The Daley Note: May 10, 2023

Natural gas premiums in Western US forward curves have dropped sharply over the past month. Supply concerns have eased as spring temperatures reduce regional demand and the return of Line 2000 boosts flows from the Permian Basin.

Northwest Pipeline - Rockies basis for the 2024 calendar is down $1 in the last month, averaging a $0.81/MMBtu premium to the Henry Hub last week vs a $1.81 premium in April. Rockies and West Coast spot prices also have fallen below the Henry Hub for the time in months.

The Pacific Coast saw wild price spikes to over $40/MMBtu this winter due to severe weather that drained storage and fanned fears of supply shortages. The Pacific region through March saw temperatures 14% colder than normal for the 2022-23 winter season, according to the National Weather Service.

Spreads gapped out in part due to an outage on El Paso's Line 2000 between Waha and SoCal, which exacerbated volatility and likely inflated fears of future shortages. With Line 2000 back in service in mid-February, Pacific region storage is already refilling, and regional flows and prices are returning to more normal seasonal patterns.

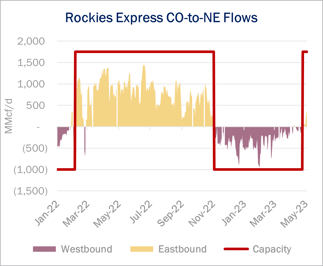

In a sign of easing market conditions, westbound flows on Rockies Express Pipeline (REX) from the Midwest to Colorado reversed last week amid shoulder-season demand in western markets. REX is currently shipping 300 MMcf/d from Colorado toward the Midwest market, the first eastbound flows on REX since early November 2022 (see figure).

REX is now flowing east and west out of the Cheyenne Hub, based on East Daley’s measurement of flows. REX is still delivering ~250 MMcf/d to Overthrust in the Western Rockies; the null point on REX has shifted to the Denver-Julesburg Basin as heating demand on Colorado’s Front Range has waned.

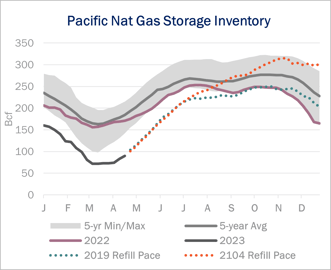

The latest storage report from the Energy Information Administration (EIA) estimates Pacific region inventory at 100 Bcf, or 93 Bcf (-48%) below the 5-year average. While low storage is a cause for concern, capacity holders can return inventories to normal seasonal levels based on two previous years featuring rapid storage refills on the West Coast. These analog years indicate the region will be able to refill storge to somewhere between the minimum and maximum inventory levels over the past five years (see figure). At the 2014 refill pace, storage in the Pacific region would flip to a bearish market factor by next winter.

Several factors should help loosen markets in the West. The Pacific region will have strong hydroelectric power generation this summer, which should cut into gas demand from the electric sector. The return of Line 2000 will also add 0.6 Bcf/d of supply (vs last year) from Waha to Southern California. Longer term however, our balances show Pacific Coast supply and demand will face major hurdles starting in 2025, when Sempra Energy’s (SRE) Costa Azul LNG export facility starts ramping up on the western coast of Mexico.

For a deeper review of Rockies and Pacific region gas markets and price dynamics, reach out to East Daley Consulting for more information. – Ryan Smith Tickers: SRE.

1Q23 Earnings Previews Now Available in Energy Data Studio

East Daley Analytics has published 1Q23 Earnings Previews and Financial Blueprint Models for all midstream companies in our coverage. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Previews and updated Financial Blueprints models are available for the following companies: AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, NS, PAA, PBA, SMLP, TRGP, TRP, WES and WMB.

Subscribers can access these reports on the Energy Data Studio platform. For more information about East Daley’s Financial Blueprints, please reach out.

Track Midstream Performance in 1Q23 Earnings Reviews

East Daley Analytics is publishing 1Q23 Earnings Reviews as companies provide updates. Use the Earnings Reviews to evaluate performance against our Financial Blueprint Models for the midstream sector. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Reviews are now available for AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, KMI, KNTK, MMP, OKE, PAA, NS, SMLP, TRGP, TRP and WES. Subscribers can access these reports on the Energy Data Studio platform. For more information about Earnings Reviews, please reach out.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)