The Daley Note: September 8, 2022

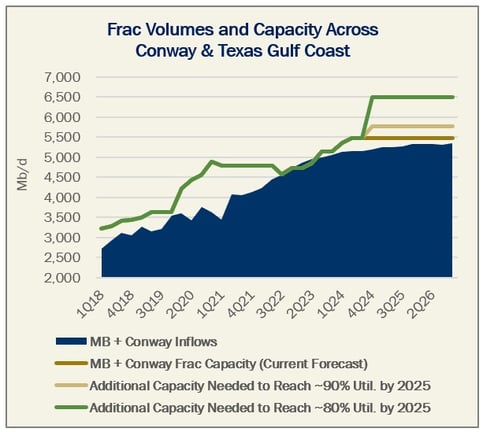

The July explosion at ONEOK’s Medford fractionator has disrupted NGL supply chains and will hasten the onset of frac constraints, according to the latest updates to our NGL Network Model.

East Daley’s 1Q22 NGL Network Model and “NGL Network Hacked” report, released in February 2022, anticipated a trend of tightening fractionation capacity due to growth in NGL supply. Driven mainly by Permian development, we saw a need for more downstream investments to fractionate growing volumes of Y-grade into NGL purity products. We will publish a new, free monthly NGL market report today. Please email Ajay Bakshani to access a copy.

Our inaugural NGL model predicted this tightening in frac capacity would become apparent by late 2022, but the Medford outage has accelerated the timeline for full-on frac constraints in our latest forecast. We updated our NGL Network Model August 10, incorporating recent market developments including the Medford frac outage, new project announcements, and updated NGL supply curves in major basins.

Back in February, we called out in “NGL Network Hacked” a relatively urgent need for new frac projects to start moving, given the extended timeline for permitting and constructing new trains. Since publishing our 1Q22 NGL model, Enterprise (EPD), Energy Transfer (ET) and Targa Resources (TRGP) announced new projects that would add a combined 420 Mb/d of fractionation capacity. Including other projects previously announced by Phillips 66 (PSX) and OKE, 695 Mb/d of frac capacity is being added between 4Q22 and 2Q24.

However, the July 8 explosion and fire at the Medford fractionator in Oklahoma immediately removed 210 Mb/d of capacity from the market, forcing OKE to reroute Y-grade volumes south to Mont Belvieu or to other fracs in the Conway market.

While the new fractionator projects will buy some time, we forecast utilization rates will be unsustainably high at 95%+. These constraints may lead to a massive build of Y-grade stocks, additional ethane rejection, and/or outright flaring unless more fracs are built.

We explore the updated NGL outlook in greater depth in an August 18 Midstream Navigator, “Medford Outage Shakes up NGL Markets”. The current situation is in line with, if not more severe, than the scenario our NGL Network Hacked report suggested in February 2022. We anticipate much higher near-term frac utilization in both the Mont Belvieu – Texas Gulf Coast and Conway regional markets as a result of recent market developments compared to our 1Q22 NGL model.

The latest 2Q22 NGL Network Model update considers new fractionation projects, the Medford outage, as well as supply curve updates to create a basin-level supply and demand balance for NGL markets through 2026. Contact abakshani@eastdaley.com for more information on the NGL Network Model.

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

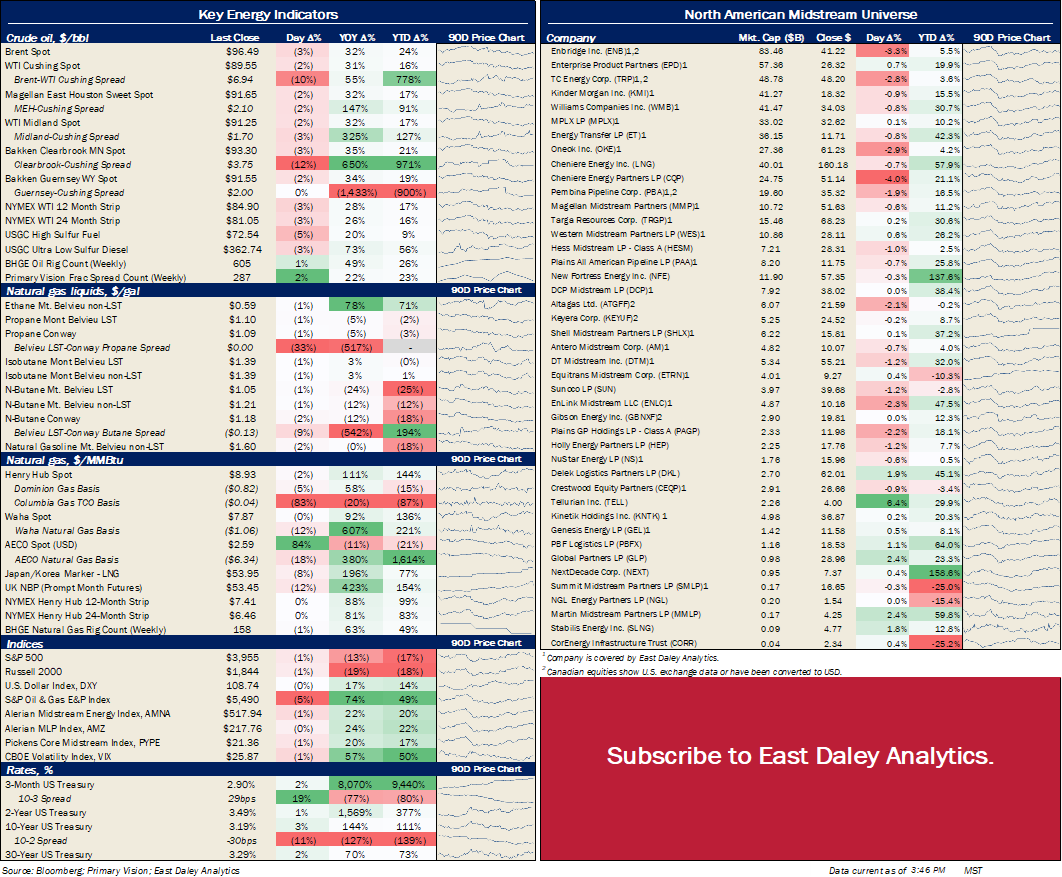

North American Energy Indicators and Equity Prices

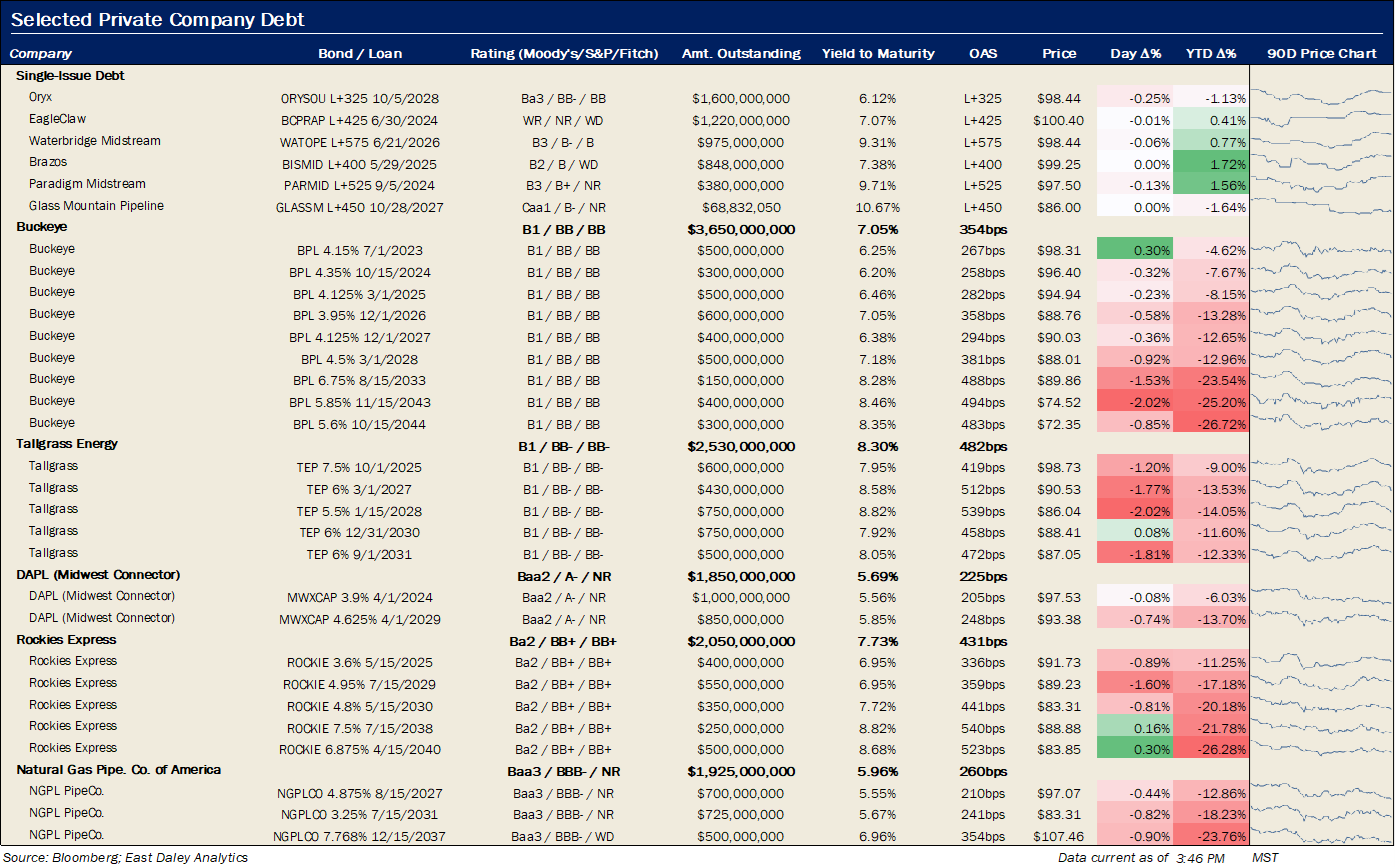

Key Private Debt Metrics

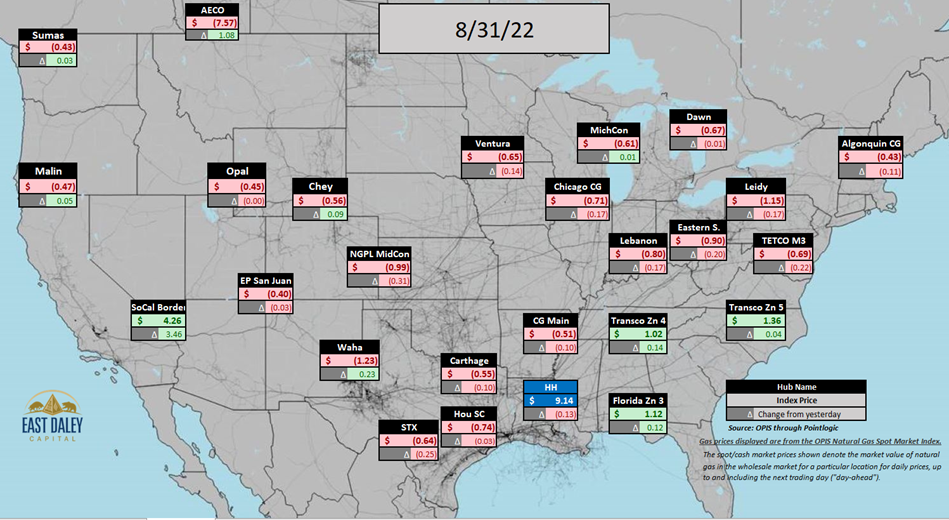

North American Natural Gas Prices

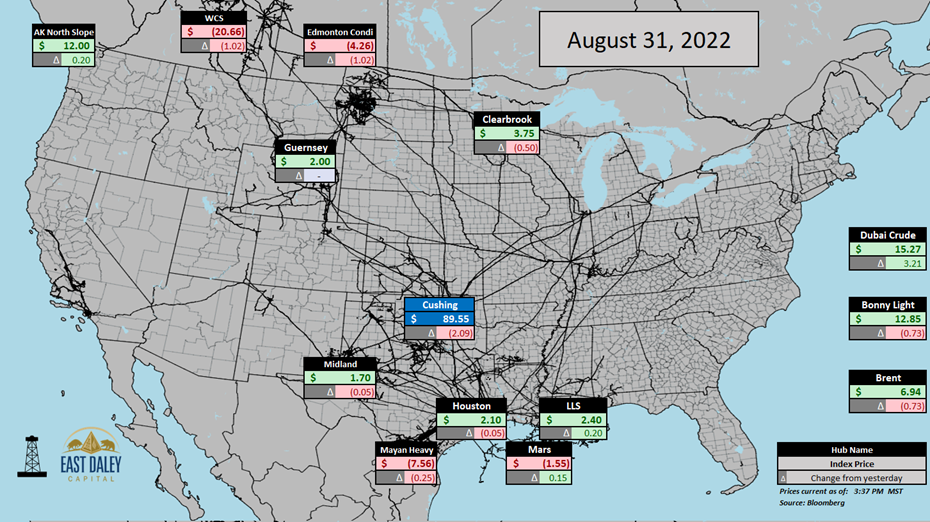

North American Crude Oil Prices

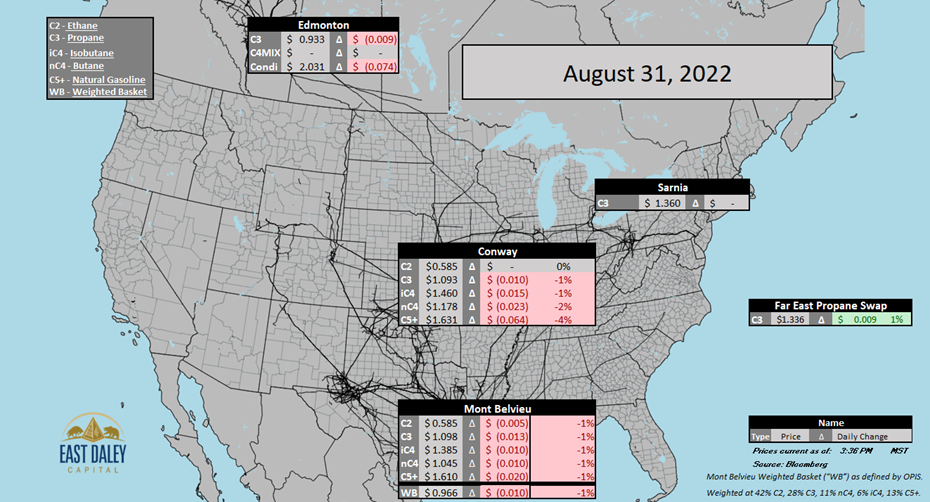

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN),“midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

-1.png)