Natural Gas Weekly: January 6, 2023

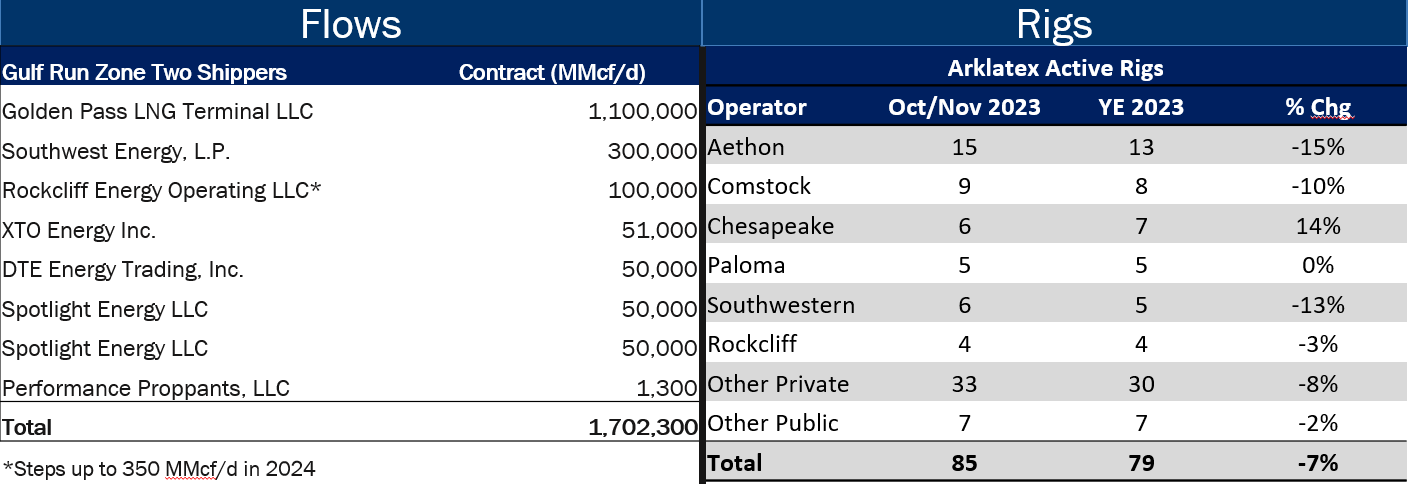

Flows – On January 1, Gulf Run Pipeline (Energy Transfer) posted new contracts for the recently finished project. Shippers that signed up include Rockcliff, Southwestern (SWN), DTE, Exxon (XOM) and other small shippers. With Golden Pass’s 1.1 Bcf/d contract, Zone 2 to the Gulf Coast is fully subscribed at 1.7 Bcf/d. We’ve seen flows show up at the Trunkline interconnect, reaching 230 MMcf/d today. We expect this to ramp up as most Zone 2 contracts are delivered to this interconnect. Until Golden Pass comes online, Gulf Run is another path to Houston, so flows will likely vary depending on netbacks to the Houston markets.

Rigs – Active rigs in the ArkLaTex fell to 79 at the end of 2022, down 7% from the average number of rigs operating in October and November 2022. East Daley expects drilling and completion activity in the ArkLaTex to slow significantly in 2023, especially with cash prices at Carthage below $3.00/MMBtu. In order to balance season-ending storage inventories in 2023, active rigs in the ArkLaTex will need to fall to 60 by mid-2023 and operators will need to build a DUC inventory of more than 300 wells. If active rigs are slower to decline, then a larger DUC inventory could be built in the region by the end of 2023 in response to very weak in-basin natural gas prices. Additionally, larger public operators are generally well-hedged heading into 2023, so most of the response will likely be from large private operators like Aethon and Rockcliff which have already scaled back drilling operations during the past month by 15% and 3%, respectively.

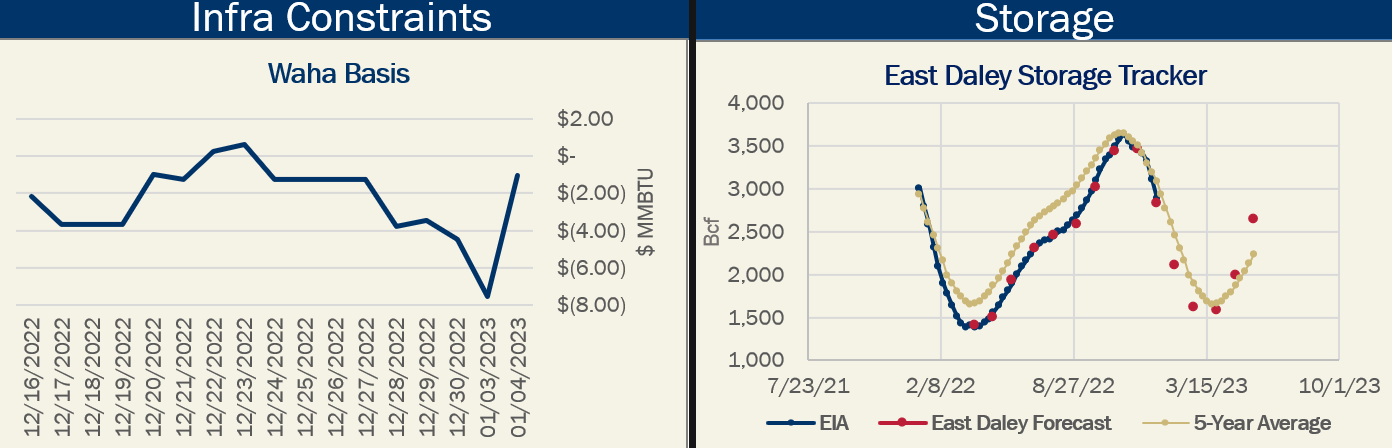

Infrastructure – Last week, Waha price fell sharply when the Gulf Coast Express Pipeline announced unscheduled maintenance on the Devil’s River compressor station, reducing capacity by 125 MMcf/d to 1.855 Bcf/d. This comes on the tail of Permian Highway already running at reduced capacity from maintenance operations that began in mid-December, reducing capacity by 400 MMcf/d to an operational capacity of 1.7 Bcf/d. The price activity highlights how constrained Permian Basin egress capacity is becoming.

Infrastructure – Last week, Waha price fell sharply when the Gulf Coast Express Pipeline announced unscheduled maintenance on the Devil’s River compressor station, reducing capacity by 125 MMcf/d to 1.855 Bcf/d. This comes on the tail of Permian Highway already running at reduced capacity from maintenance operations that began in mid-December, reducing capacity by 400 MMcf/d to an operational capacity of 1.7 Bcf/d. The price activity highlights how constrained Permian Basin egress capacity is becoming.

Storage – EIA reported an 221 Bcf storage withdrawal for the Dec. 30 week, putting inventories at 2,891 Bcf. We forecast storage to end December at 2,833 Bcf. Storage is 208 Bcf below the 5-year average after the latest EIA report.

Natural Gas Weekly

East Daley Analytics’ Natural Gas Weekly provides a weekly update to our monthly Supply and Demand forecast. The update covers rigs, flows, production, prices, and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to keep their eye on in the natural gas markets to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.