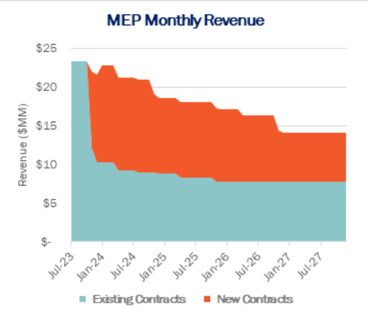

East Daley Analytics raised our outlook for Midcontinent Express Pipeline (MEP) after the pipeline successfully resigned capacity under short-term contracts that expired last quarter.

In November and December ‘23, MEP signed 30 new contracts to replace a large earnings stream that had rolled off, avoiding a potential contract cliff. EDA previously had risked the capacity for the pipeline owned by Kinder Morgan (KMI) and Energy Transfer (ET). We increased the 2024 EBITDA forecast for MEP by $54MM, or $27MM each to KMI and ET In the company Financial Blueprints.

MEP caught the eye of analysts in 4Q22 when regional price spreads blew out on the Gulf Coast, prompting shippers to sign 1.1 Bcf/d of short-term contracts. MEP revenue more than doubled to ~$60MM vs 11 prior quarters under $30MM, and revenue stayed north of $70MM in the first three quarters of 2023. EDA had been reluctant to change our long-term outlook for MEP since most of the contracts were expiring in November ‘23, and 75% of the capacity was taken by marketers such as Citadel, Total, and Freepoint.

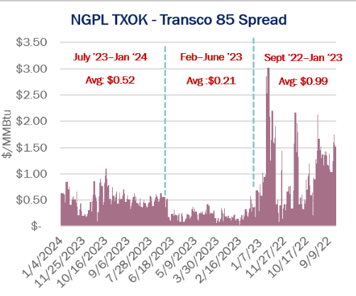

These shippers profited from the wide spread between Anadarko Basin and Southeast market prices. The spread from NGPL-TXOK to delivery at Transco Station 85 averaged nearly $1/MMBtu from September ‘22 to January ’23 (see price chart). As the regional spread considerably narrowed in February ‘23, EDA speculated that the contracts would not renew, reducing MEP’s quarterly revenue by ~$33MM.

Instead, MEP signed 30 new contracts at a lower average rate, replacing the revenue stream that had rolled off. The pipeline picked up significant contracts from TC Energy Marketing, Trafigura, and Vitol. The new contracts have a weighted average rate of $0.44/Dth/day.

While the spread between NGPL-TXOK and Transco 85 narrowed from February to June ‘23, it has since expanded to $0.52/MMBtu in the six months since June 2023 (shown in the chart). The wider spread has supported more contracting.

The new negotiated rates allow MEP to keep the pipe full while marketers can still profit from price volatility. The new contracts have an average term of about two years, providing a healthy short-term outlook for MEP. Clients can review our revised MEP forecast and other quarterly updates in the recently updated KMI Financial Blueprint. – Zach Krause Tickers: ET, KMI.

New Webinar: How Louisiana Will Reshape the Gas Market

Join East Daley and Rextag on February 27 for a new natural gas webinar. In “Ripple Effect: How Louisiana Will Reshape the US Gas Market,” Rextag and East Daley examine the key state corridor for natural gas. We trace the ripple effect across the US as we plunge into a more volatile and dynamic gas market. Join us February 27.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)