The Daley Note: June 9, 2023

TC Energy (TRP) has received regulatory approval to place the North Baja Xpress expansion into service, adding new gas delivery to the Southwest and Mexico.

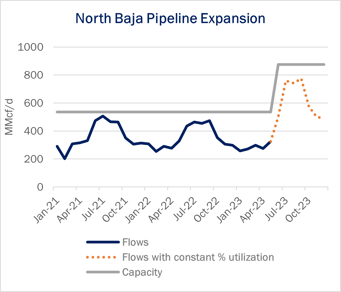

The Federal Energy Regulatory Commission (FERC) on May 31 granted TRP’s request to place the North Baja Express project into service. The project upgrades the Ehrenberg compressor station in La Paz County, AZ, boosting pipeline capacity to the US/Mexico border by 495 MMcf/d (see figure).

The project is an important upgrade to the supply chain required to eventually ship LNG from Mexico’s Pacific coast. North Baja Pipeline runs 80 miles from Arizona and California to the Mexico border, where it connects to another line linked to Sempra Energy’s (SRE) Energia Costa Azul LNG import terminal on the Baja California. SRE is adding liquefaction and export capability to the Costa Azul facility.

The bi-directional North Baja line can ship up to 600 MMcf/d northbound and 500 MMcf/d southbound to Mexico. Currently, North Baja moves ~380 MMcf/d from the El Paso Natural Gas system, nearly all of which flows to Mexico.

East Daley expects the additional capacity will eventually support LNG exports from Costa Azul, supplying up to ~430 MMcf/d for liquefaction. The Costa Azul expansion is part of a larger wave of LNG projects planned in North America that we expect to significantly boost gas demand post-2025. However, SRE is still constructing the Costa Azul expansion and targeting start-up in 3Q25, raising the question of how much gas will flow through the North Baja pipeline in the meantime.

The El Paso system interconnects with North Baja Pipeline in Ehrenberg, AZ, where it also supplies an average 745 MMcf/d (50% utilization) to the Southern California Gas distribution system, peaking at over 1 Bcf/d. It is unlikely that the North Baja pipeline would pull gas from Southern California given the premium paid on the West Coast. But when the Costa Azul expansion comes online, likely supplied under firm contracts, either California or Mexico will pay a premium. - Oren Pilant Tickers: SRE, TRP.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)