The Daley Note: September 22, 2023

ONEOK (OKE) and Magellan Midstream Partners (MMP) stakeholders have voted to approve the $18.8B merger of the two midstream companies.

Despite vocal opposition from some Magellan investors, MMP owners voted 76% of their units in favor of the merger in a special meeting, or 55% of the outstanding MMP units. OKE shareholders voted 96% of their shares in favor of the transaction in a separate meeting, the companies said. OKE and MMP aim to close the merger on September 25.

East Daley Analytics explored the OKE-MMP combination in May after the companies brokered the deal. At the time, ONEOK claimed $100-300MM in potential synergies once it acquired MMP. Using our OKE and MMP Financial Blueprints, we put these claims to the test.

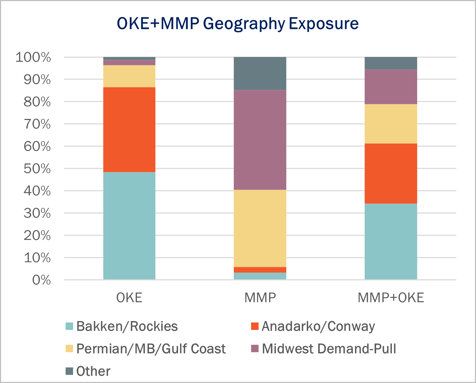

The merger creates scale for ONEOK to compete with the top midstream companies, yet also combines operations with virtually no overlap. MMP will add considerable geographic diversification for OKE, reducing its exposure in the Bakken and Anadarko from 85% to 60%. However, OKE’s Permian exposure doubles from 10% to 20% (see chart).

Despite the limited asset overlap, OKE could see several interesting commercial opportunities emerge from the combo. EDA is most excited about the potential synergies from MMP’s butane blending business once OKE levers its extensive NGL pipeline and storage network for feedstock. Magellan also has interests in three terminals on the Houston Ship Channel that could serve as a future launch pad for NGL exports.

ONEOK and Magellan could finalize the merger as soon as September 25. East Daley is currently combining the OKE and MMP Financial Blueprints for clients to reflect the $18.8B deal. – Ajay Bakshani, CFA and Andrew Ware Tickers: MMP, OKE.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides bi-monthly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)