Natural Gas Weekly: February 24, 2023

Rigs - Several Haynesville shale producers intend to drop rigs this year in response to lower natural gas prices. In its 4Q22 earnings update, Comstock Resources (CRK) said it will lay down 2 rigs from its Haynesville drilling program in East Texas and northern Louisiana, moving from 9 to 7 rigs. Chesapeake Energy (CHK) expects to drop 2 rigs in the Haynesville during 2023, one rig in 1Q23 and another in 3Q23. CHK is currently running 7 rigs in the play.

East Daley has laid out the case for sub-$2 gas prices as a result of oversupply in 2023. We expect the Haynesville (ArkLaTex Basin) to play a key role in restoring balance as producers slow drilling and completion activity. The latest announcements from CRK and CHK are first steps, and more actions will be required from the upstream. According to our Macro Supply and Demand Forecast, active rigs in the ArkLaTex will need to fall to 60 by mid-2023, from an average of 71 rigs in January, in order to balance season-ending storage inventories in 2023. We also assume operators build an inventory of more than 300 drilled but uncompleted wells (DUCs) to balance the market.

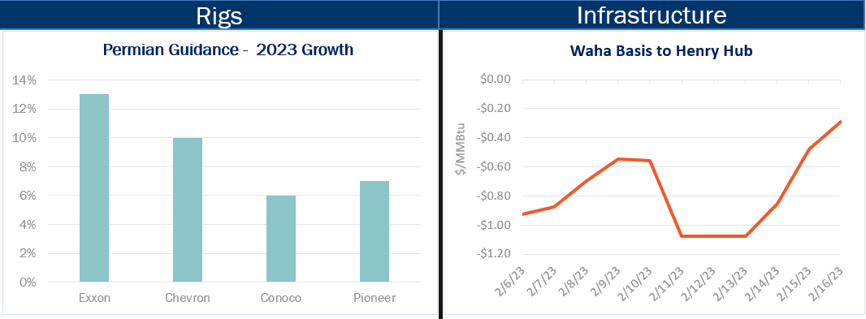

Infrastructure - Midstream companies are adding to a lost list of natural gas processing projects to keep up with supply growth in the Permian Basin. EnLink Midstream (ENLC), Targa Resources (TRGP) and Energy Transfer (ET) are some of the companies to announce new plants and Permian G&P system expansions so far in 4Q22 earnings updates.

In East Daley's latest Permian Basin Supply and Demand Forecast, we estimate over 3 Bcf/d of new gas processing capacity to come online by year-end 2024 between the Delaware (1.8 Bcf/d) and Midland (1.4 Bcf/d) sub-basins. We will update estimates as additional Permian-focused midstream companies provide guidance.

We do not foresee gas processing constraints in the Permian through 2024, though plant utilization runs high in our models. We forecast a total of 28.3 Bcf/d of processing capacity by YE24, with utilization at 91% of capacity. The latest company announcements support our view of continued supply growth from the Permian, with gas pipeline takeaway from the basin to remain a serious concern.

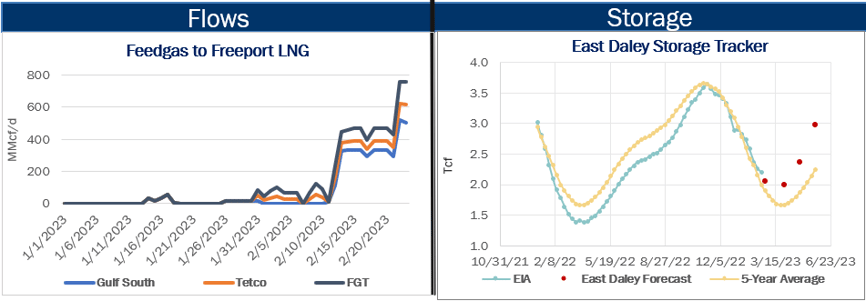

Flows – Freeport LNG is preparing to ramp feedgas volumes to 2 Bcf/d after receiving approval from regulators to restart commercial operations. The Federal Energy Regulatory Commission (FERC) authorized Freeport to resume full service from two of its three liquefaction trains, ending an eight-month outage at the Texas export facility. Commercial restart of the third train will require additional approvals from FERC as Freeport meets certain operational milestones.

Pipeline deliveries to Freeport LNG reached 760 MMcf/d on Thursday (Feb. 23). In a press release, Freeport LNG said it plans to steadily increase gas intake to 2 Bcf/d over the next several week as it restarts LNG production from all three trains. Freeport said it will initially use two of three LNG storage tanks and one of two LNG shipping berths, with the third LNG tank and second ship berth expected to return in May. Freeport has been receiving small gas volumes since late January and shipped its first LNG cargo on Feb. 11. East Daley currently models Freeport ramping to the full 2.1 Bcf/d of export capacity by the end of April.

![]() Storage - EIA reported a 71 Bcf storage withdrawal for the Feb. 10 week, putting working gas inventories at 2,195 Bcf. In our Macro model, we estimate storage inventories end February at 2,058 Bcf. Storage is 183 Bcf above the 5-year average after the latest EIA report.

Storage - EIA reported a 71 Bcf storage withdrawal for the Feb. 10 week, putting working gas inventories at 2,195 Bcf. In our Macro model, we estimate storage inventories end February at 2,058 Bcf. Storage is 183 Bcf above the 5-year average after the latest EIA report.

Methodology Note: As of Jan. 30, 2023, East Daley Analytics is switching to WellDatabase for wellhead production data and rig information. East Daley uses a data aggregator, BlackBird BI, to collect and organize raw data published by WellDatabase. As part of the change in data providers, East Daley’s active rig estimates will now reconcile with the weekly Baker Hughes rig publication. The biggest change in rig counts is a reduction in vertical rigs in areas like the Anadarko, ArkLaTex and Barnett, which is not expected to impact the production outlook. Please direct any methodology questions to Ryan Smith (rsmith@eastdaley.com). Additionally, we are happy to introduce you to our new data vendors if there is any interest.

Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)