Chesapeake Energy (CHK) and Southwestern Energy (SWN) have postponed the closing date of their E&P ‘super-merger’ following a request from the Federal Trade Commission (FTC). The move was expected by East Daley Analytics amid increased regulatory scrutiny of E&P deals.

The FTC submitted requests last Thursday (April 4) to each company for additional information, CHK and SWN notified in separate 10-K filings. The move by the FTC triggers an automatic 30-day waiting period for the companies to comply. As a result, the producers have pushed back the expected close of the merger to 2H24 from an initial target of 2Q24.

East Daley Analytics called out the ambitious timeline to close the deal when CHK and SWN announced the $17B merger in January. We expected delays based on the large share of production resulting from the combo in the Haynesville and Appalachia basins, as well as the scrutiny EQT experienced for its acquisition of Tug Hill Operating in the Northeast.

We laid out the bull case and bear case for the midstream sector if regulators allow the CHK-SWN merger to move forward. Chesapeake and Southwestern together produced ~7.7 Bcf/d of natural gas in 4Q23, accounting for ~7% of Lower 48 gas production. No doubt, the outcome will impact practically all leading midstream companies in Appalachia and the Haynesville.

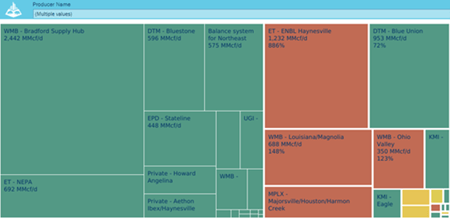

The figure, available from data in the “Producer to G&P System” profile in Energy Data Studio, breaks down Chesapeake and Southwestern gathering volumes by midstream system. The top midstream providers for the two include DTM Midstream (DTM), Enterprise Products (EPD), Energy Transfer (ET), MPLX and Williams (WMB).

Although a SWN-CHK combo would have a lower share of Appalachia production than EQT-Tug Hill, the combined firm would have an even larger share in the Haynesville, a basin poised for growth to feed increasing LNG demand. Thus, East Daley would expect similar, if not a higher level of anti-trust scrutiny, than the EQT-Tug Hill acquisition. – Ajay Bakshani, CFA and Andrew Ware Tickers: CHK, DTM, EPD, EQT, ET, MPLX, SWN, WMB.

Gain a Competitive Edge with Southeast Gulf S&D Report

Gain an edge in natural gas with the Southeast Gulf Supply and Demand Forecast. East Daley’s latest product connects supply, demand and midstream developments in the most dynamic regional market. The Southeast Gulf S&D Forecast tracks and forecasts Haynesville production in East Texas and Louisiana, regional pipeline and midstream expansions, and Gulf Coast LNG projects for a comprehensive view of the Louisiana - Gulf Coast market. Learn more about the Southeast Gulf Supply and Demand Forecast.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)