The Daley Note: October 24, 2023

Equitrans Midstream (ETRN) has postponed the expected start-up of Mountain Valley Pipeline (MVP). The new pipeline now won’t be available for most of the coming winter, leaving eastern US markets more vulnerable if the season is severe.

On October 18, ETRN filed an 8-K stating start-up would be delayed to 1Q24 from previous guidance of YE23. The 2 Bcf/d pipeline is slated to begin service on or before April 1, 2024, the filing said. The new guidance more closely aligns with East Daley Analytics’ forecast for MVP used in the Macro Natural Gas Supply and Demand Forecast, as well as the regional Northeast Supply and Demand Forecast .

Lead developer Equitrans also raised the cost estimates for the project. The additional delays have increased the total cost for MVP to $7.2B, the company said in the 8-K. ETRN anticipates footing a total of $3.7B of the increased costs and raising its ownership stake in MVP by ~1% to 48.8%, assuming a 1Q24 start date.

MVP’s timing has several impacts. Start-up obviously affects ETRN and the project’s joint-venture partners. ETRN is especially sensitive, as it has invested heavily in several projects they have yet to see returns. These projects and contingent contracts are broken out in the ETRN Financial Blueprint maintained by EDA.

On the G&P side, projects include the Hammerhead project, the Global GGA step-up agreement, and a Henry Hub upside contract with EQT. The Transmission segment has the Equitrans Expansion, Southgate, and MVP. These projects and other contract provisions are all contingent on MVP entering service and are critical to ETRN’s ability to de-lever.

The second impact is to potential shippers. EQT, the pipeline’s largest contract holder and only producer, holds 1.29 Bcf/d of capacity on MVP (500 MMcf/d has been leased to a third party for the first six years of the 20-year term). Delays to MVP have prevented EQT from potentially growing production into the new pipeline capacity in the peak demand season.

Additionally, utilities and end-users with capacity on MVP won’t have the pipeline’s services most of this coming winter. MVP customers include Roanoke Gas (10 MMcf/d), USG (250 MMcf/d), AltaGas (200 MMcf/d) and Consolidated Edison of New York (250 MMcf/d). An in-service date closer to spring prevents the utilities from being able to maximize the new capacity in the upcoming heating season.

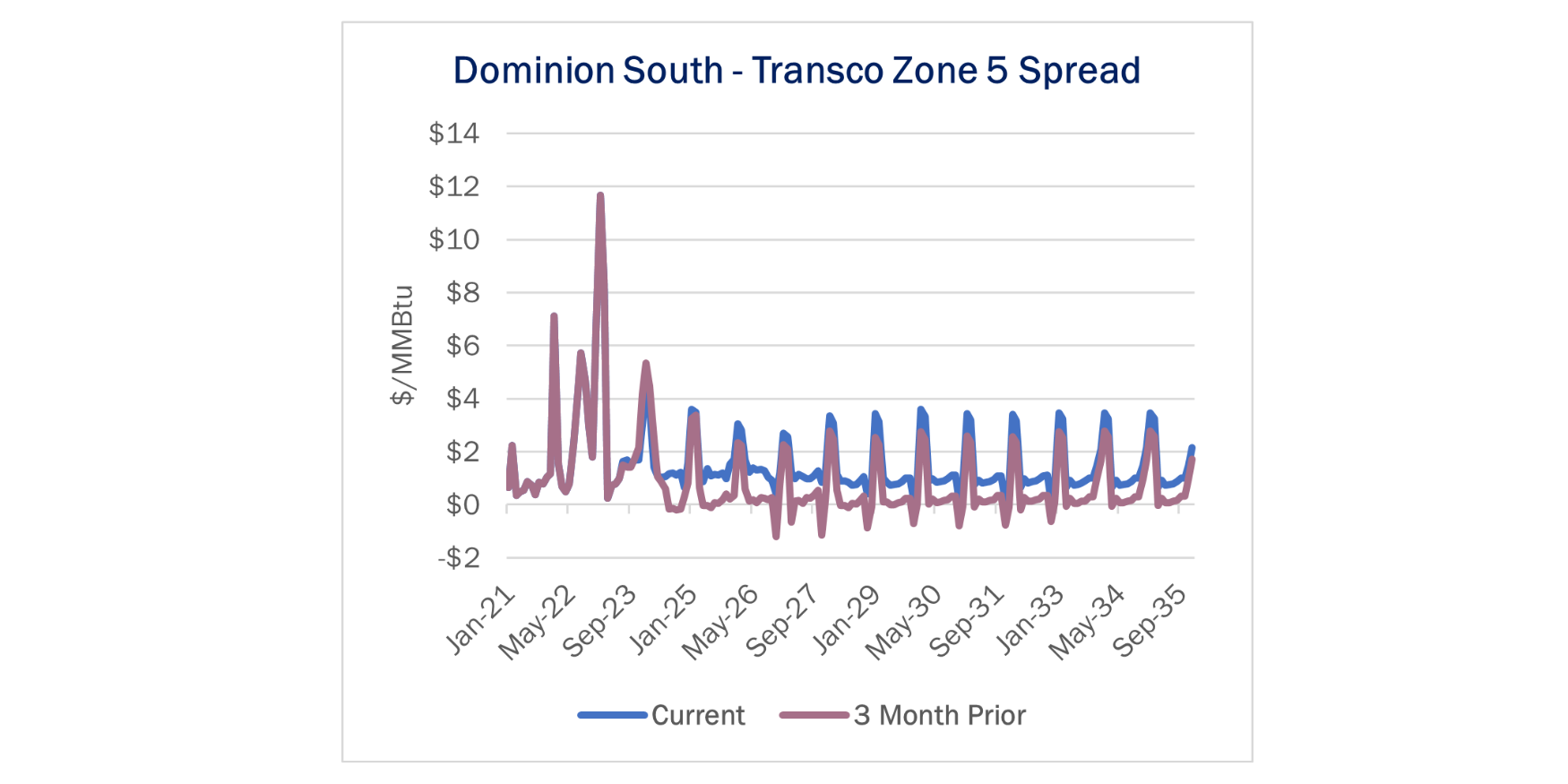

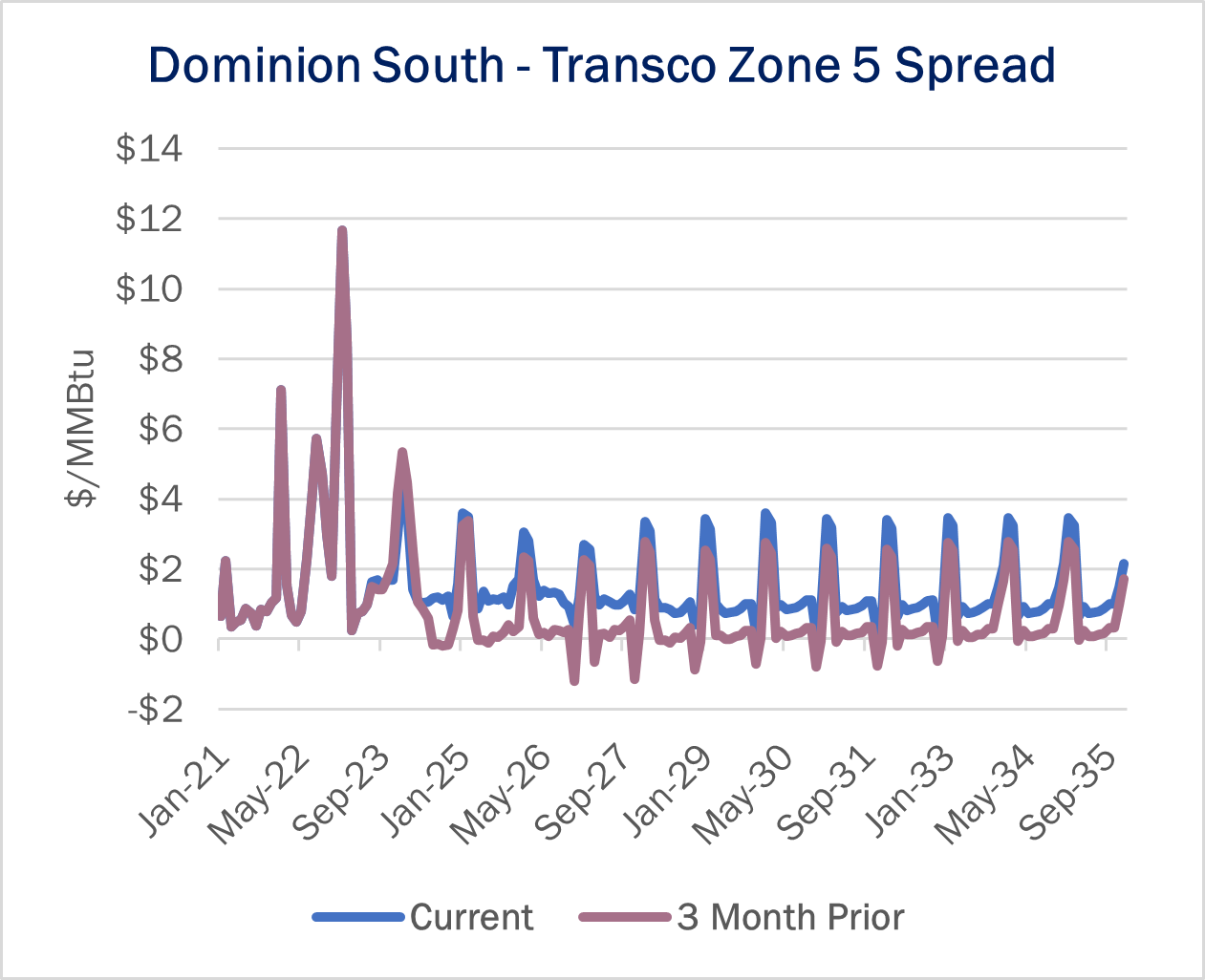

Lastly, East Daley expects MVP will not run full as it only reaches as far as Zone 5 of the Transcontinental Gas Pipeline, which is constrained southbound. The new pipeline should be able to flow at higher utilization levels in the winter and help dampen the spread between Dominion South prices in Appalachia and Transco Zone 5 prices in the Southeast. Current spreads between the two points sit between $3-$4.50/MMBtu this winter on the forward strip (see chart). The delay prevents MVP from helping alleviate that constraint.

EDA currently forecasts MVP only fills to ~400 MMcf/d in April 2024, when we anticipate the pipeline will begin service. – Alex Gafford Tickers: ETRN.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.