The Daley Note: June 28, 2023

Permian Basin natural gas prices have been more resilient than many, including East Daley Analytics, had expected at this point in 2023. Our review points to rising ethane recovery as the likeliest factor, with higher gas demand and DUC builds also potentially contributing factors.

Drilling activity in the Permian has been steady, with basin rig counts hovering around 350 rigs this year. Gas prices at the Waha hub in West Texas have been volatile and taken a dive on maintenance events, such as when Gulf Coast Express (GCX) and Permian Highway Pipeline (PHP) took ~1 Bcf/d of capacity offline in May, which indicates egress is tight. Yet Waha prices have strengthened in June and traded only $0.06-0.13/MMBtu behind the Henry Hub last week. Waha on Tuesday (June 27) traded $0.16 behind the Henry Hub. Given the tightness of egress and underlying supply growth, this is an outcome we hadn’t expected at the start of 2023.

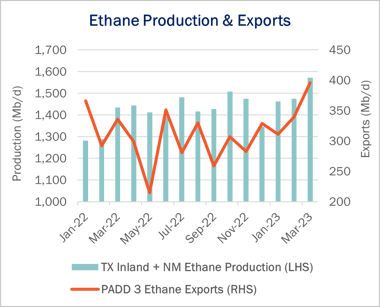

Several factors could be contributing to the tightening Waha basis. Recent data from the Energy Information Administration (EIA) indicates midstream companies are benefiting from higher overseas demand and prices for ethane. Inland Texas and New Mexico ethane production has been growing while PADD 3 ethane exports have been on the rise this year (see figure). New processing plant expansions also enable more ethane recovery in the Permian.

By shipping more Btus as ethane in Y-grade supply, operators can free up space on gas egress pipelines. East Daley already factors in relatively high ethane recovery in our NGL Network Model and NGL Purity Product forecasts, creating ~130 MMcf/d more space on gas egress pipelines. If we assume full ethane recovery in the Permian, operators could lower residue gas supply by another ~350 MMcf/d.

Higher demand is another factor. Texas has seen record-breaking temperatures, prompting the Electric Reliability Council of Texas (ERCOT), the state’s electricity grid manager, to call for conservation. Grid demand is forecast to hit a new record this week. Power plants in West Texas likely have been using more gas in the heat wave, leaving less supply to carry on pipelines.

The early summer heat is also baking Mexico, which could be importing more gas for its own power generation. Several pipelines connect at the border in West Texas and can send gas to Mexico. Market visibility into this trend is poor though due to infrequent postings on Mexico pipelines.

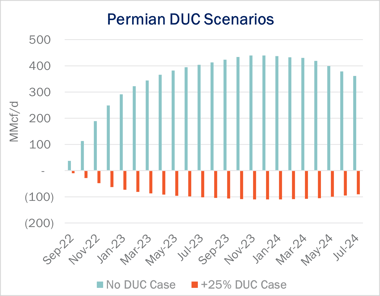

Producers could also be opting to defer well completions. The figure shows a sensitivity case from East Daley’s Permian Basin Producer Scenario Tools. If all drilled but uncompleted wells (DUCs) are removed from the model, we forecast the basin would be producing ~400 MMcf/d more gas, resulting in a grossly oversupplied egress scenario. Conversely, a 25% increase in the DUC count would decrease gas supply by 100 MMcf/d in our forecast, freeing up more egress space. – James Taylor & Ajay Bakshani, CFA.

Request Access to Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

Review the Year Ahead in Dirty Little Secrets

The 2023 Dirty Little Secrets is Now Available! Is Midstream on the cusp of another infrastructure wave? Find out in our new annual report.

Dirty Little Secrets reviews the outlook for Midstream and commodity markets in 2023 and the years ahead. East Daley discusses the outlook for crude oil, natural gas and NGLs and the impacts to midstream assets in our 2023 Dirty Little Secrets annual market report. Click here for a copy of the 2023 Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)