Crude Oil Edge: October 18, 2023

Rigs

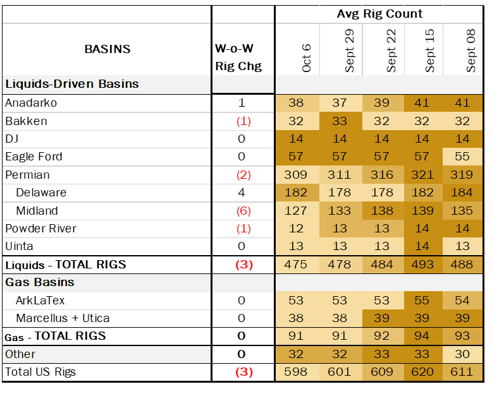

The US rig count decreased by 3 W-o-W to bring the total count to 598. Liquids basins overall lost 4 rigs, including 2 rigs in the Permian, 1 rig in the Bakken and 1 rig in the Powder River. The Anadarko gained 1 rig. Within the Permian Basin, the Delaware added 4 rigs and the Midland lost 6. The DJ, Eagle Ford and Uinta basins saw no change.

Private producers accounted for most of the rig volatility in the Permian this week. Privates lost 3 rigs in the Midland but gained 7 rigs in the Delaware. Delaware producers Matador and BTA Oil each gained 2 rigs while Capitan Energy gained 1. In the Midland, privates CrownQuest and Vencer Energy each dropped 1 rig and RP Op lost 2.

Infrastructure

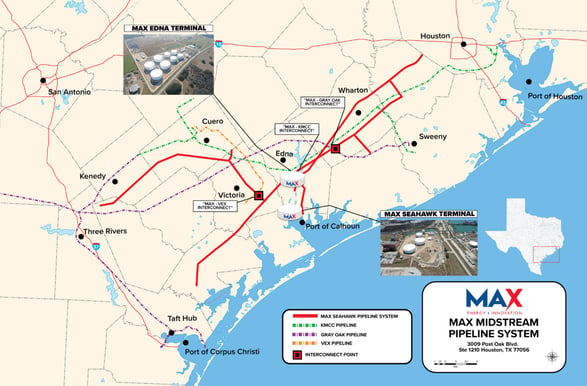

Max Midstream is creating additional egress for crude oil exports at the Port of Calhoun on the Texas Gulf Coast.

In 2021 Max converted a 21-inch, 12-mile natural gas pipeline to transport crude oil from its Edna terminal in the Eagle Ford to its Seahawk terminal at the Port of Calhoun. Later this year, Max expects to complete the conversion of a 14-inch gas pipeline to ship Eagle Ford oil via Victoria Express Pipeline (VEX) to the Edna terminal. Max is also converting a 16-inch gas pipeline to move Permian and Eagle Ford crude oil from Gray Oak Pipeline to the Edna terminal. Max is targeting completion of that project in 1Q24. In addition to the pipeline projects, Max Midstream has expanded tank capacity and truck lease automatic custody transfers (LACTs) at Edna to handle more volume.

The investments by Max coincide with a planned expansion of the Port of Calhoun’s Matagorda ship channel. The Matagorda Ship Channel Improvement Project (MSCIP) will deepen and widen the channel through two coastal bays to allow oil tankers access to the port. The Army Corps of Engineers initially approved MSCIP in 2020, but then withdrew approval in December 2022 to allow for additional environmental testing. Presently, the regulator has proposed a testing plan for contaminants in a Matagorda Bay Superfund site, which would allowing MSCIP to move forward.

Storage

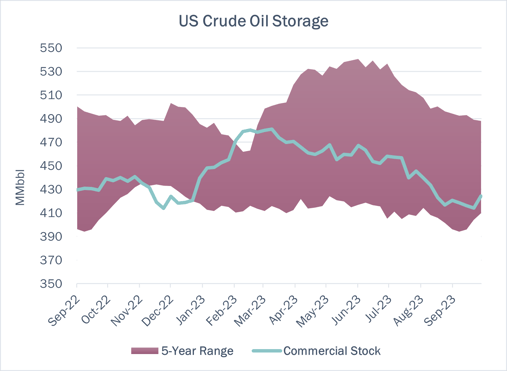

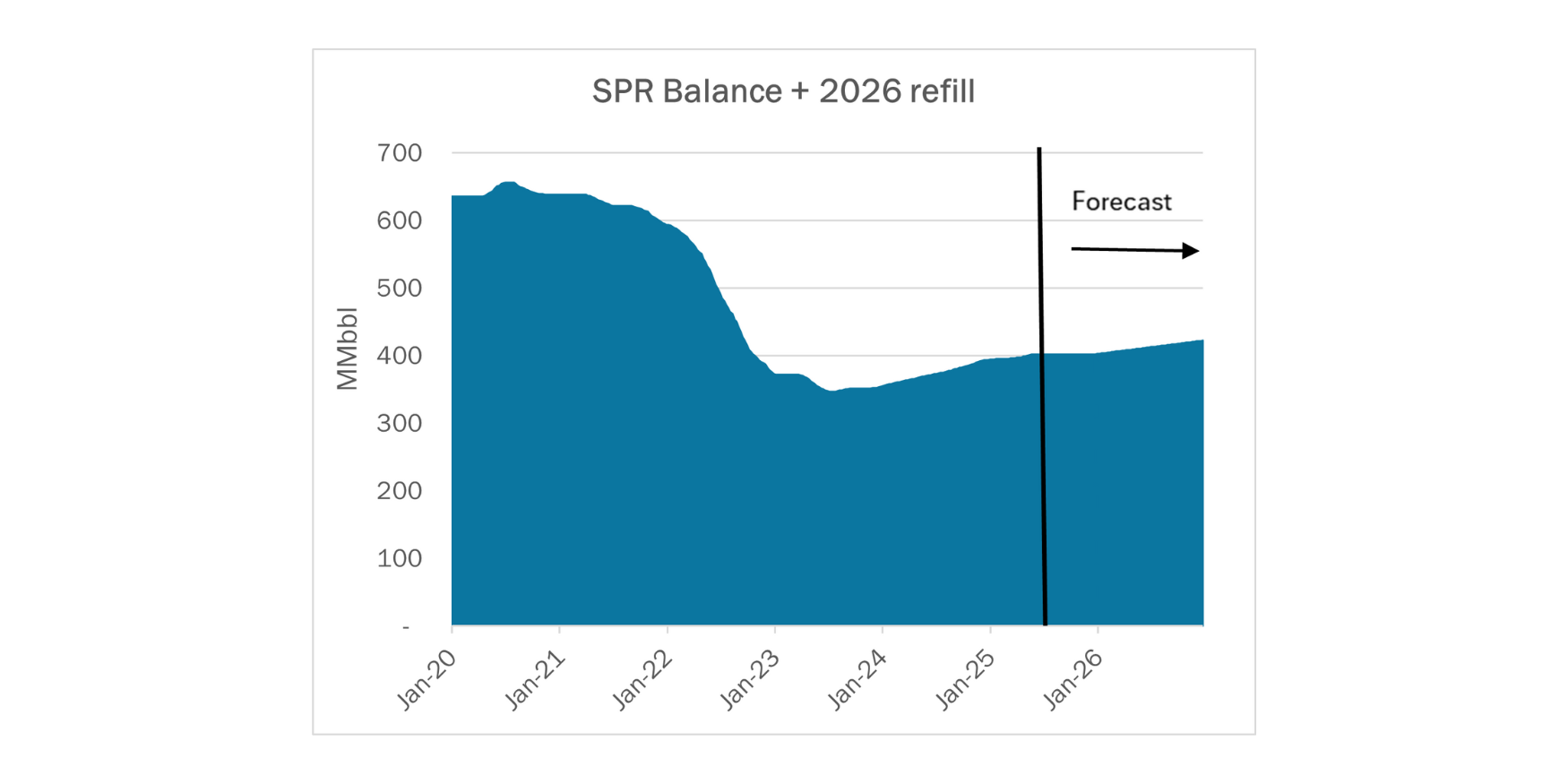

Crude oil commercial stocks are up 10.176 MMbbl over the week ending October 6 to 424.24 MMbbl. Strategic Petroleum Reserves (SPR) stocks are flat at 351.27 MMbbl.

The latest EIA Short Term Energy Forecast (STEO) predicts lower storage levels for 2023 and 2024. The 2023 forecast is slightly lower (-0.3%) to 421.4 MMbbl while 2024 is showing a more dramatic decrease of -2.7% to 427.7 MMbbl. It comes as no surprise that storage levels continue to be strained as supply remains tight due to OPEC+ production cuts planned through YE23. US exports continue to run at 3.5+ MMb/d, and a backwardated forward curve is discouraging new rig additions.

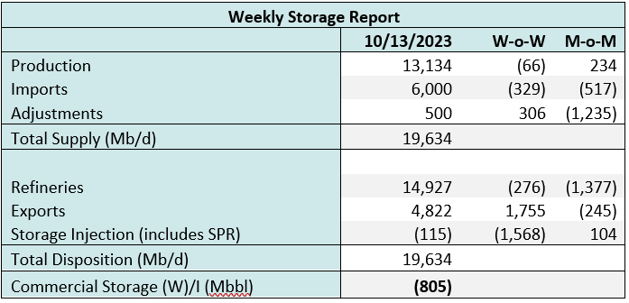

East Daley expects a draw of 805 Mbbl in commercial inventories for the week ending October 13. We expect total US stocks, including the SPR, will close at 774.7 MMbbl.

The US pipeline sample, a proxy for change in production, increased by 0.5% in liquids-focused basins. The Permian Basin saw the largest increase at 2.5%, but only ~35% of total production is visible through this data. We expect US crude production will come in at 13.1 MMb/d.

According to US bill of lading data, US crude imports declined by 330 Mb/d W-o-W to 6.0 MMb/d. On the demand side of the equation, EDA expects gross crude inputs into refineries to fall by 1.8% W-o-W, coming in at ~14.9 MMb/d. Refinery outage and turnaround data indicated there was another 276 Mb/d of capacity offline.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 29 vessels loaded for the October 13 week vs 24 vessels the prior week. EDA expects US exports to be 4.8 MMb/d, up ~1.8 Mb/d W-o-W.

Regulatory and Tariffs

Presented by ARBO

Protests and Complaint Proceedings: FERC confirmed the initial decision granting the requests of West Texas Gulf Pipeline Co. and Permian Express Partners to charge market-based rates for the Nederland, TX and Anchorage, LA destination markets, but denied the request to charge market-based rates for the Tyler, TX destination market.

Tariffs:

Centurion Pipeline (owned by Energy Transfer) established new transportation rates from Andrews County, TX (Midland Basin) to its Midland tank farm and Magellan’s Crane terminal. Shippers will pay either $0.81/bbl to get to the tank farm, or $1.01/bbl to get to Crane. Both locations offer extensive connectivity to long-haul pipelines for further delivery into downstream markets. (IS23-711, filed September 29, 2023)

Permian Express Partners increased the temporary volume incentive rate for shipments originating in Cushing, OK and delivering to Nederland, TX. The new rate is set at $1.50/bbl, representing a $0.27/bbl (22%) increase. The minimum volume threshold also increased from 2 Mb/d to 10 Mb/d. (IS23-710, filed September 29, 2023)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)