The Daley Note: August 30, 2022

A recent jump in rig activity in the Anadarko Basin supports East Daley’s bullish view on natural gas supply, according to our U.S. Macro Supply & Demand Forecast. Furthermore, it has a significant impact on one midstream name we cover. EnLink Midstream (ENLC) will cash in on volumetric upside while accommodating growth with a ‘build or buy’ capital spend decision.

Currently there are 91 rigs active in the Anadarko, backed by operators including Continental Resources (CLR), Devon Energy (DVN), Mewbourne Oil, Ovintiv (OVV) and Citation Oil & Gas. The basin is up 10 rigs since April, and activity is 60% higher than the rig count of 57 a year ago. A few midstream companies will harvest more cash from this increased activity including Energy Transfer (ET), ONEOK (OKE) and ENLC.

Based on East Daley’s rig allocation, EnLink has the most G&P exposure as a percentage of its business. We previously modeled 8 rigs on the ENLC Central Oklahoma (COK) system, but activity the last few months has surpassed our forecast. We recently raised our rig estimates to average 12 rigs through 2023 on ENLC - COK given the latest rig additions.

DVN has been the largest driver, running a total of 4 rigs recently on the COK system. DVN has a joint development program with Dow on its STACK acreage that ENLC services. Marathon (MRO), OVV, Citizen III and possibly Camino Resources also have added rigs recently on the COK system.

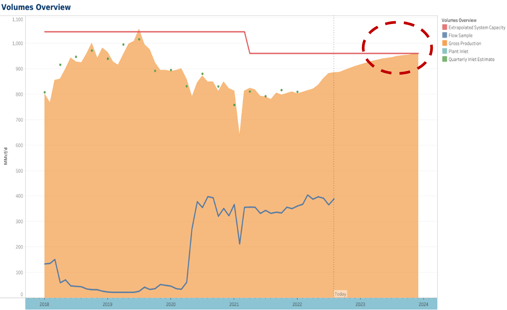

Putting money behind the molecules, EnLink will generate an additional $65 million in cash flow with the increased activity on its COK system. We have revised higher our 2023 volume estimates for the EnLink Oklahoma segment from an average of 1 Bcf/d to 1.1 Bcf/d, reaching an exit rate of 1.2 Bcf/d in 4Q23. Our updated 2Q22 modeled volumes (see Figure) will be available for clients by the end of this week.

The 1 Bcf/d threshold is critical to our forecast because that roughly equates to the gas processing capacity on the Central Oklahoma system. ENLC previously relocated the Thunderbird and Battle Ridge processing facilities to the Midland, which means the company will likely need to build or buy into new capacity to accommodate producer growth in the STACK play.

ET and OKE also will benefit from the increase in rigs. For updated outlooks on ET, ENLC and OKE, including their Anadarko G&P assets, see our 2Q22 Blueprints quarterly updates.

2Q22 Post-Call Models Now Available

East Daley published 2Q22 Post-Call Blueprint Financial Models this past week for midstream companies within our coverage including DCP Midstream (DCP) and NuStar (NS) please log in for access.

Additional Post-Call models are also available for Enterprise Products Partners (EPD), Energy Transfer (ET), Magellan Midstream Partners (MMP), Plains All American (PAA), Pembina Pipeline (PBA) and Summit Midstream Partners (SMLP).

We will distribute additional Post-Call Blueprint Financial Models as we complete updates this week. Quarterly Earnings Reviews are also now available for all midstream companies within East Daley coverage; please log in to access Earnings Reviews included in your subscription or contact insight@eastdaley.com for more information.

Key features of our Earnings Reviews include quarterly company earnings forecasts compared to Street consensus and actual company performance, a detailed list of the top assets impacting the quarter, and analysis of near- and long-term risks to future earnings, along with forecasts for Adj. EBITDA by segment through 2023.

Please contact insight@eastdaley.com for more information about East Daley’s research previewing 2Q22 midstream earnings, or for access to our 2Q22 Earnings Reviews. Tickers: DCP, EPD, ET, MMP, NS, PAA, PBA, SMLP.

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

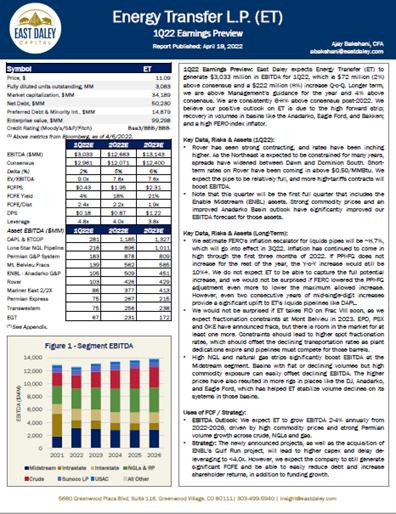

North American Energy Indicators and Equity Prices

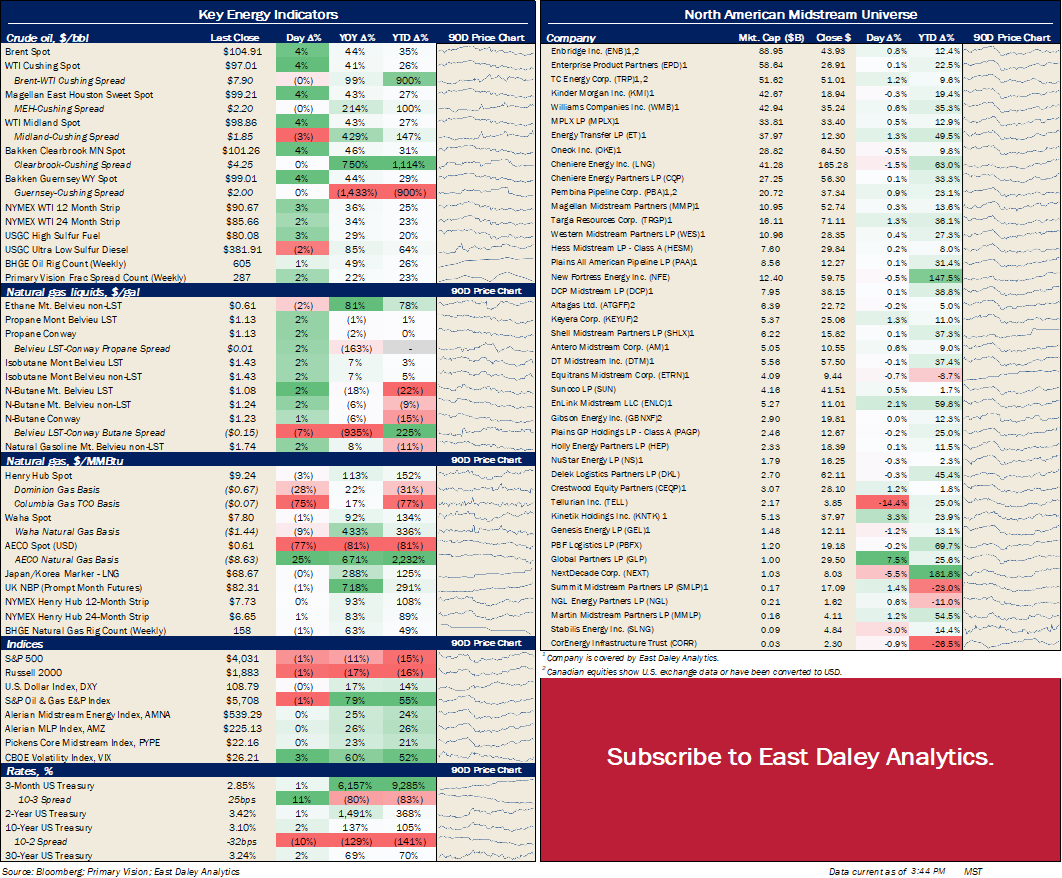

Key Private Debt Metrics

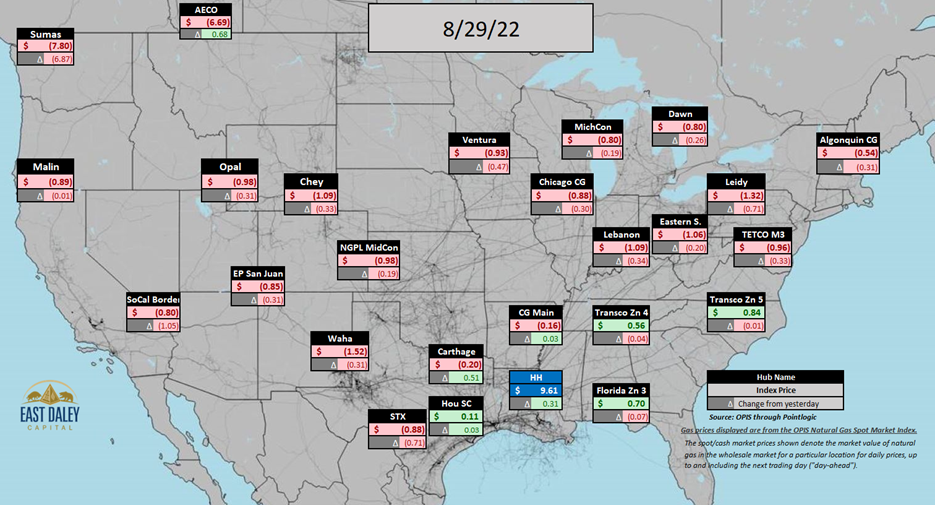

North American Natural Gas Prices

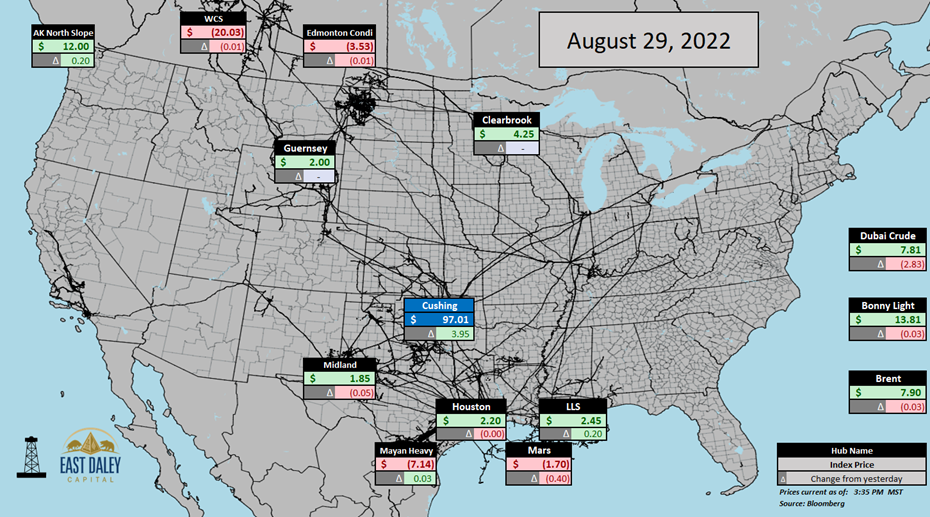

North American Crude Oil Prices

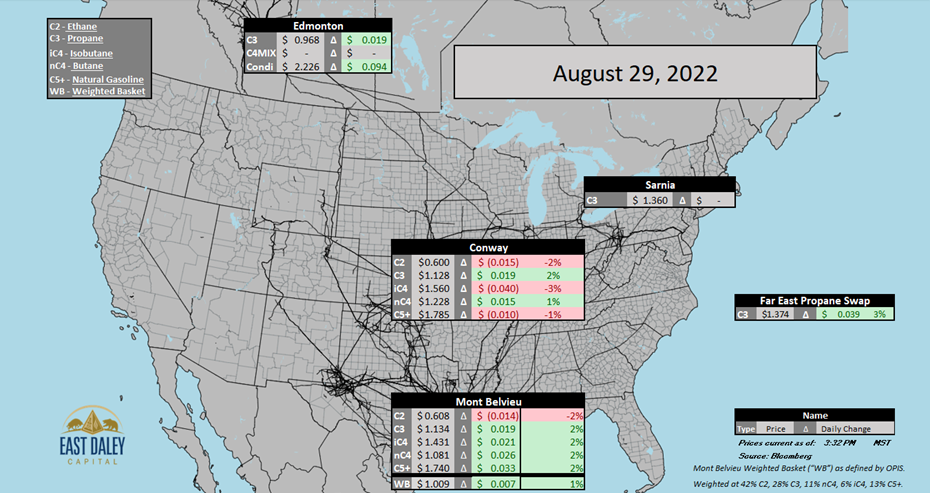

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

-1.png)