Natural Gas Weekly: October 5, 2023

Infrastructure - Kinder Morgan (KMI) is partnering with WBI Energy to boost southbound pipeline takeaway from the Williston Basin. East Daley expects the coordinated projects to help producers in the Bakken play as well as Western Canada this winter.

KMI provided an update on the new project, Bakken (WBI) to Cheyenne, at its annual customer meeting in May 2023. The project creates a path out of the Williston to the Cheyenne hub in Wyoming using existing and leased capacity on the Fort Union Gas Gathering (FUGG), Bighorn Gas Gathering (BGG), and Wyoming Interstate Medicine Bow systems. KMI estimated a 3Q23 in-service date for the project.

WBI is building its own project, Grassland South Expansion, to connect with the KMI project. Grassland South includes 15.3 miles of pipeline connecting the Bear Creek gas processing plant to the Manning compressor station on the WBI Energy Transmission system. The companies will add an interconnect from the WBI system to BGG to create the seamless route to the Cheyenne hub. The KMI and WBI projects are sized to add 92 MMcf/d of takeaway from the Williston through the Powder River Basin. WBI estimates a November 1, 2023 in-service date for Grassland South.

WBI is building its own project, Grassland South Expansion, to connect with the KMI project. Grassland South includes 15.3 miles of pipeline connecting the Bear Creek gas processing plant to the Manning compressor station on the WBI Energy Transmission system. The companies will add an interconnect from the WBI system to BGG to create the seamless route to the Cheyenne hub. The KMI and WBI projects are sized to add 92 MMcf/d of takeaway from the Williston through the Powder River Basin. WBI estimates a November 1, 2023 in-service date for Grassland South.

East Daley includes impacts of the KMI/WBI projects in the Bakken Supply and Demand Forecast. As detailed in the report, we expect the expansions to help producers based in North Dakota as well as Western Canada. The egress options out of the Williston Basin include Northern Border Pipeline, Alliance Pipeline, and WBI Energy Transmission. Around 85% of Bakken supply moves on Northern Border, which runs at full utilization out of the basin. Alliance Pipeline transports another 250 MMcf/d of Bakken gas. The strong flows compete with Canadian producers moving gas further upstream on these pipelines.

EDA assumes Northern Border will continue to be fully utilized at flows around 2.5–2.6 Bcf/d. However, the Grassland South expansion could free up some space on the other two pipelines. Currently, Alliance transports around 1.6 Bcf/d of Canadian supply. Displacement via the KMI/WBI projects could allow inbound supply from Canada to increase by 5%.

Flows - Early October flows are lower in pipeline samples covering the Appalachian Basin. If the trend holds, Northeast pipeline flows would decline for the third month in a row. Samples through October 4 are down almost 0.5 Bcf/d M-o-M from the September average and 830 MMcf/d lower vs June 2023. October nominations could still be revised upward, but for now they confirm a down trend for Marcellus/Utica gas producers.

Flows - Early October flows are lower in pipeline samples covering the Appalachian Basin. If the trend holds, Northeast pipeline flows would decline for the third month in a row. Samples through October 4 are down almost 0.5 Bcf/d M-o-M from the September average and 830 MMcf/d lower vs June 2023. October nominations could still be revised upward, but for now they confirm a down trend for Marcellus/Utica gas producers.

East Daley forecasts continued declines through the first half of 2024 in the Northeast Supply and Demand Forecast, resulting in a Y-o-Y decline of ~700 MMcf/d as of June 2024. Our outlook bucks the historical trend by Appalachian producers to grow production into the winter months.

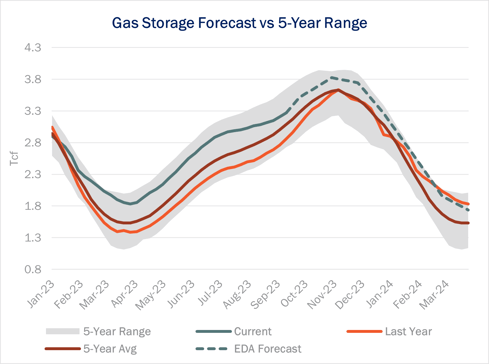

Storage - EIA reported an 86 Bcf storage injection for the week ending September 29, 8 Bcf below market expectations for a 94 Bcf injection. The EIA report brings total Lower 48 storage inventory to 3,445 Bcf, 357 Bcf greater than last year and 172 Bcf greater than the 5-year average.

Storage - EIA reported an 86 Bcf storage injection for the week ending September 29, 8 Bcf below market expectations for a 94 Bcf injection. The EIA report brings total Lower 48 storage inventory to 3,445 Bcf, 357 Bcf greater than last year and 172 Bcf greater than the 5-year average.

Some forecasts had called for the storage injection to exceed 100 Bcf, which has only happened twice this season and not since the week ending June 2. The below-expectation storage report sparked a 6% rally in The front-month Henry Hub contract, trading up $0.17 Thursday morning to $3.14/MMBtu.

With five weeks left in the injection season, injections would need to average 77 Bcf/week to match East Daley's end-of-season estimate of 3,824 Bcf in the September Macro Supply and Demand Forecast.

While the storage surplus to the 5-year average continues to erode on a national level, Pacific Coast storage inventories have been making up ground this year. Last week, inventories in the Pacific region eclipsed the 5-year average of 269 Bcf to stand at 271 Bcf. At the beginning of injection season, Pacific inventories stood at just 73 Bcf. Capacity holders have injected an average of 8 Bcf/week over the past 25 weeks in the Pacific region, or double the 5 -year average injection rate of 4 Bcf/week.

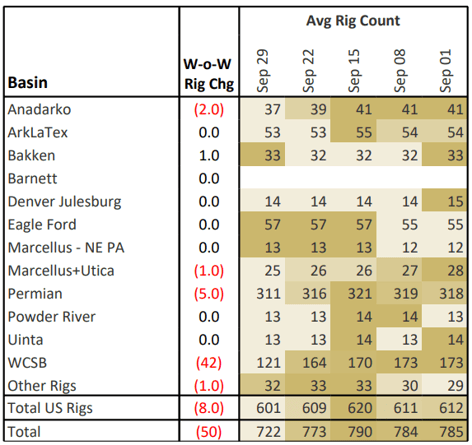

Rigs - US rigs decreased by 8 W-o-W to bring the total count to 601 for the September 29 week. The Permian is down 5 rigs, the Anadarko is down 2 rigs, and the Marcellus+Utica is down 1 rig.

Rigs - US rigs decreased by 8 W-o-W to bring the total count to 601 for the September 29 week. The Permian is down 5 rigs, the Anadarko is down 2 rigs, and the Marcellus+Utica is down 1 rig. Natural Gas Weekly

East Daley Analytics' Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Subscribe to the Natural Gas Weekly.

-1.png)