The Daley Note: October 5, 2023

Dogged by high debt, TC Energy (TRP) is selling stakes in several pipelines and positioning other assets for future deals. The company’s high leverage is closely tied to spending for the ambitious Coastal GasLink project.

TRP began planning Coastal GasLink in 2012 when the LNG Canada partners selected the company to build, own and operate the 670-km (415-mile) pipeline through northern British Columbia. Fast-forward 11 years, and the pipeline is C$8B over budget and still under construction.

Coastal GasLink will deliver up to 2.1 Bcf/d of natural gas from northeastern British Columbia to the LNG Canada facility under construction in Kitimat, BC. Along with an expansion of the Trans Mountain crude oil pipeline, it is of one of two closely watched projects in Canada. The two pipelines will open maritime access for producers in Western Canada and lessen their dependence on the US market. However, both projects have faced obstacles during the construction phase that have caused costs to spiral.

TC Energy took a final investment decision (FID) on Coastal GasLink in 2018 and began construction in July 2019. At the time, TRP estimated Coastal GasLink would cost C$6.2B. In February 2023, TRP raised the project cost estimate to C$14.5B, a 130% increase, citing a shortage of skilled labor, contractor underperformance, and challenging terrain.

Under the current Capex estimate of C$14.5B, TC Energy is responsible for C$5.4B. At this cost, East Daley estimates the cost/EBITDA multiple of the project to be 16.1x! TRP hopes to complete the pipeline by the end of this year, but if construction activities extend into 2024, the price could jump by another C$1.2B.

The cost overrun on Coastal GasLink is a major contributor to TRP’s current leverage position. At the close of 2Q23, TRP was sitting at 5.97X net debt to EBITDA, according to East Daley Analytics’ TRP Financial Blueprint. The high debt level has spurred TRP’s 40% equity sale of the Columbia Gulf and Columbia Gas pipelines. The company is also considering a sale of a minority interest in the Nova Gas Transmission system.

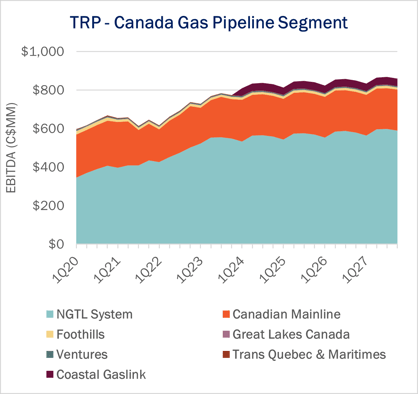

Despite the rough road, construction on Coastal GasLink is now 93% complete with mechanical completion slated for YE23. EDA’s Financial Blueprint forecasts that TRP’s 35% limited partnership equity interest in Coastal Gas Link will generate ~C$336MM in annual EBITDA and ~C$158MM in net income (see figure).

The addition of Coastal GasLink leads to a 5.1% increase in annual EBITDA in the Financial Blueprint for TRP’s Canadian natural gas pipeline segment. TRP could see upside from efforts to recover some of the C$14.5B budgeted to the project, but that can’t be fully determined until the pipeline enters service. LNG Canada, the anchor customer, is targeting start-up around 2025. – Zach Krause Tickers: TRP.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides bi-monthly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)