Woodside Energy (WDS) has broken the mold and will move forward with the Louisiana LNG project without a diversified customer base. WDS on April 28 announced a $17.5B final investment decision (FID), a bullish signal for the Haynesville and other basins supplying the Gulf Coast.

The project in Calcasieu Parish, LA is sized to make 16.5 mtpa of LNG (~2.5 Bcf/d feedgas equivalent). The commitment by Woodside is unusual as, unlike past LNG project FIDs, Louisiana LNG only has 8% of its capacity contracted under binding supply and purchase agreements (SPAs). However, Stonepeak recently invested $5.7B in the project, covering 75% of 2026 and 2027 capital expenditures.

Woodside acquired the former Driftwood LNG project as part of its $1.2B acquisition of Tellurian. The three-train facility is expected to produce first LNG in 2029. The project has capacity to add two more trains, which would bring total potential demand to over 4 Bcf/d. WDS is in discussions with potential partners to reduce its current $11.8B share of capital exposure, including selling an interest in the $1.1B Line 200 header.

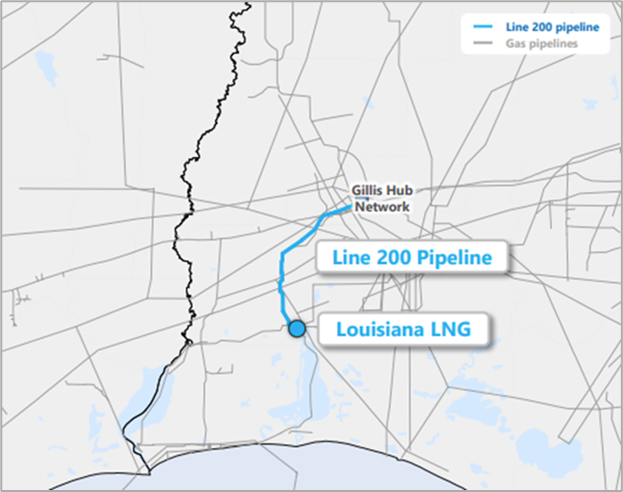

The 3+ Bcf/d Line 200 pipeline would extend 37 miles from Lake Charles to the Gillis hub, interconnecting with up to 11 pipelines (see map). Woodside also acquired the proposed Driftwood Mainline (4 Bcf/d) and Line 300 from Tellurian, projects that would provide ample optionality in a crowded Gillis market.

With this latest FID, East Daley estimates 12.7 Bcf/d of incremental LNG feedgas demand by YE30 in the Macro Supply & Demand Report. We have been bullish on demand growth from the LNG sector, and Woodside’s decision supports this outlook.

Several more LNG projects aim to make FID later this year. CP2 (3+ Bcf/d) and Commonwealth LNG (~1.26 Bcf/d) both received their non-FTA export licenses from the Department of Energy (DOE) earlier this year under the friendlier-to-LNG Trump regime. Energy Transfer (ET) also expects to make FID on Lake Charles LNG (~2.5 Bcf/d) in 4Q25, management said on its 4Q24 earnings call.

ET has made good headway recently advancing its LNG project. Lake Charles LNG signed an SPA with Chevron (CVX) late last year, and CVX is working to recruit other customers. ET also signed a Heads of Agreement with MidOcean Energy, a subsidiary of EIG Global Energy Partners, to jointly develop the Lake Charles facility. Under the terms of the non-binding framework, MidOcean would commit to 30% of construction costs in return for 30% of the LNG production. Lake Charles is still waiting on its DOE non-FTA approval after the original expired, but we do not expect this to pose a major obstacle.

See East Daley’s Macro Supply & Demand Report for more on the LNG outlook, and the SE Gulf Supply & Demand Report for a deeper review of the Gillis, LA market. – Oren Pilant Tickers: CVX, ET.

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Get the FERC Intrastate Pipeline Data

Introducing East Daley’s latest data file: FERC 549D Intrastate Contract Data. This new offering delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.