Natural Gas Weekly: January 20, 2023

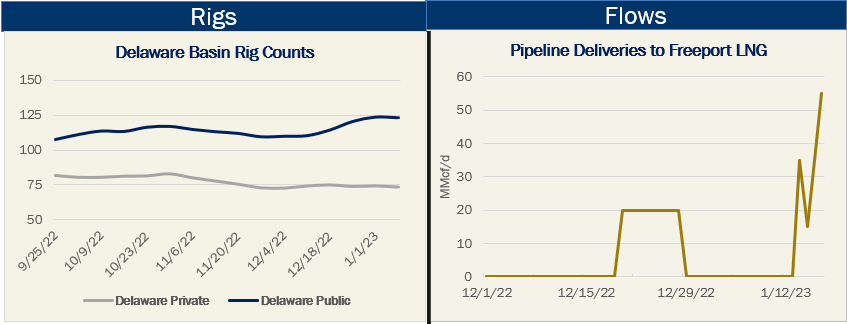

Rigs - Permian Basin rig counts recovered in late December/early January after a multi-week decline dating from October. The Permian rig count totaled 353 rigs at the start of January, up from a recent low of 335 rigs at the end of November, and just short of the 355 rigs active in the basin for most of October. Public operators in the Delaware Basin are driving the recent recovery. While private company rig counts have flattened, public E&Ps have added 14 rigs in the Delaware since the first week of December.

Flows – Feedgas deliveries to Freeport LNG restarted over the MLK holiday weekend, raising market hopes for a return of the leading Texas export facility. Deliveries to Freeport LNG climbed to 55 MMcf/d on Tuesday (Jan. 17), though volumes remain well below the ~315 MMcf/d East Daley has modeled in our Macro forecast for the plant restart. Freeport has been offline since a fire broke out at the liquefaction plant in June 2022, removing ~2.1 Bcf/d of demand from the gas market. East Daley continues to forecast Freeport LNG to restart in February and ramp to full capacity by 2Q23.

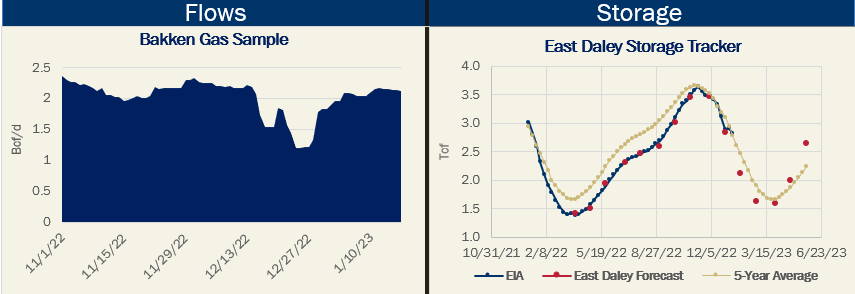

Flows – Bakken residue samples have recovered in the last week from the Artic blast in late December. Since the storm hit over the 12/23–12/29 period, the basin sample is up 60% (801 MMcf/d). However, it is still down 4% (92 MMcf/d) from normal levels of 2.2 Bcf/d. The recovery is consistent with declines of 0.3 - 0.5 Bcf/d seen in the Bakken during previous winter storms. We have ~100% sample coverage in the Bakken, so these are reliable estimates of freeze-offs.

Flows – Bakken residue samples have recovered in the last week from the Artic blast in late December. Since the storm hit over the 12/23–12/29 period, the basin sample is up 60% (801 MMcf/d). However, it is still down 4% (92 MMcf/d) from normal levels of 2.2 Bcf/d. The recovery is consistent with declines of 0.3 - 0.5 Bcf/d seen in the Bakken during previous winter storms. We have ~100% sample coverage in the Bakken, so these are reliable estimates of freeze-offs.

Infrastructure – Waha prices crashed to -$2.71/MMBtu earlier this week as the El Paso pipeline placed an underperformance cap on the Keystone and Waha pooling areas. Issues seemed to persist this week through Tuesday (Jan. 17), with Waha prices eventually turning positive again on Wednesday and trading for $2.31 on Thursday (Jan. 19), according to Bloomberg data. Pipeline samples dropped by 165 MMcf/d last Friday (Jan. 13) but seemed to recover quickly.

Storage - EIA reported an 82 Bcf storage withdrawal for the Jan. 13 week, putting working inventories at 2,820 Bcf. We forecast storage to end January at 2,117 Bcf. Storage is 43 Bcf above the 5-year average after the latest EIA report.

Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)