The Daley Note: April 25, 2023

An unusual weather pattern this winter has created division in the natural gas market that will influence regional prices and spreads in 2023, according to East Daley Analytics’ US Macro Supply and Demand Forecast.

On a national level, the US saw winter temperatures 6% above normal through the end of March, according to gas-weighted heating degree days (GW-HDD) measured by the National Weather Service (NWS). The mild winter lowered gas demand for heating and, combined with strong production growth, helped create a looser market balance.

Heading into spring, US underground storage inventory is ~330 Bcf above the seasonal 5-year average, according to the latest weekly Energy Information Administration (EIA) storage data, a key reason Henry Hub prices have fallen to the $2/MMBtu level.

While net bearish, the national weather data fails to capture the nuance in the winter gas story. At a regional level, the winter was unusually balmy across the eastern two-thirds of the US, including record warmth in parts of the mid-Atlantic and Southeast, while the West Coast and Rocky Mountains experienced a harsh winter.

According to NWS census data, New England (-13%), the Mid-Atlantic (-14%) and the Southeast (-14%) regions saw total GW-HDDS significantly below normal through the end of March. By contrast, cumulative GWHDDs were 14% above normal in the Pacific region and 6% above normal in the Rocky Mountains.

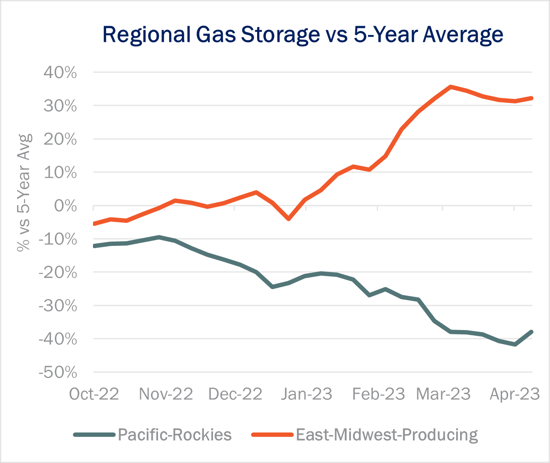

The opposing demand trends have created two distinct markets split along the Continental Divide. Working gas storage inventory in the West (Pacific and Rockies regions) is 38% below the 5-year average as of April 14, according to EIA storage data, while combined working gas in the producing and eastern consuming regions (Midwest and Northeast) is 32% above 5-year norms (see figure).

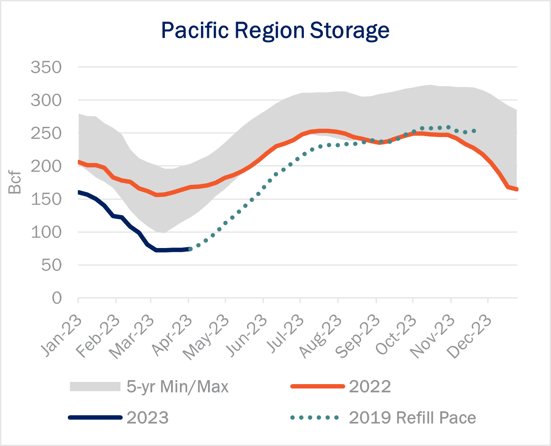

The situation is particularly dire for storage in the downstream Pacific region. The West Coast was pummeled by a series of storms this winter, including a February blizzard in Southern California. West Coast storage inventory fell to 72 Bcf in mid-March, according to EIA’s weekly survey, the lowest ever in at least 13 years based on weekly regional estimates dating to 2010. The long winter sent gas prices spiking to over $40/MMBtu at hubs in California and the Pacific Northwest.

East Daley covers the West Coast in our US Macro Supply and Demand Forecast, including pipeline flows to the West in the Rockies and Permian Supply and Demand Forecasts. Working gas storage in the Pacific region storage totaled 83 Bcf in EIA’s latest survey for the April 14 week, 53% lower than the 5-year average for this time of year (see figure).

While gas has fallen under $2/MMBtu in many basins, the West Coast continues to trade higher at the Southern California border and at the Sumas and Malin points in the Pacific Northwest. These points frequently commanded a $1-1.60 premium over the Henry Hub in recent trading. Prices in the Rockies also have been trading at a premium to the Henry Hub, providing a relative boost for producers and midstream companies active in the region.

The divergence in storage should continue to support wider regional spreads. Premium prices have been drawing gas from as far away as the Northeast via the Rockies Express Pipeline, and western prices must stay elevated to attract volumes. Shippers on pipelines that directly feed the West Coast, including the Permian, Rockies and Western Canada, could see gains in an otherwise tough macro gas environment. Please reach out to East Daley Consulting for more information. – Andrew Ware & Ryan Smith.

1Q23 Earnings Previews Now Available in Energy Data Studio

East Daley Analytics has published 1Q23 Earnings Previews and Financial Blueprint Models for midstream companies in our coverage. Our industry-leading Blueprints provide historical and forecasted volumes and financial information for 1,300+ midstream infrastructure assets by individual company.

1Q23 Earnings Previews and updated Financial Blueprints models are now available for the following companies: AM, CEQP, DTM, ENB, ENLC, EPD, ET, ETRN, GEL, KMI, KNTK, MMP, MPLX, OKE, NS, PAA, PBA, SMLP, TRGP and WES.

Subscribers can access these reports on the Energy Data Studio platform. For more information about East Daley’s Financial Blueprints, please reach out.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)