Natural Gas Weekly: May 26, 2023

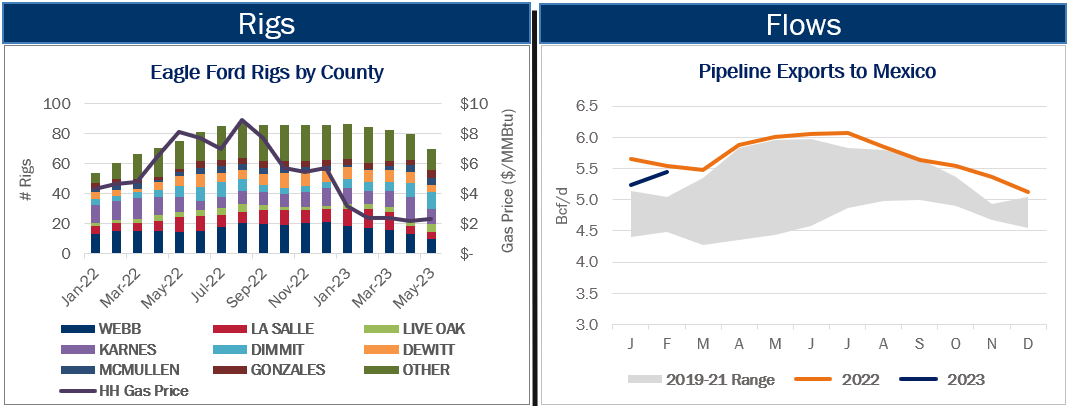

Rigs - Active rigs in the Eagle Ford shale have fallen by 13 rigs (16%) in the past two months, with most of the decrease occurring in the dry gas window of the play. East Daley estimates basin rig counts have averaged 70 in May 2023, down from 83 rigs in March 2023.

The loss of gas-focused drilling in the Eagle Ford will help correct for US gas oversupply heading into next winter. In our balanced US Macro Supply and Demand Forecast, we anticipate deferred upstream activity in several dry gas basins, including the Eagle Ford, to help avert storage overfill by October 2023. In the long term (2025-26), East Daley expects the dry gas window of the Eagle Ford to support LNG export development, so rig activity will likely return as gas prices rebound.

Flows - Recent price action in the Permian suggests pipeline exports to Mexico are on the rise. Waha gas prices strengthened this week, trading only $0.35-0.40/MMBtu behind the Henry Hub vs a $0.80-1.00 range the week prior. Prices have fully recovered from recent pipeline maintenance that sent Waha into negative territory.

Flows - Recent price action in the Permian suggests pipeline exports to Mexico are on the rise. Waha gas prices strengthened this week, trading only $0.35-0.40/MMBtu behind the Henry Hub vs a $0.80-1.00 range the week prior. Prices have fully recovered from recent pipeline maintenance that sent Waha into negative territory.

The gains at Waha come amid the shoulder period of relatively low market demand. We suspect pipeline exports to Mexico are behind the recent price strength. Historically, exports to Mexico increase in late spring as air conditioning demand increases with warming temperatures. Several pipeline interconnect in West Texas allow for Permian gas to be exported directly to Mexico, removing pressure on prices as demand ramps. However, the market has poor visibility into this seasonal trend due to lagged or non-reporting by pipelines in Mexico. For now, analysts and traders rely on export data reported by EIA on a three-month lag.

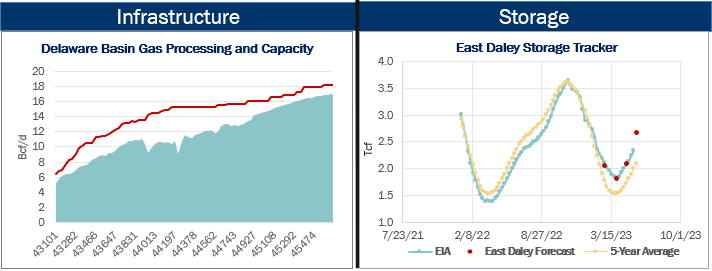

Infrastructure - Western Midstream (WES) plans to build a new 250 MMcf/d gas processing plant in North Loving County, TX in the Delaware Basin. The new North Loving plant is expected to enter service in 4Q24, WES said. The North Loving project is one of many expansions planned in the Permian Basin. In the Permian Basin Supply and Demand Forecast, East Daley forecasts 2.6 Bcf/d of new processing capacity will come online in the Delaware by YE24. We forecast another 1.6 Bcf/d to start up in the Midland Basin during the same period.

Storage - EIA reported a 96 Bcf storage injection for the May 19 week, putting working gas inventory at 2,336 Bcf. In our updated Macro Supply and Demand Forecast, we estimate working gas ends May at 2,652 Bcf. US storage is 340 Bcf above the 5-year average after the latest EIA report.

Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)