Natural Gas Weekly: February 2, 2023

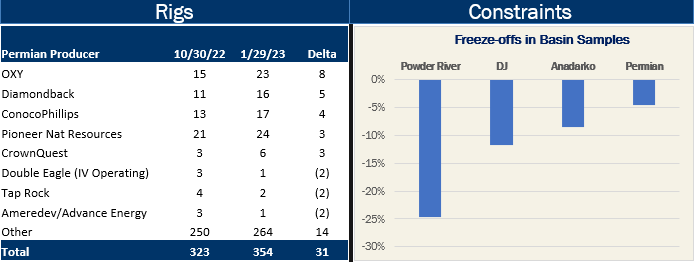

Rigs - Producers continue to add rigs in the Permian Basin, supporting East Daley's outlook for strong gas production growth this year. Over the past three months, Permian producers have added 31 rigs, bringing total Permian drilling activity to 354 rigs (see chart below). The gains come despite softening commodity prices over this period. WTI crude traded this week around $76/bbl vs prices near $90 at the end of October 2022, while Henry Hub natural gas prices fell under $3/MMBtu in January.

East Daley forecasts Lower 48 dry gas production to increase by 4.6 Bcf/d in 2023 (exit to exit), with 1.5 Bcf/d of that growth to come from the Permian Basin. Infrastructure coming online in 2023 will create enough space for Permian producers to grow into our 1.5 Bcf/d growth forecast via the return of El Paso Line 2000, plus the Whistler and Permian Highway compression expansions. Increased rig activity in the Permian should continue to put downward pressure on the ability of gas-centric basins like the Marcellus and Haynesville to grow.

Exxon and Chevron (not included in the table) have also increased rig activity by 2, from 23 to 25 rigs over the last three months. Exxon expects 360 Mb/d of production in 2023 and 13% CAGR through 2027. While Chevron would not explicitly guide to growth in ’23, the major did say it would be a “little bit lower” than the 16% growth realized in 2022. In either case, CVX and XOM have signaled a faster pace than our overall Permian growth forecast of 9.8% in 2023.

Flows – A bitter cold front moved through the Rockies and Central US in late January, causing wellheads to freeze over in several basins. As of Feb. 1 , East Daley has observed gas pipeline samples decrease in the Powder River (-25%), Denver-Julesburg (-12%), Anadarko (-9%) and Permian (-5%) basins since the last week of January. We calculate the delta of lost supply using the monthly January average in each basin prior to the freeze-off event.

Flows – A bitter cold front moved through the Rockies and Central US in late January, causing wellheads to freeze over in several basins. As of Feb. 1 , East Daley has observed gas pipeline samples decrease in the Powder River (-25%), Denver-Julesburg (-12%), Anadarko (-9%) and Permian (-5%) basins since the last week of January. We calculate the delta of lost supply using the monthly January average in each basin prior to the freeze-off event.

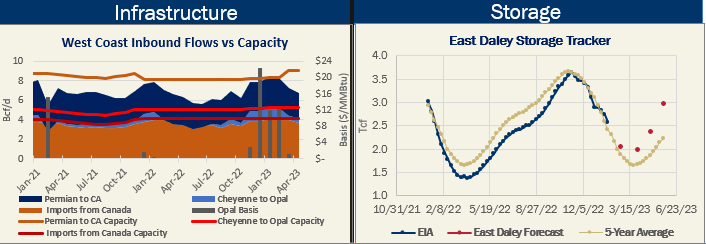

Infrastructure – West Coast natural gas prices could be nearing a relief point as Kinder Morgan (KMI) prepares to return Line 2000 of the El Paso system back to service. In a shipper notice posted on Jan. 25, El Paso said it has completed the repair work to Line 2000 and submitted a request to the US Pipeline and Hazardous Materials Safety Administration (PHMSA) to lift pressure restrictions. Approval from PHMSA could come in a matter of weeks. Line 2000 has been offline since an explosion in August 2021. The outage has reduced capacity between the Permian and Arizona/California by 620 MMcf/d, a factor contributing to soaring natural gas prices on the West Coast this winter.

East Daley expects El Paso to be fully back online within the next month. Once Line 2000 is back in service, the extra 600 MMcf/d of capacity will relieve pressure at price points like SoCal, Opal and Sumas. Even if PHMSA takes more than one month to approve the request, demand is likely to taper off starting in March, which could also provide relief.

Storage - EIA reported a 151 Bcf storage withdrawal for the Jan. 27 week, putting working gas inventories at 2,583 Bcf. The EIA report included a bearish 5 Bcf upward revision to the prior week's inventory report. In our Macro model, we estimate storage inventories end February at 2,058 Bcf. Storage is 117 Bcf above the 5-year average after the latest EIA report.

Storage - EIA reported a 151 Bcf storage withdrawal for the Jan. 27 week, putting working gas inventories at 2,583 Bcf. The EIA report included a bearish 5 Bcf upward revision to the prior week's inventory report. In our Macro model, we estimate storage inventories end February at 2,058 Bcf. Storage is 117 Bcf above the 5-year average after the latest EIA report.

Methodology Note: As of Jan. 30, 2023, East Daley Analytics is switching to WellDatabase for wellhead production data and rig information. East Daley uses a data aggregator, BlackBird BI, to collect and organize raw data published by WellDatabase. As part of the change in data providers, East Daley’s active rig estimates will now reconcile with the weekly Baker Hughes rig publication. The biggest change in rig counts is a reduction in vertical rigs in areas like the Anadarko, ArkLaTex and Barnett, which is not expected to impact the production outlook. Please direct any methodology questions to Ryan Smith (rsmith@eastdaley.com). Additionally, we are happy to introduce you to our new data vendors if there is any interest.

Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)