The Permian Basin will drive new NGL supply growth in 2024, as East Daley Analytics highlighted in our recent 1Q24 NGL webinar. Yet it may come as a surprise to investors which midstream company will see the biggest lift.

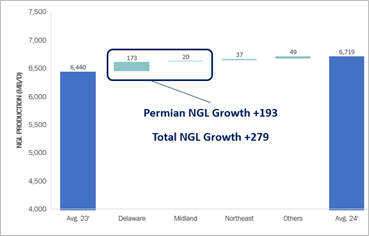

EDA expects NGL production to grow by 280 Mb/d on average in 2024 in the NGL Network Model. Almost 200 Mb/d, or nearly 70% of that growth will occur in the Permian (see figure).

Enterprise Products (EPD) and Targa Resources (TRPG) have garnered the most attention recently in the Permian NGL space, announcing new construction for gas gathering and processing plants (a combined 2.3 Bcf/d), NGL pipelines (combined 1.0 Mb/d), new fractionation trains (0.6 Mb/d), and new LPG export facilities (0.4 Mb/d).

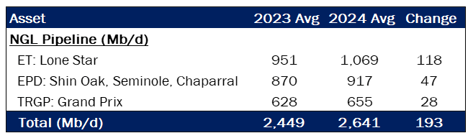

However, we expect Energy Transfer (ET) to win the most growth volumes in 2024 given latent capacity on its Lone Star NGL pipeline system, while EPD and TRGP’s NGL pipes are largely constrained until their growth projects come online in early 2025 (see table).

Enterprise transported about 550 Mb/d in 4Q23, bumping up against nameplate capacity in the NGL Network Model, and we believe Targa flowed at least 615 Mb/d on its Permian-to-Mont-Belvieu pipeline segment. That would mean the pipeline is already at capacity, given prior comments by management alluding to effective pipeline capacity of 650 Mb/d with the addition of pump stations.

Producers fueling NGL production growth behind these three midstream behemoths include EOG, Chevron (CVX), ConocoPhillips (COP) and ExxonMobil (XOM), to name a few. Clients can track plant inlet volumes and the gas interstate meter samples for these producers throughout the year in Energy Data Studio. - Rob Wilson, CFA Tickers: CVX, EOG, EPD, ET, TRGP, XOM.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch our latest product, the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)