The Daley Note: September 7, 2022

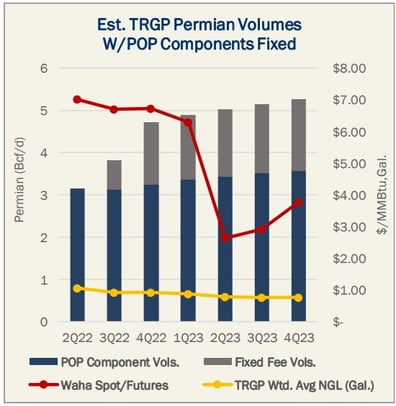

Targa Resources (TRGP) should benefit from an increasing share of fixed-fee Permian G&P volumes in 2022-23, and we expect the company to outperform consensus EBITDA estimates in the near term.

Our August Permian Supply & Demand Forecast Report and Dataset details an increase in basin-wide flaring beginning in March 2023 and natural gas egress capacity further tightening in August 2023. Capacity could reach its limit in 2Q-3Q23.

The forward strip for the Waha Hub indicates the broader market forecasts a steep drop in spot prices from $6.28/MMBtu in 1Q23 to $2.63/MMBtu in 2Q23, likely in anticipation of increasingly limited takeaway capacity. Forward prices recover slightly in 4Q23, most likely due to demand seasonality and the projected completion of the Permian Highway Pipeline expansion previously announced by Kinder Morgan (KMI).

TRGP services contracts are a mix of fixed-fee and percent-of-proceeds (POP) arrangements. Though TRGP is known for having POP exposure on its G&P systems, the Lucid Energy acquisition completed in July will increase the share of fixed-fee contracts in its portfolio. As a result, East Daley believes TRGP will be better prepared to weather a decline in future spot gas prices in the Permian given its increasing share of fixed-fee G&P volumes. We project fixed-fee contracts to account for almost 32% of TRGP’s Permian volumes by 2Q23.

TRGP’s POP contracts also have a fee component to them and are further supported by hedges. Overall, we believe that our previous “above consensus” EBITDA estimates for TRGP are justified.

Please reach out to jblumensheid@eastdaley.com for more information on TRGP’s estimated fixed fee vs. POP contract mix, volume growth, Delaware vs. Midland portfolio mix, rig activity by system or Financial Blueprints.

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

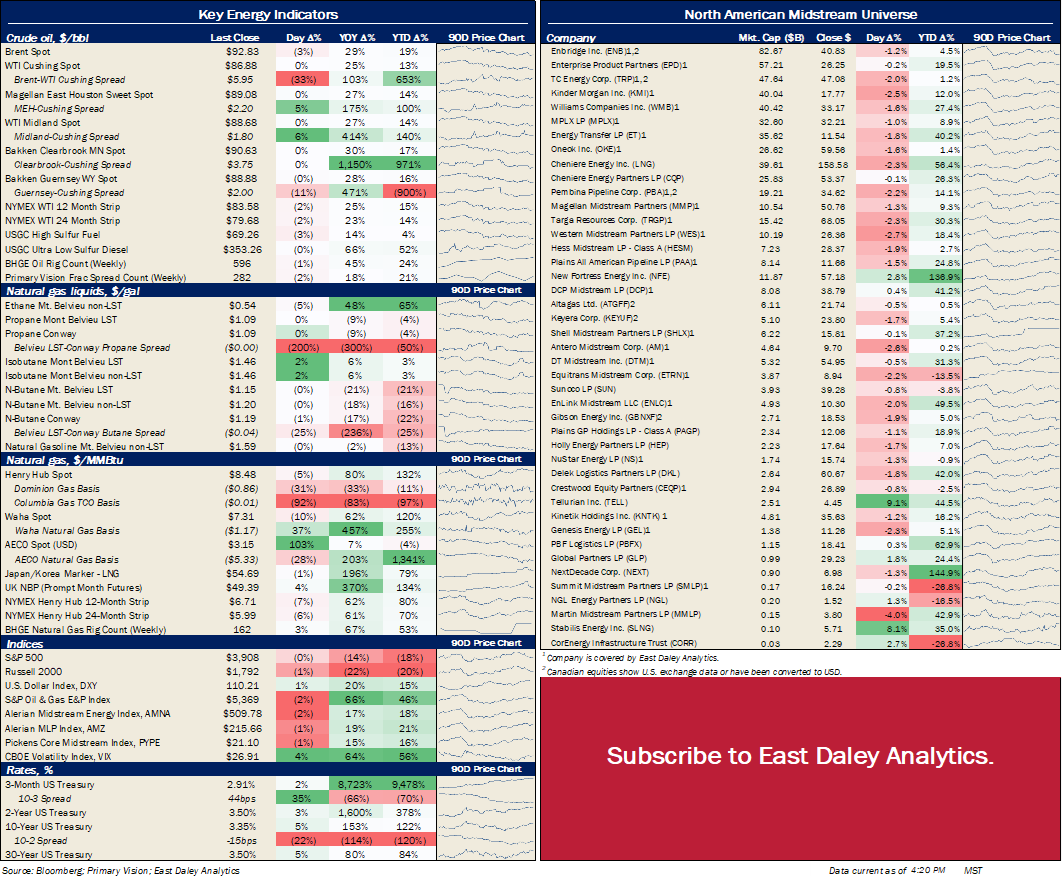

North American Energy Indicators and Equity Prices

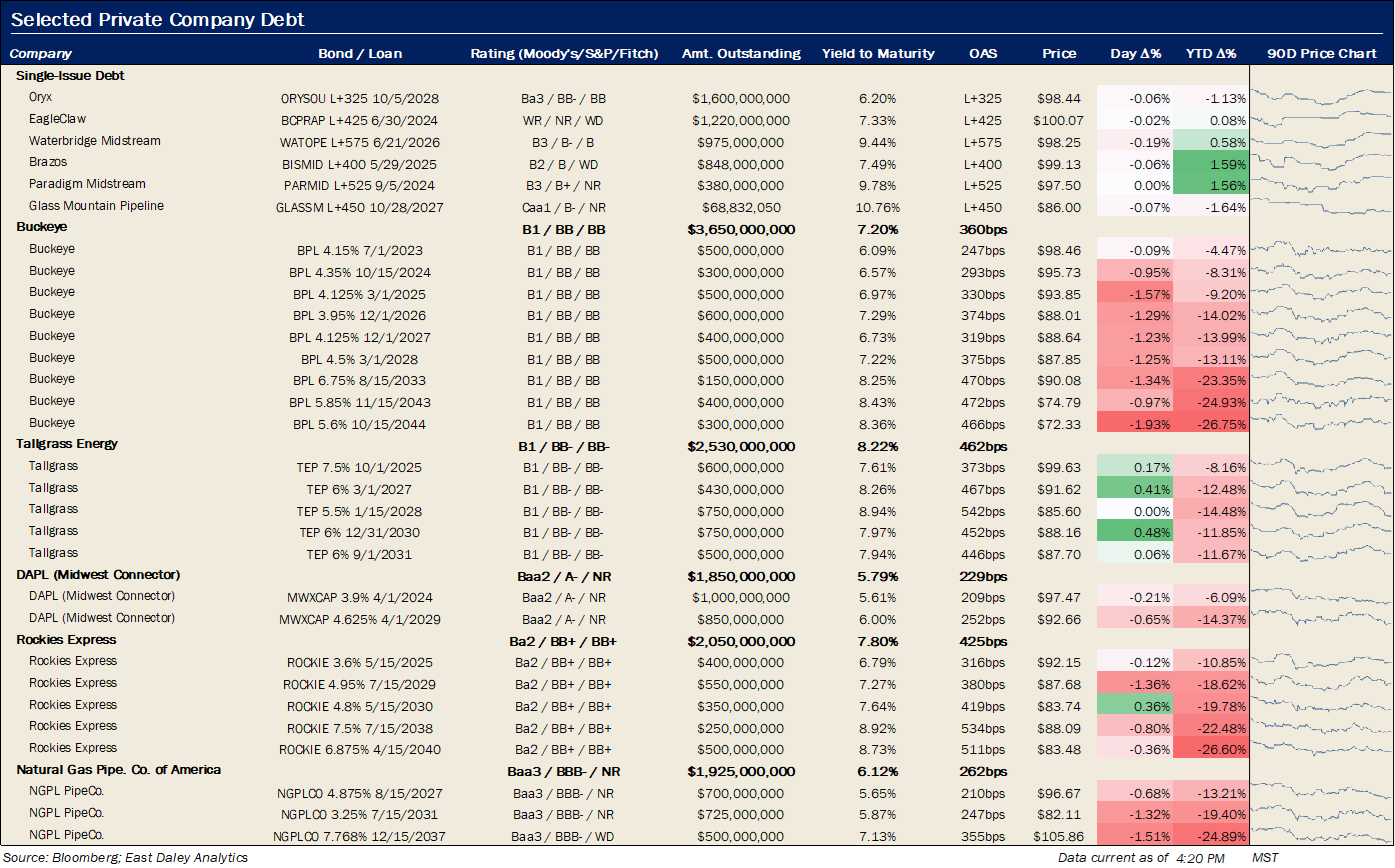

Key Private Debt Metrics

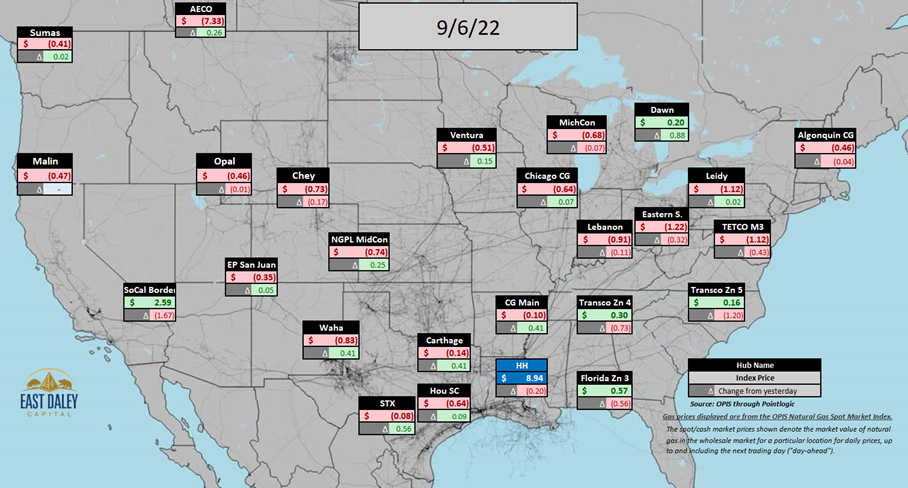

North American Natural Gas Prices

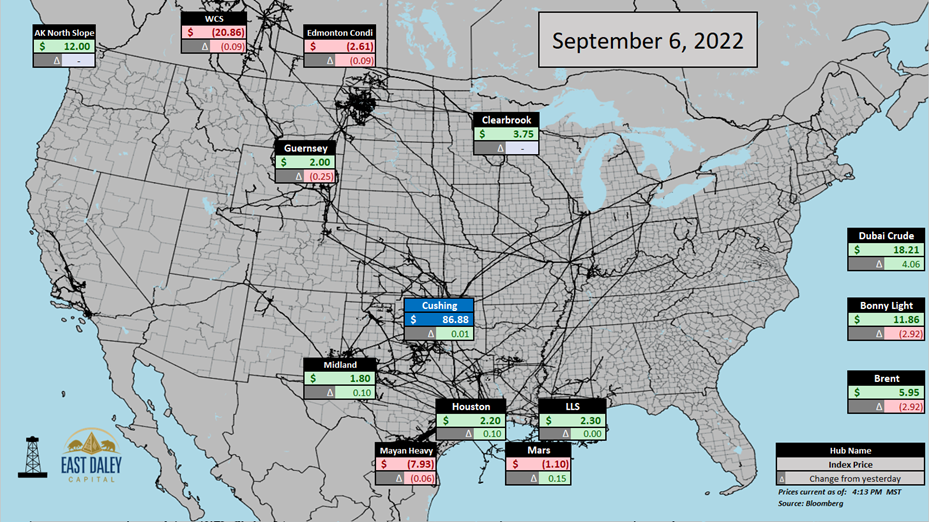

North American Crude Oil Prices

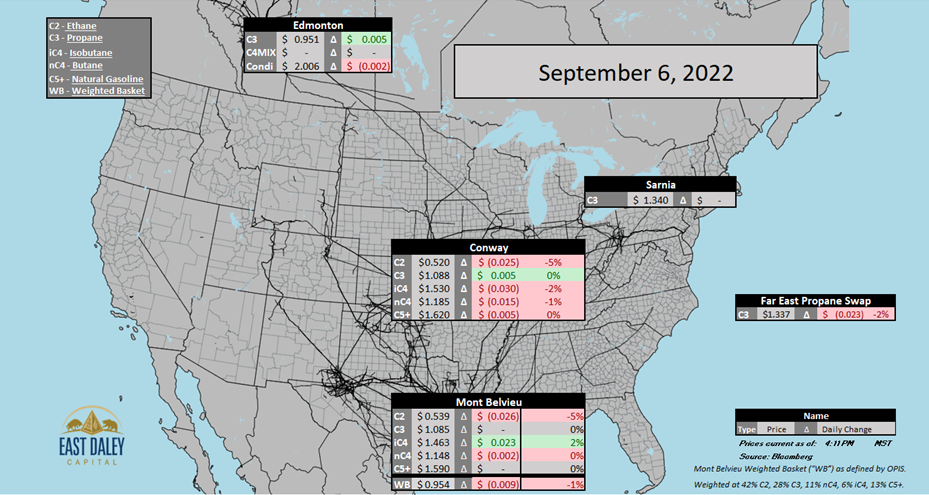

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

-1.png)