Kinder Morgan (KMI) has started partial service on an expansion of the Markham gas storage facility on the Texas Gulf Coast. The announcement supports a trend East Daley Analytics expects to see of growing investments in natural gas storage assets.

KMI updated on the project in its 4Q23 earnings. KMI is expanding working gas capacity by 6 Bcf at the Markham facility, located south of Houston in Matagorda County, TX. The company is adding a new salt cavern to increase withdrawal capacity by 650 MMcf/d onto KMI’s Texas intrastate pipeline system. KMI placed the Markham expansion partially in service on November 1, 2023 and expects to start full service in June 2024.

Kinder Morgan joins midstream giants Williams (WMB) and Enbridge (ENB) in raising their investments recently in natural gas storage. KMI is one of the largest storage operators with interests in 702 Bcf of working gas capacity, and the Markham expansion will add to the company’s sizable assets.

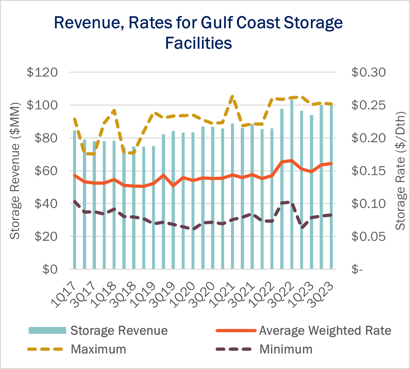

East Daley monitors storage revenue reported in Federal Energy Regulatory Commission (FERC) filings by major pipelines in the Gulf Coast region. Using contracted storage volume and revenues, we have backed into storage rates earned by different pipelines. We find the weighted average rate for storage service has increased 21% since 2018 for pipelines with access to Gulf Coast storage fields, or a ~3% CAGR in storage rates (see chart).

Storage rates are increasing for a number of reasons, as we discuss in the new Dirty Little Secrets annual report. Price spreads between the summer and winter seasons drive the intrinsic value of storage assets, and these spreads have grown wider recently. Pipeline loads are also becoming more variable, led by growth from new LNG facilities and power generation. Extrinsic factors like renewables, extreme weather, and higher overall market demand result in more reliance on storage to manage supply and demand fluctuations.

In the latest Dirty Little Secrets, East Daley predicts interest in natural gas storage will pick up in 2024. In our view, developers have not increased storage capacity to keep pace with the growth in demand. The value of assets already in the ground is increasing as a result. – Zach Krause Tickers: KMI.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on December 13, 2023. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy's journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA's deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley's Energy Data Studio tools for natural gas predictive analytics with Hart Energy's Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)