Tallgrass Energy said it has secured anchor shippers for a potential 2.4 Bcf/d pipeline that will connect Rockies Express Pipeline (REX) to Permian gas supply. The project would overbuild the Permian and further tilt the playing field toward producers, according to our basin forecast.

Tallgrass provided scant details in the May 12 announcement, but said the precedent agreements are already sufficient to move forward with construction. The company plans an open season to offer additional capacity for up to 2.4 Bcf/d of total egress available by late 2028.

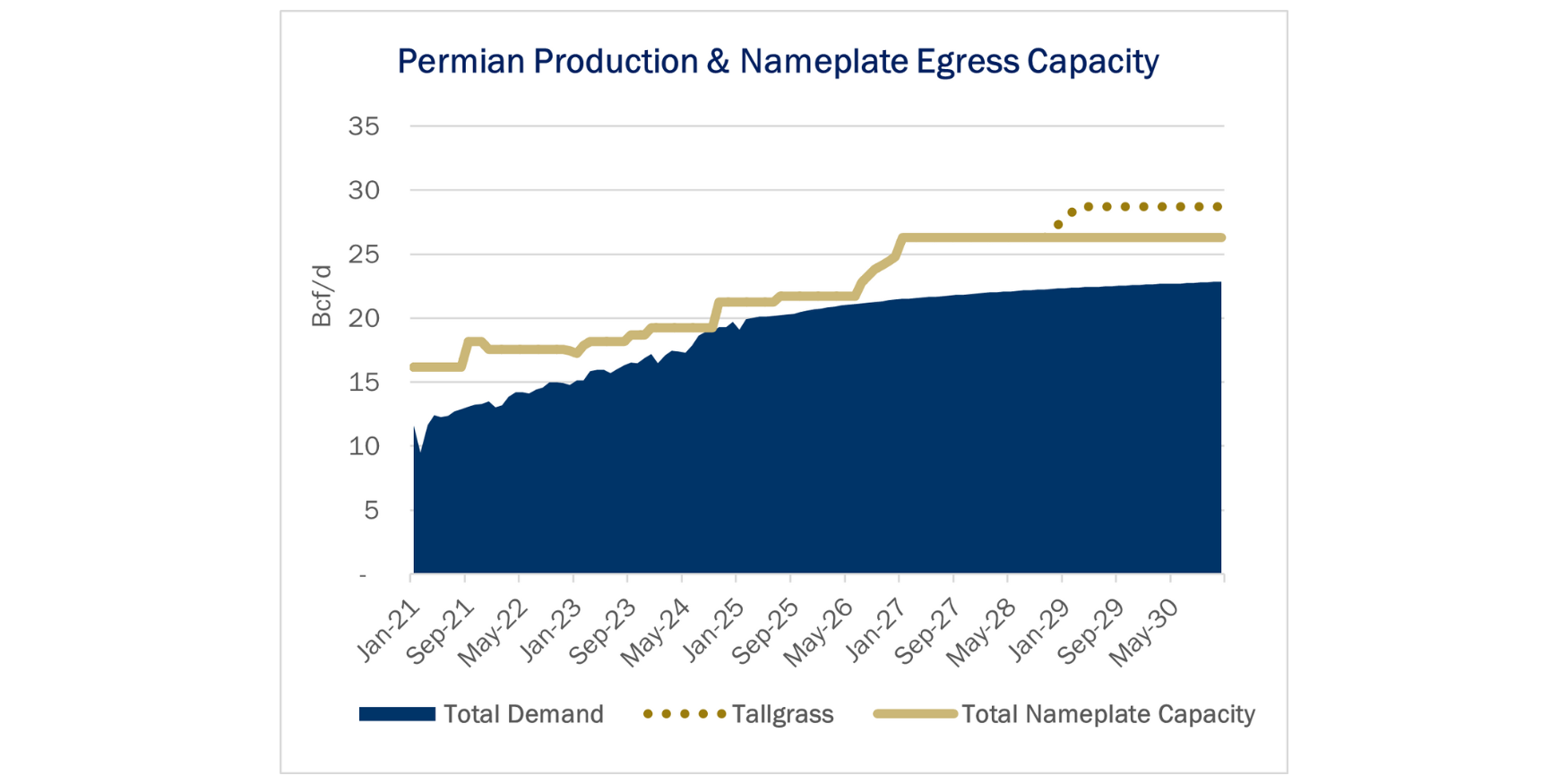

The new pipeline would add to an overbuild by the end of the decade, according to East Daley Analytics’ Permian S&D Model. WhiteWater Midstream is building the 2.5 Bcf/d Blackcomb Pipeline, and Energy Transfer (ET) has taken a final investment decision on the 2.2 Bcf/d Hugh Brinson project. Taken together, we estimate the Permian will have ~6 Bcf/d of excess egress capacity in 2029 and 2030 with the Tallgrass pipe (see figure).

On the supply side, Permian gas production continues to grow, but the pace slows over time. Several producers have pulled back on 2025 spending plans given recent volatility and lower WTI prices, which has dampened growth in the forecast.

The significant excess pipe capacity would flip the normal dynamics of tight takeaway from the Permian. This means more runway for supply growth, and higher in-basin prices as shippers have more flexibility to move gas.

The Tallgrass announcement could intensify rate pressure on other Permian routes. Permian Highway Pipeline has 12 contracts expiring before 2030 at average tolls near $0.51/MMBtu-day, while Gulf Coast Express sees most of its capacity roll off in 2029 at $0.40–0.46/MMBtu-day. With up to 7 Bcf/d of capacity set to come online, both pipelines could face downward pressure on volumes and tolls, impacting equity owners such as Kinder Morgan (KMI) and Kinetik (KNTK). – Zach Krause Tickers: ET, KMI, KNTK.

Coming Soon – The Burner Tip

Introducing The Burner Tip, East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. — Subscribe now to The Burner Tip!

Data Center Demand Monitor - Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Get the FERC Intrastate Pipeline Data

Introducing East Daley’s latest data file: FERC 549D Intrastate Contract Data. This new offering delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)