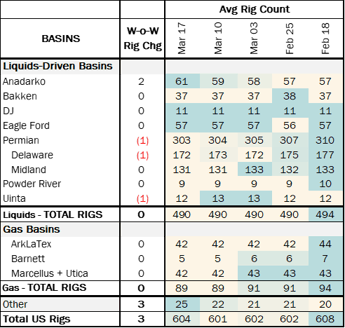

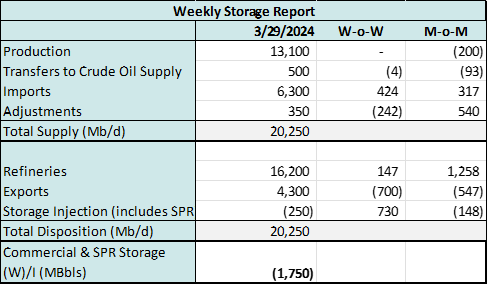

Executive Summary: Rigs: The total US rig count increased by 3 rigs W-o-W, up from 601 to 604 for the March 17 week. Infrastructure: Canadian producers are gearing up to raise crude oil output in anticipation of the new Trans Mountain Pipeline expansion (TMX). Storage: East Daley expects a withdrawal of 1.750 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 29.

Rigs:

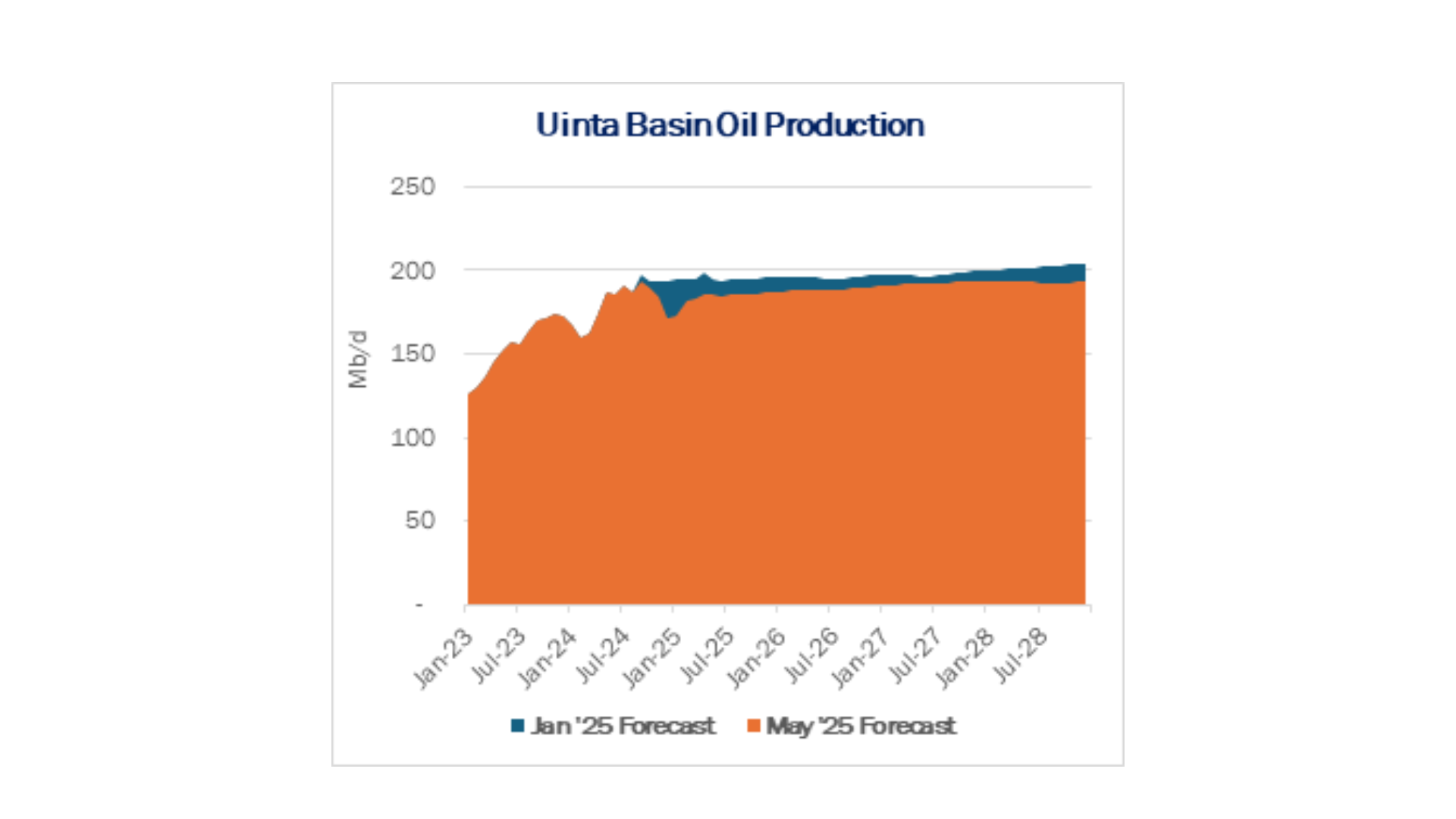

The total US rig count increased by 3 rigs W-o-W, up from 601 to 604 for the March 17 week. The gain came mainly from rigs in ‘Other’ basins. Rigs were flat in liquids-driven basins. Producers added 2 rigs in the Anadarko Basin, while the Permian and Uinta each lost 1 rig.

Anadarko operators Merit Energy and BCE-Mach III each added a rig W-o-W. In the Permian, operators such as Ovintiv, Chevron, EOG Resources, Permian Resources, Devon Energy, and Occidental Petroleum all moved rigs across the basin, ultimately leading to a net loss of 1 rig in the Delaware. Uinta Wax Operating dropped 1 rig W-o-W in the Uinta Basin.

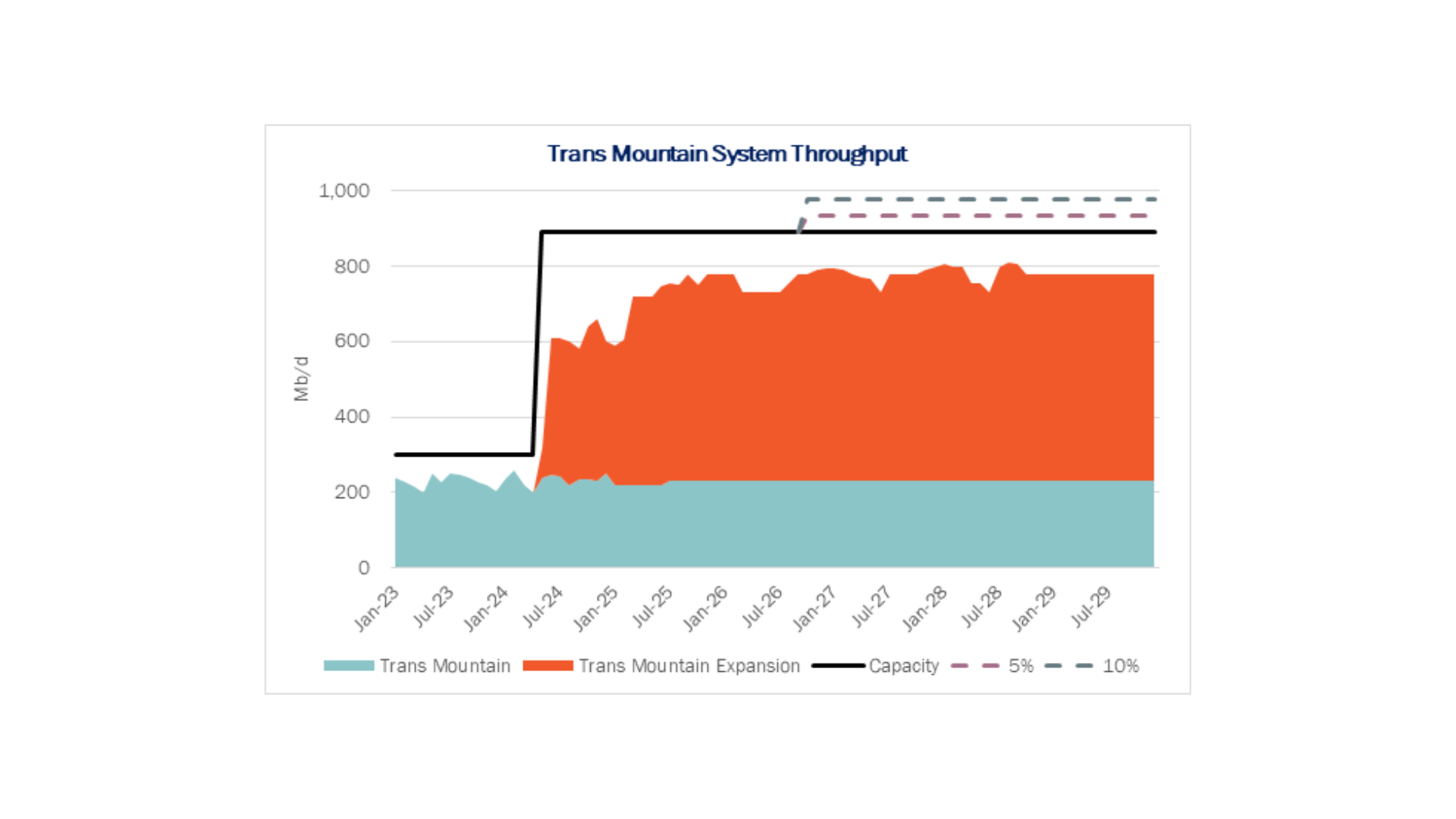

Infrastructure:

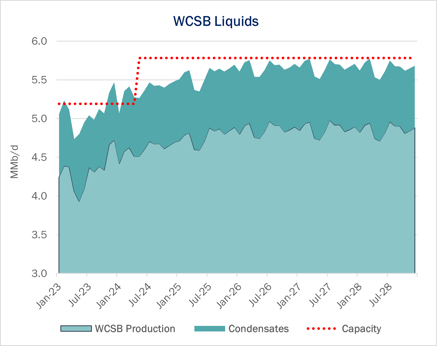

Canadian producers are gearing up to raise crude oil output in anticipation of the new Trans Mountain Pipeline expansion (TMX). In the Crude Hub Model, East Daley Analytics expects the new egress capacity to British Columbia will be filled by mid-2026.

After several years of delay, TMX is slated to begin operations in May 2024. The project will twin the existing Trans Mountain line, adding 590 Mb/d of capacity from Alberta to the Westport Terminal in Burnaby, BC. Owned by the Canadian federal government, Trans Mountain expects to begin filling the new pipeline this month (April ’24).

The new market access has spawned expansion plans by operators in the Western Canadian Sedimentary Basin (WCSB). We expect most of the growth to come from the oil sands, specifically in-situ recovery where bitumen is heated and pumped out of the ground. Based on company announcements, EDA expects the lion’s share of growth to begin in 2H24 and continue through 2025.

In the Crude Hub Model, EDA forecasts Canadian oil production to grow ~45 Mb/d (1%) by YE24, ramping to growth of ~200 Mb/d (4%) by YE25. The figure shows WCSB oil production and associated condensates (produced+imports) blended into the bitumen to facilitate oil flows. The graph does not account for rail volumes, which will increase once shippers fill available pipeline capacity.

Western Canada’s largest producers have announced plans to expend and fill the long-awaited pipeline project. Canadian Natural Resources (CNQ) is developing five in-situ projects in the oil sands, one to come online in 2024 and four to start in 2025. Cenovus (CVE) has six in-situ projects approved in the Athabasca oil sands. CVE plans to start one project in 2024, three in 2025, and two in 2026.

Overall, the Alberta Energy Regulator has approved at least 44 projects in the oils sands, including four in the oil sand mines, 36 in the Athabasca oil sands region, and four in the Cold Lake oil sands region.

Storage:

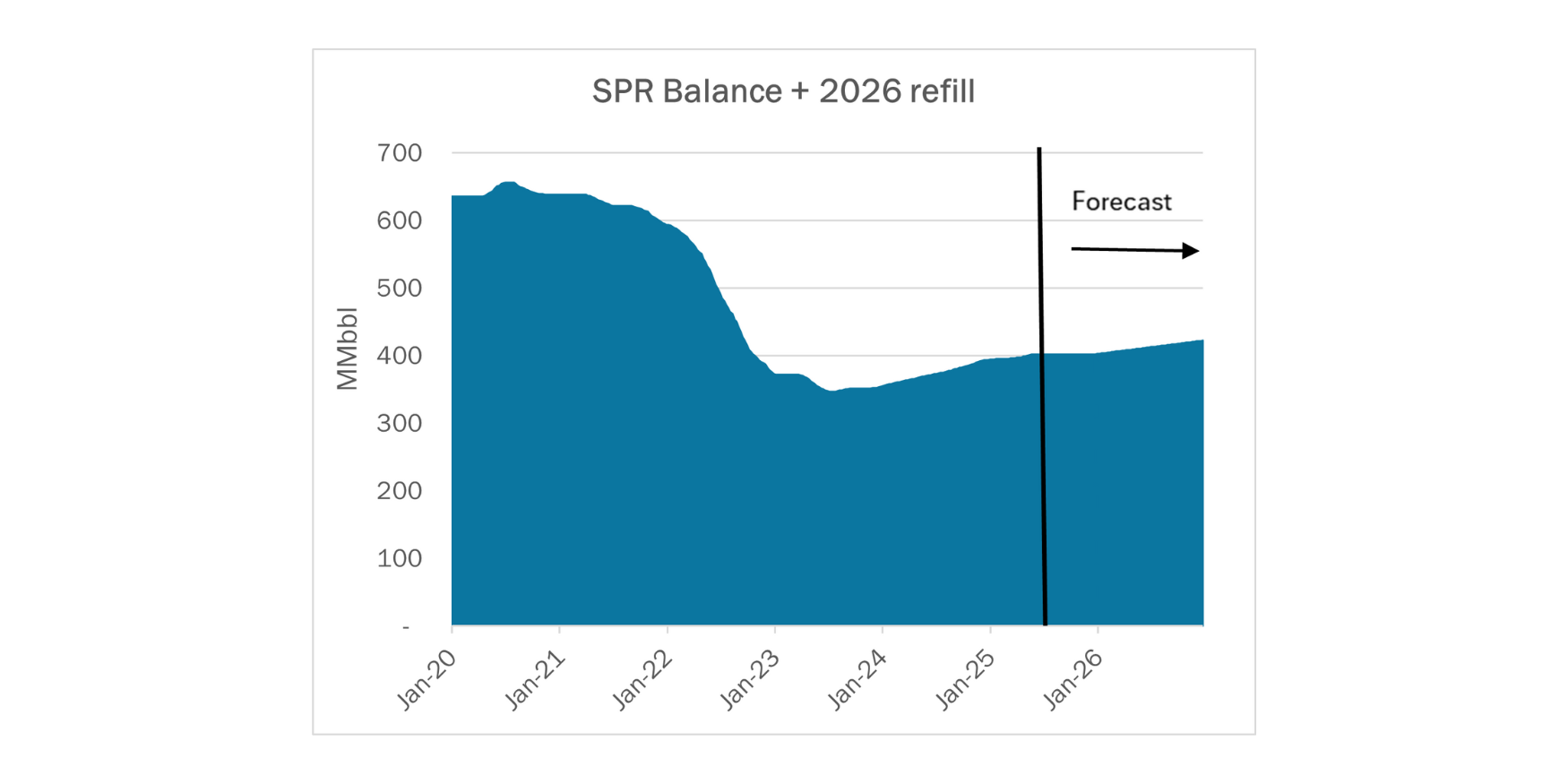

East Daley expects a withdrawal of 1.750 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 29. We expect total US stocks, including the SPR, will close at 809.507 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, fell ~0.5% W-o-W across all liquids-focused basins. Samples declined 2.3% in the Rockies and 0.9% in the Permian Basin. The declines were offset by a ~3.4% increase in the Eagle Ford. We expect US crude production to remain flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports decreased by 402 Mb/d W-o-W to 6.3 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico and Nigeria.

As of March 29, there was ~662 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~265 Mb/d W-o-W, coming in at 16.2 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 28 vessels loaded for the week ending March 29 and 23 the prior week. EDA expects US exports to be 4.3 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in April 2024. The SPR has 363.750 MMbbl in storage as of March 29, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Seaway Crude Pipeline Company LLC The temporary volume incentive rates have been extended through April 30, 2024. (FERC No 1.8.1 IS24- 228, filed March 19, 2024)

Enbridge Pipelines LLC The uncommitted international joint rates were decreased on the Canadian mainline from receipt points in Western Canada to Flanagan, IL. (FERC No 3.41.0 IS24- 225, filed February 29, 2024

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)