The Daley Note: May 9, 2023

Targa Resources (TRGP) reported 1Q23 results that significantly beat Street and East Daley’s estimates. The company reported Adj. EBITDA of $941MM, 10% above East Daley’s estimates and 8% above Street consensus.

G&P volumes were reported almost exactly in line with our Financial Blueprint forecast, while segment margin came in slightly higher at $538MM. East Daley leverages plant-level data from our patented G&P Allocation Model to track rigs across Targa’s systems. This data is available to clients in East Daley’s Energy Data Studio through our G&P system database and Targa Financial Blueprint. Clients also received a “First Take” a few days prior to TRGP earnings that updated our analysis with the latest Texas plant data.

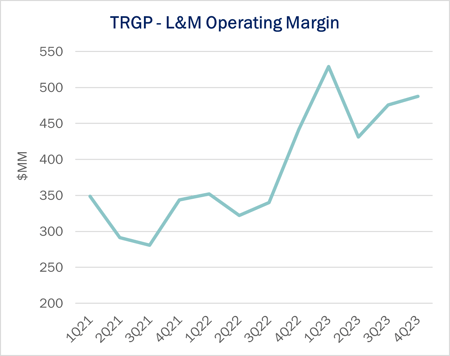

The beat for Targa was entirely driven by Logistics & Marketing. The segment reported margin of $529MM, which is $87MM (20%) above 4Q22 results and $177MM (50%) above 1Q22 results (see figure).

Using East Daley’s Financial Blueprint for TRGP, we can pinpoint what exactly caused the beat in the L&M segment. Volumes on the Grand Prix NGL pipeline came in 6% above our forecast, and NGL exports came in a whopping 16% above our forecast. However, updating our Blueprint with those increased volumes only increases EBITDA by $18MM.

That leaves the “Marketing” portion of the segment as the biggest contributor to outperformance, and unfortunately that can be the hardest to forecast. TRGP also beat 4Q22 estimates due to strong marketing gains. East Daley subsequently pointed to recent data filed with the Federal Energy Regulatory Commission showing TRGP contracted space on some Permian egress pipes to market the spread between Waha and Carthage. As a result, we anticipated a large Y-o-Y increase in 1Q23 (+$65MM), but Targa surpassed even our raised expectations (see chart).

Despite the large beat in 1Q, management maintained guidance of $3.5-3.7B EBITDA for FY23, pointing to lower commodity prices going forward. When the company initially announced guidance, it budgeted around a $2.25/MMBtu price for Waha gas. The current Waha strip now only averages $1.35 for 2023. The spread between Waha and Houston Ship Channel is also narrowing; it averaged $1.25/MMBtu for 4Q22 and 1Q23, and is now $0.95 for the rest of 2023.

Even with decreased marketing potential, we forecast strong volume gains for most TRGP’s assets in the Blueprint, and now expect the company to hit the midpoint of its guidance of $3.6B.– Ajay Bakshani, CFA & Yamah Nabiyar Tickers: TRGP.

1Q23 Earnings Previews Now Available in Energy Data Studio

East Daley Analytics has published 1Q23 Earnings Previews and Financial Blueprint Models for all midstream companies in our coverage. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Previews and updated Financial Blueprints models are available for the following companies: AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, NS, PAA, PBA, SMLP, TRGP, TRP, WES and WMB.

Subscribers can access these reports on the Energy Data Studio platform. For more information about East Daley’s Financial Blueprints, please reach out.

Track Midstream Performance in 1Q23 Earnings Reviews

East Daley Analytics is publishing 1Q23 Earnings Reviews as companies provide updates. Use the Earnings Reviews to evaluate performance against our Financial Blueprint Models for the midstream sector. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Reviews are now available for AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, KMI, KNTK, MMP, OKE, PAA, NS, SMLP, TRGP, TRP and WES. Subscribers can access these reports on the Energy Data Studio platform. For more information about Earnings Reviews, please reach out.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)