The crude oil price spread from Midland to the Magellan East Houston (MEH) market is primed to significantly widen later in 2024 and 2025, according to flows predicted in East Daley’s Crude Hub Model, creating the potential for more profits moving barrels.

While we don’t expect spreads to blow out to the $12/bbl range seen in 2018, East Daley believes the market is underestimating the potential for regional volatility.

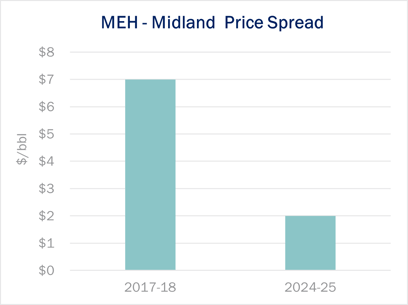

The MEH hub on the Houston Ship Channel currently trades at a $0.30/bbl premium to WTI-Midland. Futures contracts are pricing the MEH-Midland spread to average ~$0.42 for the rest of 2024 and $0.80 in 2025. By contrast, EDA expects the MEH-Midland spread will eventually increase to ~$2.00, or 150% above current expectations, without new pipe expansions (see figure 1).

Volatility will come from relatively lower WTI-Midland prices. As Permian crude oil production continues to grow, pipelines leaving the basin will fill. The Crude Hub Model predicts total Permian egress to exceed 80% utilization starting in July 2024. Midland prices will come under pressure as pipe capacity grows scarce, causing the spread to MEH to widen.

Our expectations are based on pipeline economics. With crude oil pipes to Corpus Christi and Houston filling, the lion’s share of remaining egress capacity is on routes running to the Cushing hub in Oklahoma. In order for a Permian barrel to reach the Gulf Coast via Cushing, it must first travel north to Cushing and then south to the Houston/Nederland markets, incurring additional tariffs. The barrel will also likely lose its premium as a ‘pure Permian’ barrel due to extensive blending at Cushing.

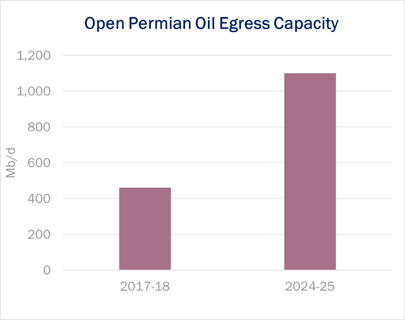

The 2018 MEH spread blowout was mainly due to pipeline constraints. As Permian egress approached 80% utilization in 2018, MEH prices averaged $7+/bbl over Midland. Available pipeline space leaving the Permian averaged ~460 Mb/d at the time.

EDA in the Crude Hub Model forecasts pipe utilization to cross 80% once again by July 2024, yet spreads are much tighter in futures trading. One key difference now is that Permian shippers have much more overall capacity available after the construction of several greenfield pipelines. The latest Crude Hub Model forecasts available pipeline capacity to average ~1,100 Mb/d in 2H24, more than double the available egress in 2017 and 2018 (see figure 2).

The Permian Basin saw strong growth in 2023, and East Daley’s Production Scenario Tools forecast the Permian to grow another 6% through 2024. The bulk of this supply growth will take place in 2H24 and amount to 245 Mb/d of incremental volume, ending the year at 6.5 MMb/d of production.

We expect MEH-Midland volatility to pick up later in 2024, and we will keep a close eye for potentially bigger price swings in 2025. While Enbridge’s (ENB) new plan to expand Gray Oak Pipeline would dampen upside, we view the latest announcement as confirmation of the growing tightness in moving Permian crude oil. – Kristy Oleszek Tickers: ENB.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch our latest product, the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)