Executive Summary: Rigs: The total rig count decreased by 4 for the November 3 week, down to 563 from 567. Infrastructure: Canada’s crude oil production continues to surge ahead, liberated by start-up of the TransMountain Pipeline expansion (TMX) in May ‘24. Storage: East Daley expects a 630 Mbbl withdraw from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending November 15.

Rigs:

The total rig count decreased by 4 for the November 3 week, down to 563 from 567. Liquids-driven basins declined by 5 rigs W-o-W.

- Anadarko (-1): American Warrior (-1)

- Bakken (-1): Chord Energy (-1)

- Eagle Ford (+1): EXCO Resources (+1)

- Permian (-2):

- Delaware (-1): EOG Resources (-1)

- Midland (--1): Exxon (-1)

- Powder River (-1): Anschutz Corp. (-1)

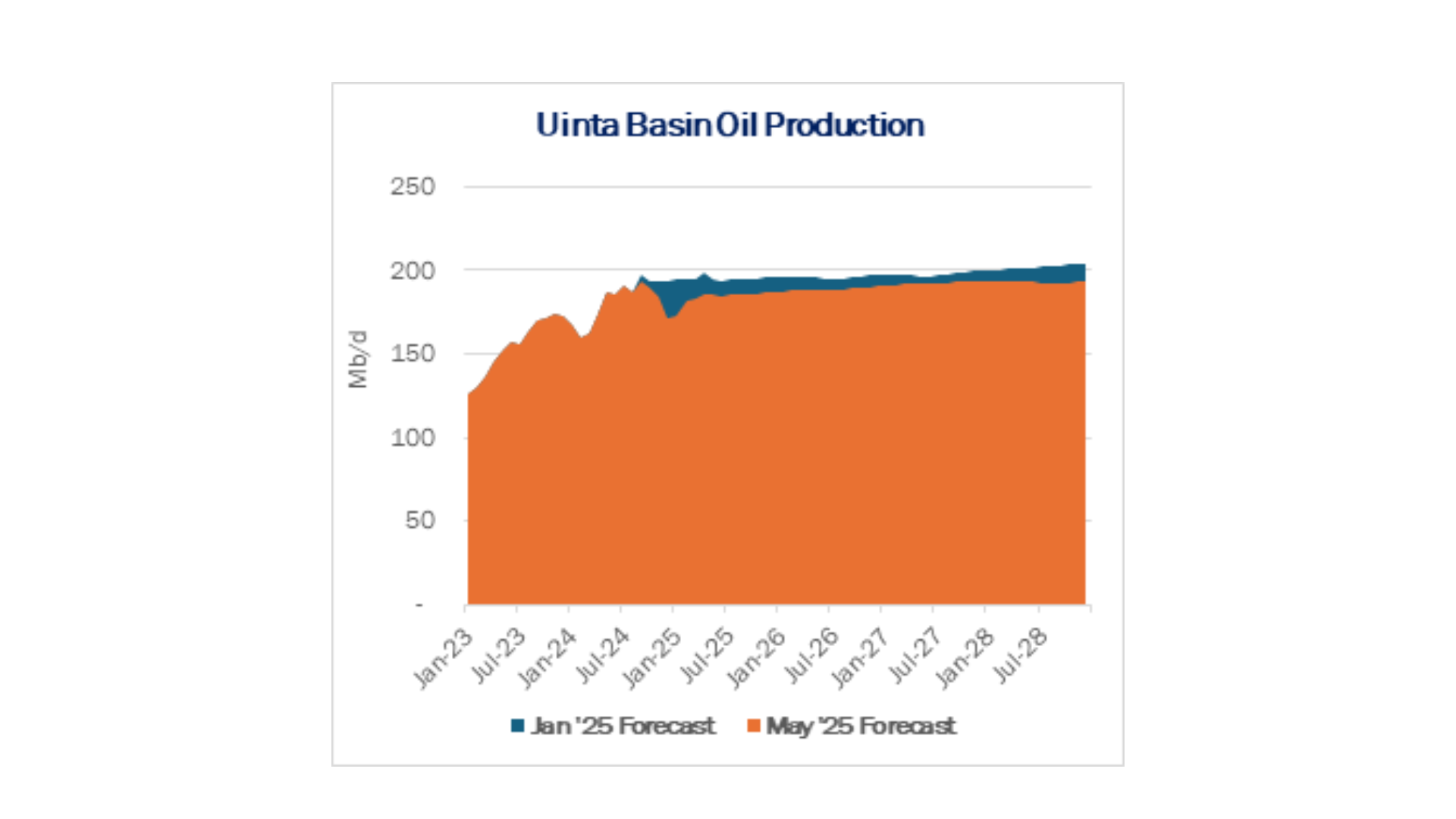

- Uinta (-1): WEM Operating, LLC (-1)

Infrastructure:

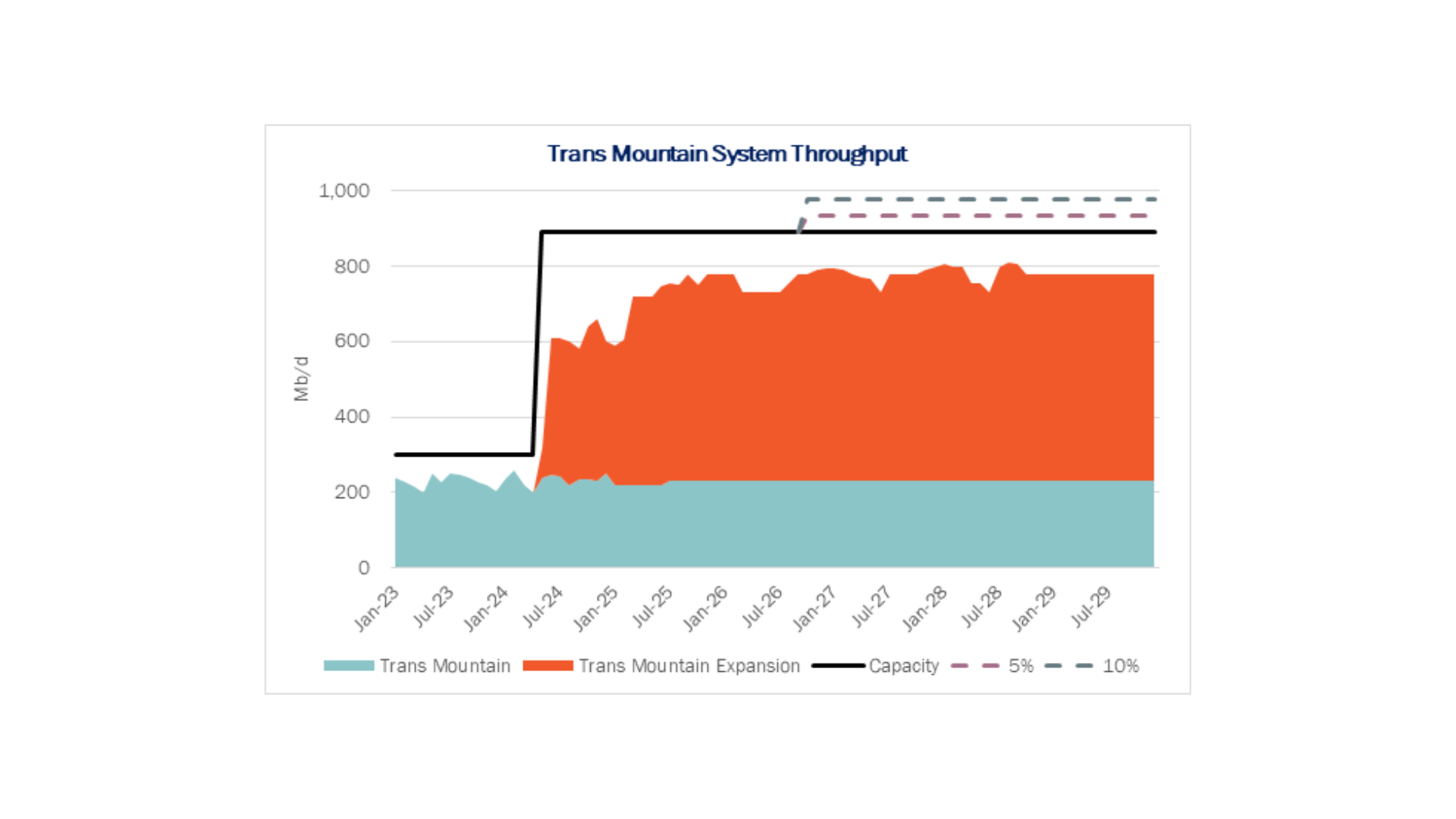

Canada’s crude oil production continues to surge ahead, liberated by start-up of the TransMountain Pipeline expansion (TMX) in May ‘24. East Daley forecasts the 590 Mb/d of egress created by TMX will be filled with organic supply growth by YE25.

In our Western Canadian Sedimentary Basin (WCSB) production forecast, most of the growth occurs in Alberta. The province hosts the Peace River, Athabasca, and Cold Lake oil sands mines, as well as the Duvernay and Montney plays that produce lighter oil. These sources account for ~83% of total WCSB oil production. Looking forward, we forecast WCSB production to grow ~5.6% in 2024 and up to 7% in 2025, reaching 5 MMb/d by December ’25 (see figure).

Canadian Natural Resources (CNRL), the WCSB’s largest crude oil producer, is one of the main operators driving growth. CNRL reported 1.02 MMb/d of production in 3Q24, up 4.5% from 3Q23. The company is running 16 rigs in the Montney and Mannville/Clearwater areas, up 4 rigs from 1H24.

CNRL is well-positioned to move barrels to market following its purchase of PetroChina’s TMX minimum volume commitments (MVCs). The acquisition brings CNRL’s total MVCs on TMX to 169 Mb/d. CNRL also has ~90 Mb/d of commitment to the Gulf Coast via the Enbridge Mainline/Flannigan South and Keystone pipelines.

CNRL has been active on other fronts in Western Canada. The producers recently acquired Chevron’s (CVX) interests in the Athabasca Oil Sands, the Scotford Upgrader, and its 70% working interest in Duvernay assets. The companies expect to close the deal in 4Q24. The acquisition will bring CNRL’s Athabasca interest to 90% and add 62.5 Mb/d of Syncrude production, plus 30 Mb/d from the Durvernay fields.

As Canadian producers fill the remaining egress, we expect increased volatility and congestion will return to WCSB price benchmarks. Oil grades like Western Canadian Select are likely to lose some of the gains made with the start-up of TMX and improved access to international markets.

Storage:

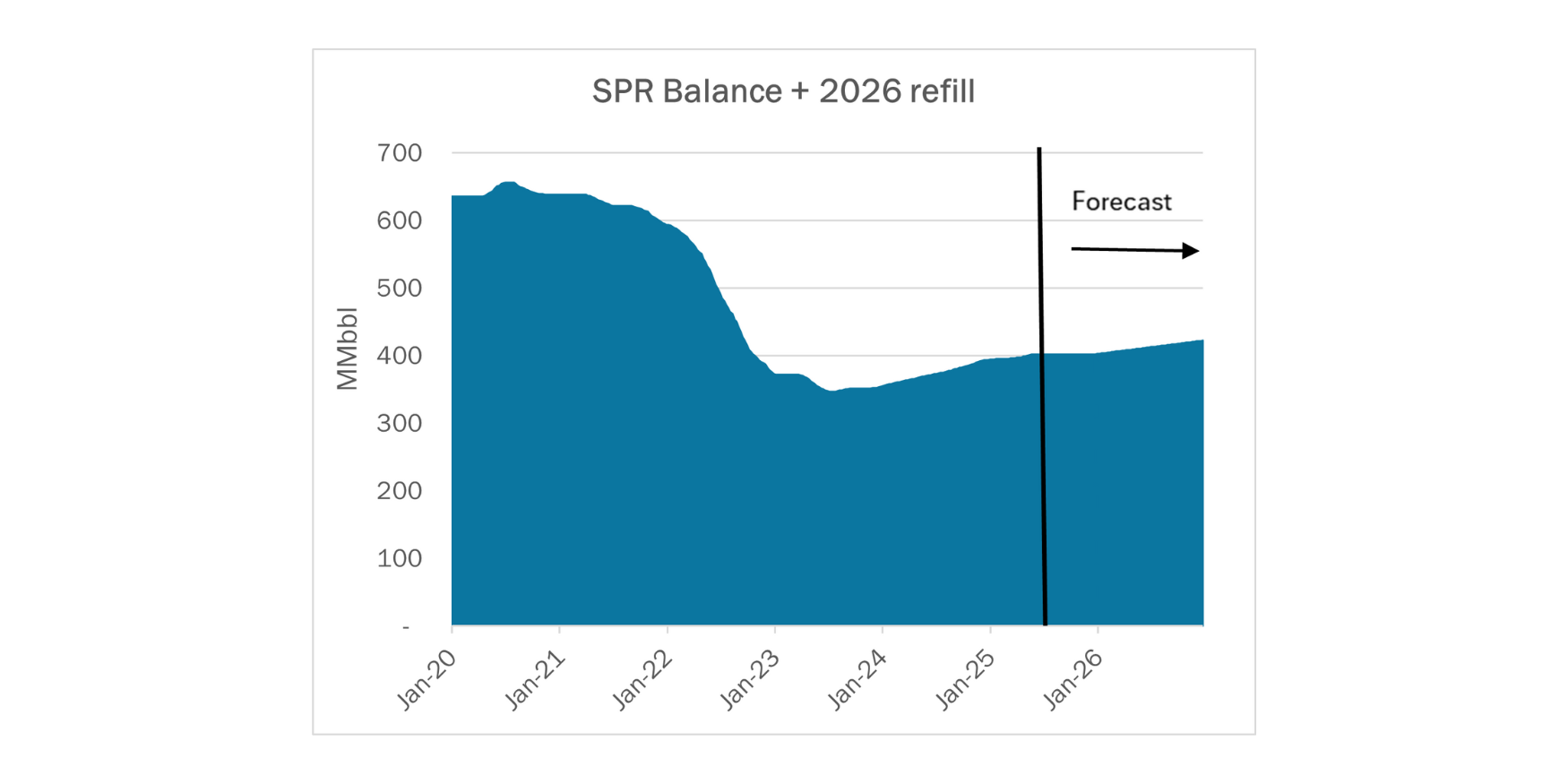

East Daley expects a 630 Mbbl withdraw from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending November 15. We expect total US stocks, including the SPR, will close at 817 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 0.57% W-o-W across all liquids-focused basins. Samples increased 8% in the Eagle Ford and 1.36% Rockies. Hurricane Rafael caused some production to be shut in the Gulf of Mexico resulting in a 23% decrease in gas samples. The Rockies and the Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to increase to 13.5 MMb/d. According to US bill of lading data, US crude imports increased by 300 Mb/d W-o-W to 6.8 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico, Venezuela and Brazil.

As of November 15, there was ~100 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~200 Mb/d W-o-W, coming in at 16.7 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 25 vessels loaded for the week ending November 16 and 22 the prior week. EDA expects US exports to be 4.35 MMb/d.

The SPR awarded contracts for 4.55 MMbbl to be delivered in November 2024. The SPR has 388 MMbbl in storage as of November 8, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Bridger Pipeline LLC. Bridger Pipeline is cancelling gathering movements from Billings, Golden Valley and Stark Counties in North Dakota due to limited very limited shipper interest. Bridger will continue to offer gathering services McKenzie County, North Dakota. All impacted shippers have been notified. FERC No 117.26.0 IS25-74 (filed November 15, 2024) Effective January 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)