The Daley Note: November 02, 2022

Earnings season is under way, and one company we’re watching is Kinetik Holdings (KNTK). East Daley is bullish on the midstream sector’s latest public entrant, mainly due to our expectations for the company's EagleClaw system in the Delaware Basin.

Eight months since its launch, Kinetik is quickly making waves in the Permian. KNTK began trading in February 2022 from the former Altus Midstream, completing the reverse merger by Blackstone-controlled BCP Raptor, the owner of EagleClaw Midstream and the EagleClaw G&P system. Valued at $9 billion when announced in October 2021, the deal created the largest pure-play midstream company in the Permian.

East Daley explored the new Kinetik in a recent Midstream Navigator available to clients. We see the complementary nature of the EagleClaw and Alpine High G&P systems, the respective crown-jewel assets of KNTK and Altus in the southern Delaware, as the key value of the merger. Located on prime Permian acreage, EagleClaw has a deep bench of producer counterparties but is short on natural gas processing. Meanwhile, the nearby Alpine High system sees limited upstream activity but has plenty of spare processing available at its Diamond Cryo complex.

Rig counts rose to 17 in May, more than double the count of 7 rigs at the start of 2022, according to system allocations in our Midstream Activity Tracker. We’re currently monitoring 11 rigs on EagleClaw. Click Here for a free sample of our weekly MAT product.

The recent rig gains on EagleClaw coincide with the completion of upgrade work to integrate the newly acquired Alpine High to the south. Kinetik finished the ‘super-system’ interconnects in June, the company said in its 2Q22 earnings, adding ~500 MMcf/d of capacity to move gas between the systems. The upgrade work allows KNTK to shift more raw gas through Alpine High’s Diamond Cryo processing, where the company can gain a deeper cut of NGLs from processing. The additional processing flexibility means producers on EagleClaw can develop their acreage with greater confidence.

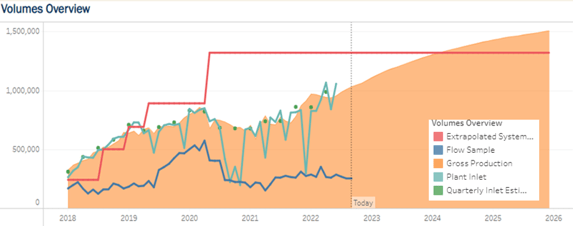

Clients can review rigs, producers and supply forecasts for the EagleClaw and Alpine High systems through East Daley’s Energy Data Studio. Natural gas produced on the EagleClaw system crossed the 1 Bcf/d threshold in August, according to our models. We forecast robust gas supply growth of ~50% over the next few years based on our forecast for system rigs, growing gathered volumes on EagleClaw to 1.5 Bcf/d by YE2025 (see figure).

Kinetik will report 3Q22 earnings on Nov. 10. As a relatively new company, Kinetik isn’t widely covered on Wall Street. Nevertheless, East Daley is bullish on KNTK’s outlook compared to Street consensus. Our latest Blueprint Financial Model forecasts 2022 pro forma Adj. EBITDA of $852 million, $14 million above Bloomberg consensus estimates. Our 2023 EBITDA estimate for KNTK is 10% above the Street.

Please reach out for more information on Kinetik or other midstream company Blueprints. – James Taylor Tickers: KNTK.

Join East Daley for a Spotlight Happy Hour

Join East Daley in Houston at our Spotlight Happy Hour on November 9 as we discuss the new Targa Resources Spotlight Report and meet the teams from RBN Energy and East Daley. The event will follow the Targa Resources Spotlight Report, released on Nov. 2, and the Spotlight Live Session webinar being held on Nov. 7 at 10:30 AM CT online. You will have the opportunity to ask us questions about the Spotlight Report and Live Session, plus network with some of the energy industry’s best and brightest. Learn more on East Daley's Events page.

3Q22 Earnings Previews Now Available

East Daley has published a complete group of 3Q22 Earnings Previews and Blueprint Financial Models for midstream companies within our coverage. Quarterly Earnings Previews and Blueprints are now available for Antero Midstream (AM), Crestwood Equity (CEQP), Enbridge (ENB), EnLink Midstream (ENLC), Enterprise Products (EPD), Energy Transfer (ET), Equitrans Midstream (ETRN), Kinder Morgan (KMI), Kinetik Holdings (KNTK), Magellan Midstream (MMP), MPLX (MPLX), ONEOK (OKE), Plains All American (PAA), Summit Midstream (SMLP), Targa Resources (TRGP), TC Pipelines (TRP), Western Midstream (WES) and Williams (WMB).

Our Earnings Previews include quarterly earnings forecasts compared to Street consensus, a detailed list of the top assets that will impact the quarter, analysis of near- and long-term risks to future earnings, along with forecasts for Adj. EBITDA by segments. Please log in to access these reports.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)