The Daley Note: February 28, 2023

Several top Haynesville shale producers intend to drop rigs this year in response to lower natural gas prices. These are the first steps of a larger undertaking required to balance the market this year, according to our Macro Supply & Demand natural gas forecast.

Public producers are lowering 2023 guidance as a part of 4Q22 earnings updates. Comstock Resources (CRK) said it will lay down 2 rigs from its Haynesville drilling program, moving from 9 to 7 rigs in 2023. Chesapeake Energy (CHK) plans to drop 2 rigs in the Haynesville, one rig in 1Q23 and another rig in 3Q23. CHK is currently running 7 rigs in the play. Southwestern Energy (SWN) guided to running 10-11 rigs between its Haynesville and Marcellus acreage, down 2-3 rigs from 13 total rigs in 2022.

East Daley recently predicted sub-$2 natural gas prices as a result of oversupply in 2023. While prices could be volatile on the downside, we expect the Haynesville (ArkLaTex Basin) to ultimately play a key role in restoring balance as producers slow drilling and completion activity.

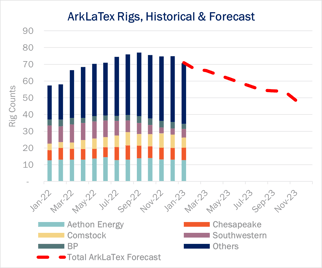

ArkLaTex rig counts averaged 71 in January and were at 74 rigs in mid-February, according to East Daley’s Energy Data Studio. CRK and CHK together account for ~22% of the rigs in East Texas and northern Louisiana.

Our Macro Supply and Demand Forecast projects that overall drilling activity in the basin will need to fall to 60 rigs by mid-2023 to slow supply and keep underground storage within facility limits by 4Q23 (see figure). Larger public operators in the ArkLaTex like CRK and CHK were generally well-hedged heading into 2023, so we expect large private operators like Aethon and Rockcliff will drop many of the rigs this year.

Producers will need to take other proactive measures. In our “Balanced” gas market view, we assume lower prices prompt Haynesville operators to defer completions and build an inventory of more than 300 DUCs. Other gas-focused basins will see a similar slowdown to bring supply back in line with demand in 2023

With growth from the Permian Basin likely locked in this year, we view the ArkLaTex as a critical source of swing supply due to the highly productive gas wells drilled in the Haynesville and Bossier shales. East Daley can create custom producer profiles for clients as part of our Advisory Services to evaluate the impacts of rig changes by operator or midstream system in the ArkLaTex. Later this week, we will profile one of these top producers to illustrate the challenge ahead.

We also explored the dynamics of the ArkLaTex and other basins in meeting future needs of the natural gas market in our latest update for clients, “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” on Thursday, Feb. 23. A recording of our latest webinar is available here. – Andrew Ware, Ryan Smith & Maria Paz Urdaneta Tickers: CHK, CRK, SWN.

Dirty Little Secrets: After Hours – The Natural Gas Undoing Project

East Daley hosted a webinar on Thursday, Feb. 23 to look deeper into the natural gas story. In “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” East Daley explored the short- and long-term supply and demand factors driving natural gas prices. Are market risks being accurately priced in the forward curve? When will more LNG demand arrive? East Daley explores the dynamics driving the natural gas market. Click here to see a recording of “The Natural Gas Undoing” webinar.

Stay Ahead of the Market with Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Contact us for more information on Natural Gas Weekly.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)