The Daley Note: September 21, 2022

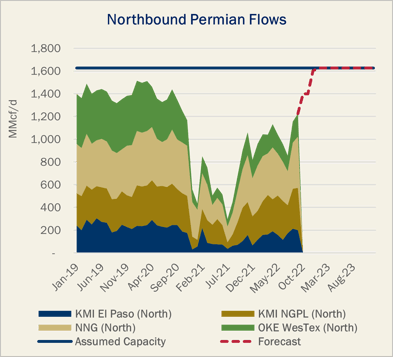

Looking to find the next big bottleneck in midstream? Our compass points north from the Permian Basin. Northbound Permian gas pipelines are beginning to fill, supporting East Daley’s thesis that basin egress will tighten in early 2023. History shows bottlenecks can crush natural gas prices within the basin, but also light a fire under midstreamers to develop new takeaway solutions.

Key northbound routes we monitor include Kinder Morgan’s (KMI) El Paso and NGPL pipelines, as well as Northern Natural Gas and ONEOK’s (OKE) WesTex system (see Figure 1). We assume these northbound pipelines are the last to fill out of the Permian due to less favorable price netbacks compared to Gulf Coast or Southwest gas markets.

East Daley flagged future Permian residue gas constraints at the start of the year in our 2022 Dirty Little Secrets report, and we regularly update our view in the Permian Supply and Demand Forecast. The answers to the important questions (How soon? How much?) change month-to-month with rig trends and as midstreamers push forward new egress projects targeting Gulf Coast industrial and LNG demand hubs.

Key pipelines moving ahead include the 2.5 Bcf/d Matterhorn by sponsors Whitewater Midstream, EnLink Midstream (ENLC), Devon Energy (DVN) and MPLX LP (MPLX). Operators also have greenlit compression expansions on Permian Highway Pipeline (KMI) and Whistler Pipeline (MPLX). Energy Transfer (ET) has proposed a mixed green- and brownfield project to route up to 2.0 Bcf/d of Permian gas through Central Texas along the ET Fuel intrastate system to reach the Gulf Coast.

New projects will dampen the severity of future constraints as Permian gas production grows. But they still face execution risk, and in the meantime takeaway out of the Permian looks tight. With Gulf and West Coast-bound pipelines effectively full, we model Permian shippers pushing another 500 MMcf/d of gas into the Midcontinent by the end of the year before new pipe expansions start to come online. This additional Permian gas could back out Canadian and Northeast supplies and pressure AECO and Northeast prices lower.

For more information on our Permian or Macro Supply and Demand Forecasts, contact Zack Van Everen.– Zack Van Everen & Andrew Ware Tickers: DVN, ENLC, ET, KMI, OKE, MPLX.

Kinder Morgan Poised to Capture Haynesville Growth

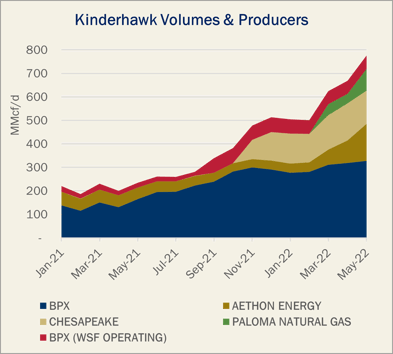

We expect Kinder Morgan’s (KMI) Kinderhawk gathering system in the Haynesville to continue its 2022 growth trajectory through 2H22, reaching above 1 Bcf/d in volumes by the end of the year.

According to Louisiana state data, Kinderhawk volumes increased 32% from January through May 2022. Driving this increase are BPX (+50 MMcf/d), Aethon (+119 MMcf/d) and a new producer on the system, Paloma Natural Gas, which grew to 92 MMcf/d from no previous system volumes. Surrounding ArkLaTex systems are tight on capacity, so we could see additional upside if more producers shift new volumes to KMI’s Kinderhawk system.

We see production ramping significantly in the Haynesville, and KMI is in an excellent position to capture upside as the Kinderhawk system is running at less than 50% utilization. Kinderhawk consists of 535 miles of pipeline and ~2.35 Bcf/d of gathering capacity. The largest producers on the system include BPX, Aethon and Chesapeake (CHK).

Looking ahead, we forecast ArkLaTex egress remaining tight through 2022 with some relief when Gulf Run comes online in early 2023. After Gulf Run, we forecast basin takeaway to remain tight until the LEAP expansions by DTM Midstream (DTM) start to come online in late 2023.

For more detail, we offer a direct line of access to our in-house analytics team through our Advisory Services, giving clients a leg up in predicting future market constraints or other developments. This analysis was published first in our weekly Midstream Activity Tracker. Contact James Taylor for more information on this weekly publication. – Zack Van Everen Tickers: CHK, DTM, KMI.

Upcoming Event

HART Energy – America’s Natural Gas Conference 9 a.m. – Tuesday, Sept. 27 in Houston, TX

Click here to set up a meeting with Zack on Weds., Sept. 28 in Houston the day following EDA’s presentation.

The Daley Note

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

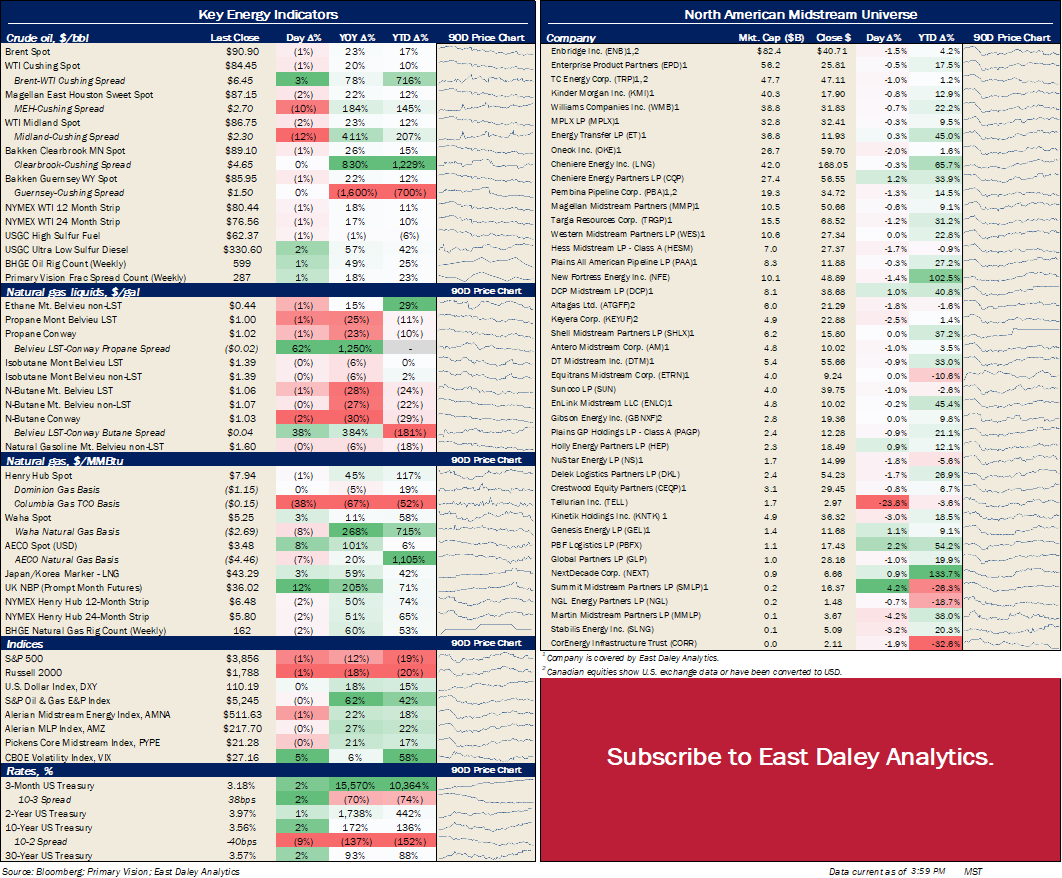

North American Energy Indicators and Equity Prices

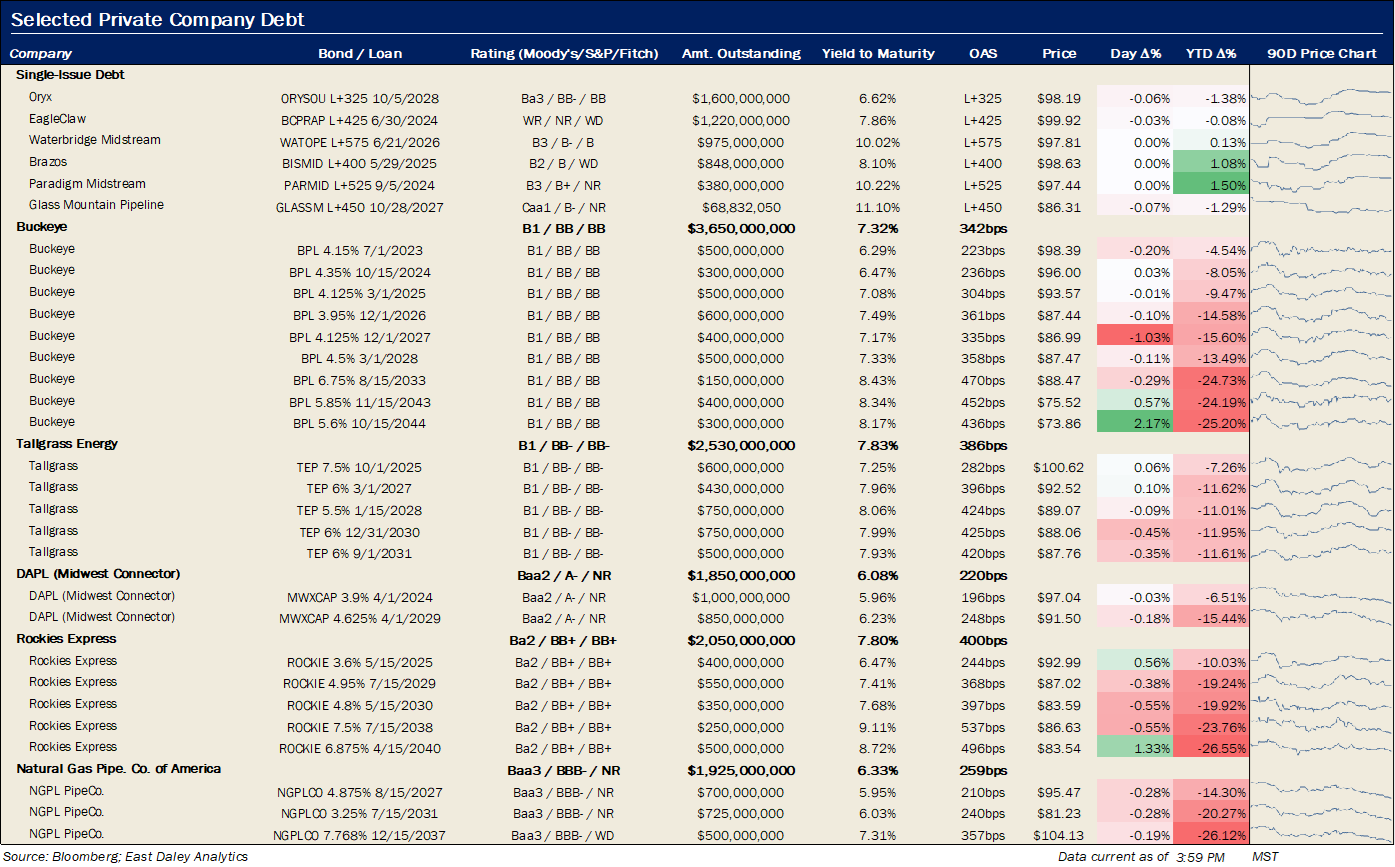

Key Private Debt Metrics

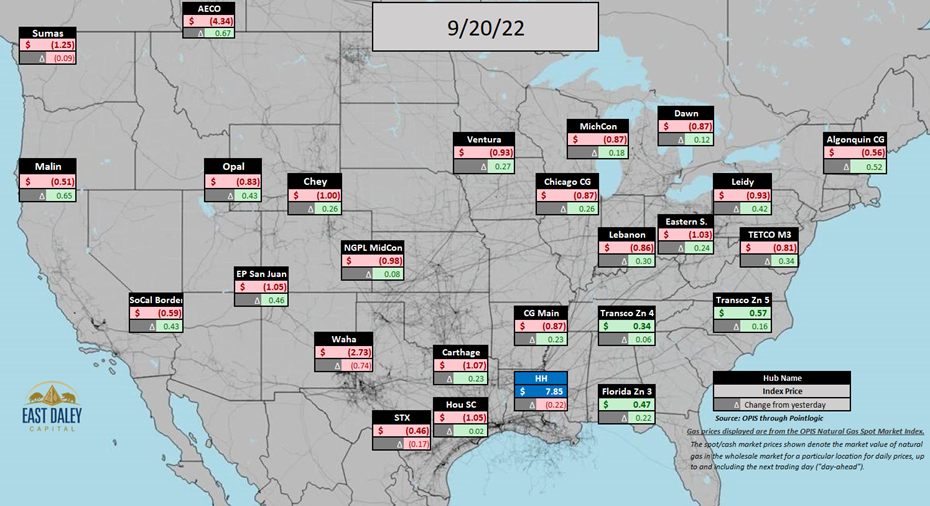

North American Natural Gas Prices

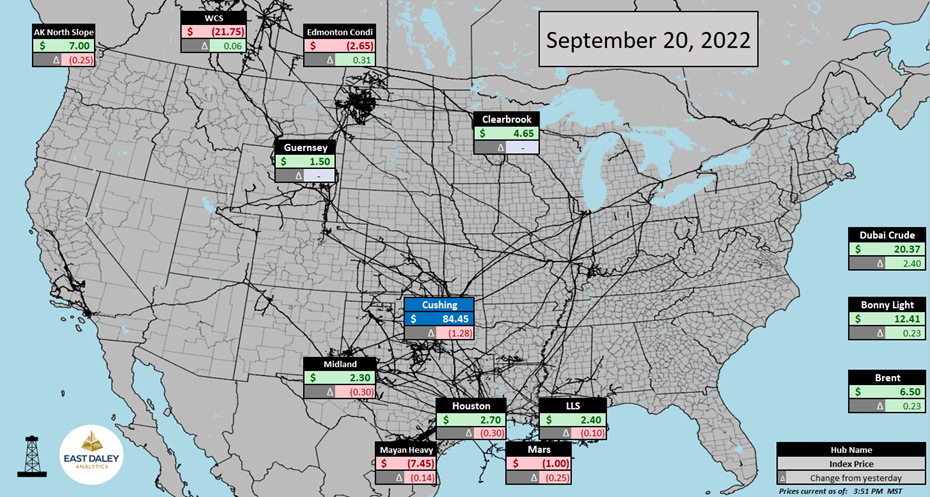

North American Crude Oil Prices

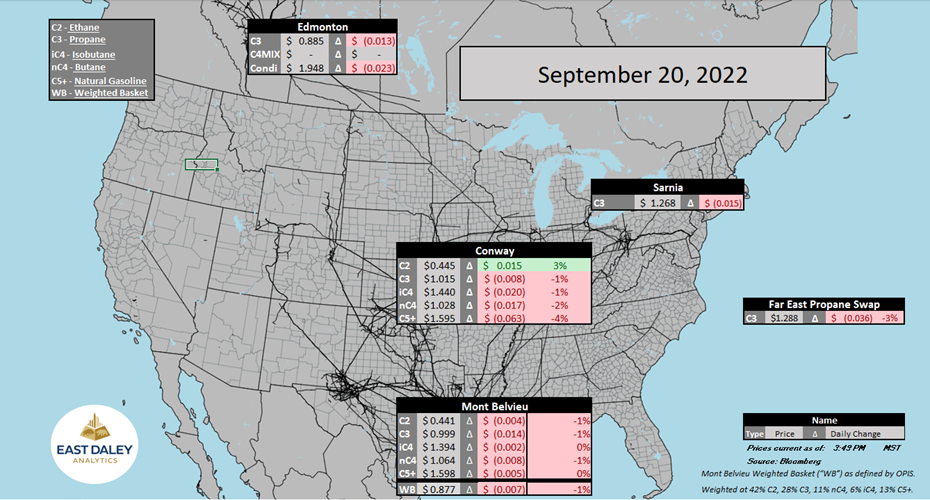

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN),“midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

-1.png)