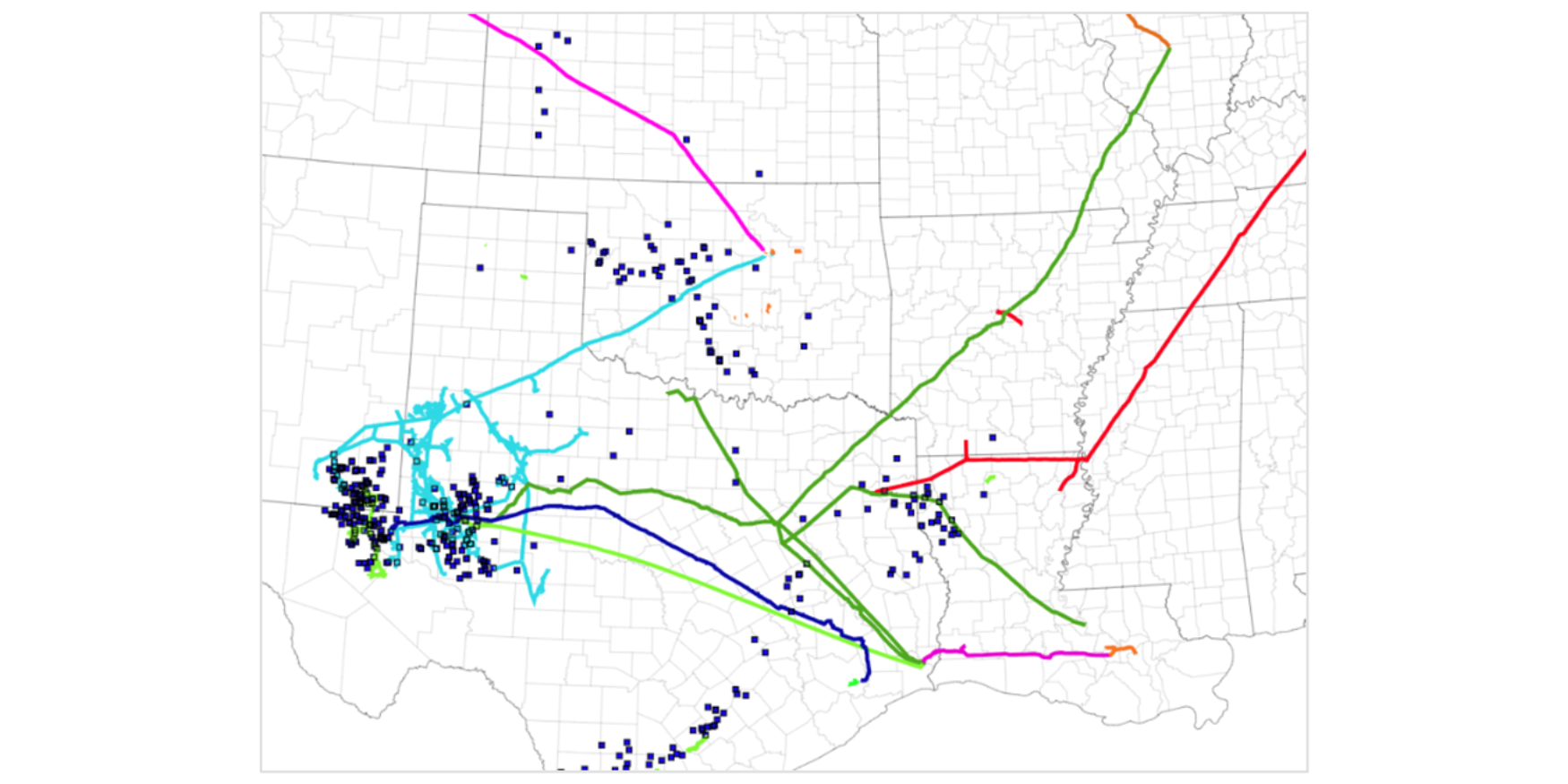

Diamondback Energy (FANG) and Kinetik Holdings (KNTK) have acquired a joint 30% equity stake in EPIC Crude Pipeline. East Daley believes Chevron (CVX) sold its 30% stake, inherited via the acquisition of Noble Midstream in 4Q20. The new owners will commit more volumes to EPIC, the last Permian crude oil pipeline with upside for expansions.

FANG and KNTK announced the deal last Wednesday (September 25) for the 30% interest in EPIC Crude, an affiliate of EPIC Midstream. Each company now holds 27.5% of the pipeline, with EPIC Midstream retaining a 45% share.

EPIC Crude spans 800 miles and connects the Permian and Eagle Ford basins to Corpus Christi, the premiere destination for crude exports. EPIC has a stated capacity of 600 Mb/d, yet the pipe transported 622 Mb/d in July ’24, according to the Crude Hub Model. EPIC is likely using drag-reducing agents to flow above its stated nameplate capacity. The pipeline is expandable up to 1 MMb/d.

Under the deal, Diamondback will convert its existing commitments on EPIC Crude to a larger 200 Mb/d minimum volume commitment (MVC) from 2025 to 2035. The 10-year MVC represents over 33% of EPIC Crude’s current capacity. The acquisition solidifies FANG’s position in the Permian Basin following its $26B acquisition of Endeavor Energy Resources, providing more capacity to accommodate additional barrels.

Separately, Kinetik reached a transportation agreement with EPIC Crude to build a new interconnect with its crude gathering system. Although KNTK’s core business is in natural gas gathering and processing, KNTK’s stake would allow it to bundle services and potentially attract new customers.

While no transaction value was publicly disclosed, East Daley anticipates the deal fetched a high multiple of ~10x EV/EBITDA, given the premier destination market, utilization rate, and that 90% of EPIC Crude’s capacity is secured under MVCs. According to the KNTK Financial Blueprint Model, 2Q24 LTM EBTIDA was $281MM, implying a value of $2,810MM (including any debt at the pipeline). Thus, the 30% stake would net to a $843MM transaction value including any assumption of debt.

Storage:

East Daley expects a 600 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 27. We expect total US stocks, including the SPR, will close at 799 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 14% W-o-W across all liquids-focused basins. Samples decreased 22% in the Williston and 14% in DJ and Powder River basins. The Permian Basin and Texas Gulf saw 14% decreases. The Williston, Rockies and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin correlation is less than 45%. We expect US crude production to increase to 13.3 MMb/d.

According to US bill of lading data, US crude imports increased by 594 Mb/d W-o-W to 7.05 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Canada’s Westride Marine Terminal in Vancouver.

As of September 27, there was ~850 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~100 Mb/d W-o-W, coming in at 16.2 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 28 vessels loaded for the week ending September 27 and 23 the prior week. EDA expects US exports to be 3.9 MMb/d.

The SPR awarded contracts for 2.77 MMbbl to be delivered in September 2024. The SPR has 382 MMbbl in storage as of September 20, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Hiland Crude, LLC A new volume committed shipper rate was established for shippers executing a TSA during the month of August for a term of at least 3 years combined with a minimum volume take or pay commitment. FERC No 5.41.0 IS24- 792 (filed Aug 30, 2024) Effective October 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)