Natural Gas Watch: October 19, 2022

Natural Gas Watch is East Daley's weekly review of natural gas market fundamentals, provided free to subscribers each Thursday morning ahead of the EIA storage release. Subscribe to Natural Gas Watch. "Cut through the noise, take action.”

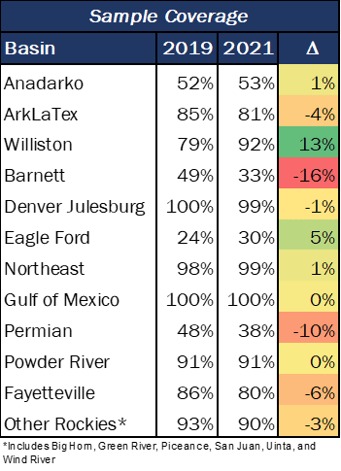

East Daley's basin-by-basin review of gas samples finds robust coverage in the Northeast and Haynesville, lending confidence to the reliability of our Macro Supply and Demand Forecast.

The US gas sample coverage averaged 78% in 2021. Basins with the highest coverage include the Williston, Northeast and Rockies. Pipeline samples tracked to ~93% of gas production from these regions. However, basins such as the Permian, Eagle Ford and Barnett had a low combined coverage of ~34%.

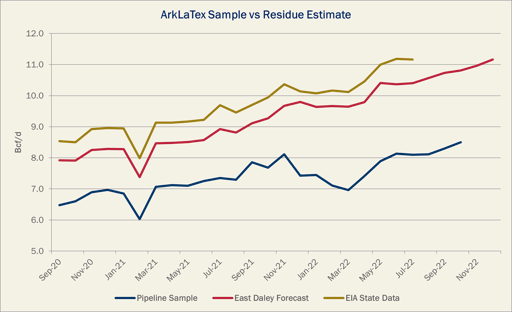

Our ArkLaTex sample coverage is ~81%, which is relatively high and gives EDA confidence in our forecast based on daily pipe data. Overall, the high Northeast/ArkLaTex sample coverage (51% of US production) increases the reliability of our Macro Supply and Demand Forecast.

Since 2019, the Permian sample coverage has decreased by 10%, a result of most new projects involving intrastate pipelines. We expect the decline in Permian coverage to continue, making other midstream data more valuable for understanding basin dynamics.

******

Haynesville pipeline samples have increased by ~200 MMcf/d so far in October, lending support to our bullish ArkLaTex supply outlook. We forecast gas volumes in the Haynesville to ramp ~430 MMcf/d from September to December. Pipe scrapes as well as EIA data had been flat the last few months, but the recent trend in samples indicates the forecasted volumes are starting to show up. For more on our Haynesville outlook, see our Oct. 12 Natural Gas Watch, "More Rigs, More Supply in Haynesville".

In the Northeast, we model an even larger supply ramp of ~922 MMcf/d between September and December. Our forecast is in line with recent winters, which typically see production grow to capture higher regional demand and prices. We

anticipate Northeast samples start trending upwards in late October/early November.

******

Dry production for the 10/13–10/19 week averaged 98.5 Bcf/d according to flows.

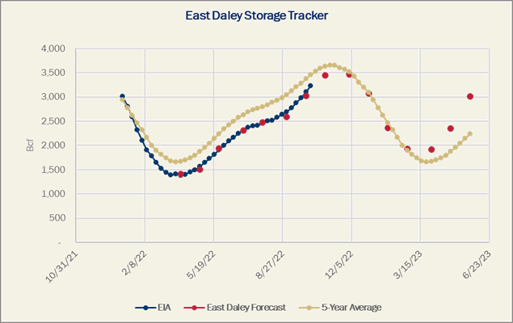

We estimate October production to average 99.3 Bcf/d in our Macro Supply and Demand Forecast. We forecast storage to end October at 3,447 Bcf, implying 216 Bcf of additional injections during October.

Subscribe to Natural Gas Watch. "Cut through the noise, take action.” NGW highlights East Daley's high-level perspective on weekly natural gas market changes.

-1.png)