The Daley Note: September 21, 2023

Consolidation continues in the Permian Basin as producers look to add reserves in the industry’s hottest play. The latest deals will add to a trend of falling rig counts as the number of players shrink.

On September 13, Vital Energy (VTLE) announced three agreements to acquire Henry Energy and two Henry Resources affiliates, Tall City Property Holdings and Maple Energy Holdings, active in the Permian. The deals together are valued at ~$1.17B.

The acquisitions by VTLE follow another $1B deal earlier this month between Viper Energy Partners, a Diamondback Energy (FANG) subsidiary, and affiliates of Warwick Capital Partners and GRP Energy Capital for Permian assets.

Rig counts in the Permian Basin have declined from a recent high of 353 in late April to 318 rigs in early September. Lower commodity prices have played a role, but merger and acquisitions (M&A) are also driving the trend. Investors want to see synergies from all the dealmaking, and cutting rigs is one way to lower expenses from merged companies.

The Vital announcement is a case in point. In a presentation to investors, VTLE said it plans to drop 2 of the 3 rigs run by the acquired producers when the deals close in 4Q23. Vital aims to lift free cash flow by 90% after streamlining operations.

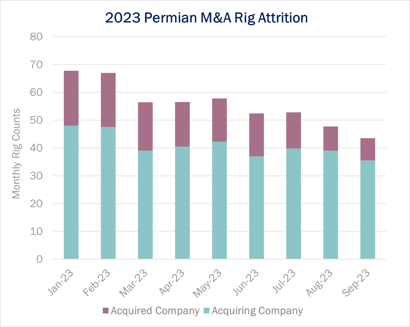

A recent review by East Daley Analytics found Permian operators involved in M&A have cut rigs by 30% since the start of 2023. Using historical rig data in Energy Data Studio, we have identified nearly 20 Permian operators active in the last year as either a buyer or seller. Rig counts by this group have declined from 68 at the start of 2023 to only 44 rigs so far in September (see chart).

The M&A trend shows no sign of slowing. Leading private producer CrownRock may put itself up for sale in early 2024, Reuters reports. A sale of CrownRock, a joint venture of CrownQuest Operating and Lime Rock Partners, could fetch over $10B. CrownQuest was running 4 rigs in the Permian in early September, according to allocations in Energy Data Studio, down from 8 rigs at the start of 2023.

Even with the pullback in rig counts over the last few months, the Permian Basin will continue to be a growth engine. In the Permian Supply and Demand Forecast, EDA projects natural gas production to increase by about 3 Bcf/d in 2023. Whether producers can maintain this trajectory depends on decisions from a leaner upstream. – Maria Paz Urdaneta Tickers: FANG, VTLE.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides bi-monthly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)