A delayed start to the Louisiana Energy Gateway (LEG) project will cost Williams (WMB) $20MM in earnings this year, according to East Daley Analytics’ company forecast. Nevertheless, we remain more positive than the Street on WMB’s 2024 outlook.

Williams CEO Alan Armstrong confirmed the project delay at the CERAWeek conference in March. WMB and Energy Transfer (ET) have been embroiled in a legal dispute over the use of rights-of-way that has set back the timeline for the 1.8 Bcf/d pipeline. WMB had planned to start operations on LEG in 4Q24, but is now targeting start-up in 2H25.

East Daley models the LEG project to contribute ~$20MM of quarterly EBITDA in the WMB Financial Blueprint. The delay reduces our 2024 forecast for Williams by ~$20MM, and our 2025 forecast by ~$40MM.

In addition to the LEG delay, producers have been curtailing production in the Northeast and Haynesville, creating short-term headwinds for some midstream companies. Prior to these developments, EDA had modeled WMB earnings 5% above consensus for 2024 and 2025.

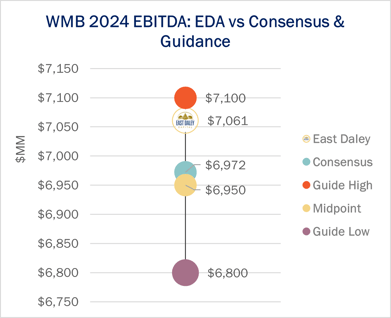

Despite these headwinds, we remain bullish on the outlook for Williams. In updates ahead of 1Q24 results, we estimate WMB will make EBITDA of $7.06B in 2024. Our forecast is on the high end of company guidance of $6.8-$7.1B, while consensus is for EBITDA of $6.97B in 2024 and $7.64B in 2025 (see figure from the WMB Financial Blueprint). Consult EDA’s latest WMB Blueprint and 1Q24 Earnings Preview for more information. Williams will report 1Q24 results on May 6.

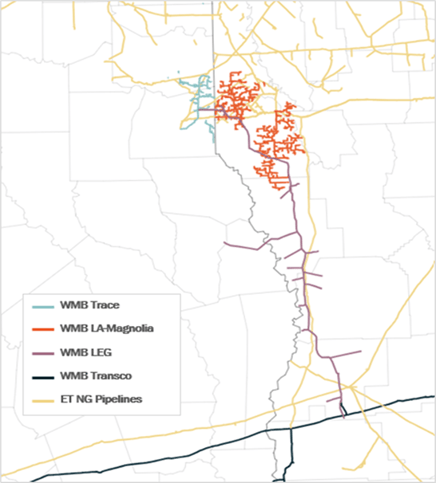

The dispute between Williams and Energy Transfer centers around the use of ET’s easements to lay new pipelines. ET argues that WMB is effectively building an interstate pipeline rather than gathering, and should not be allowed to piggyback off its rights-of-way. In addition to LEG, ET has sued to block pipelines planned by DT Midstream (DTM) and Momentum Midstream in Louisiana.

During WMB’s analyst day, management disclosed that the company has secured permits for the northern part of LEG, but has not finalized permits for the southern section. The southern segment of LEG follows closely to ET’s Gulf Run Pipeline, a major point of conflict with ET (see map).

In a petition filed with the Federal Energy Regulatory Commission (FERC), ET asserts that LEG will function as a transmission line and should be subject to the same federal regulations as other interstate projects. In the petition, ET notes that LEG crosses ET’s pipeline right-of-way 43 times but has not been subject to the same standard of regulation due to its classification as a gathering line. – Zach Krause Tickers: DTM, ET, WMB.

Gain a Competitive Edge with Southeast Gulf S&D Report

Gain an edge in natural gas with the Southeast Gulf Supply and Demand Forecast. East Daley’s latest product connects supply, demand and midstream developments in the most dynamic regional market. The Southeast Gulf S&D Forecast tracks and forecasts Haynesville production in East Texas and Louisiana, regional pipeline and midstream expansions, and Gulf Coast LNG projects for a comprehensive view of the Louisiana - Gulf Coast market. Learn more about the Southeast Gulf Supply and Demand Forecast.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)