Energy Transfer (ET)

Get deep, comprehensive insights on Energy Transfer to understand market trends and assess investment opportunities throughout the oil and gas industry.

What makes East Daley’s Capital Intelligence Data on Energy Transfer so unique?

0

Assets

0

Asset Types

0

Commodities

0

Basins

East Daley Analytics Preview and Review Report

East Daley regularly updates Midstream Company Financials. Clients get access to Preview and Review Reports and Models on each company. This is an example of a previous report on Energy Transfer.

ENERGY TRANSFER on Energy Data Studio

The Energy Data Studio platform’s interactive dashboard allows users to easily navigate weekly, monthly, and quarterly updates to individual producers, midstream assets, and midstream company financials, providing flexibility for working with data. It is available through data downloads from the visual interface, in Excel files, or as direct data delivered into subscribers’ workflow via secure file transfer.

Lower Gas Prices Dampen Energy Transfer Outlook

Energy Transfer (ET) released earnings on Feb. 15, and while the company beat both East Daley and consensus expectations, 2023 guidance came in well below our forecast. We trace the discrepancy to ET’s exposure to falling natural gas prices.

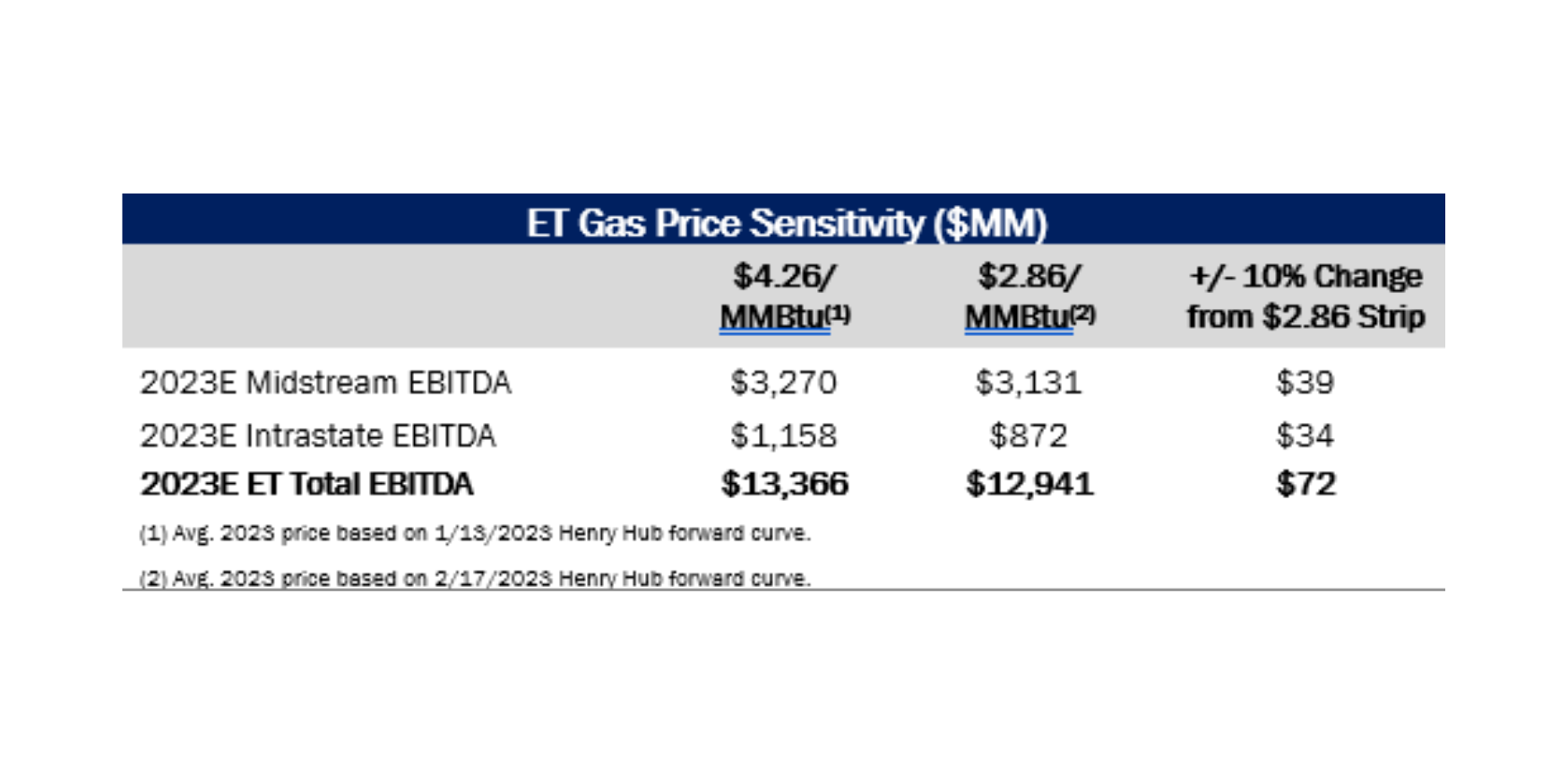

ET guided to 2023 Adj. EBITDA of $12.9-$13.3 billion, well below East Daley’s estimate of $13.4 billion in our company Financial Blueprint. Our forecast was based on our last Blueprint model released mid-January, when the forward Henry Hub price still averaged $4.26/MMBtu for 2023.

Henry Hub futures have fallen sharply in 2023 on a combination of mild winter weather and strong supply growth. As of Feb. 17, the forward curve averaged $2.86/MMBtu for the year, a 33% drop from our mid-January update ahead of the 4Q22 report.

Read Full Article

East Daley forecasts the Southeast will be short natural gas in 2026 and ’27 owing to more than 3 Bcf/d of demand pressure from Plaquemines...

Restrictions on US ethane exports to China have come to a head for the energy sector. The Department of Commerce’s Bureau of Industry and...

On May 30, EOG Resources (EOG) announced a $5.6B deal to acquire Encino Acquisition Partners, adding momentum to a recent surge in...

Shares of Kinetik Holdings (KNTK) have traded higher following its 1Q25 earnings update, boosted by bullish CEO commentary. East Daley is...

Natural Gas Weekly

Updates

Dirty Little Secrets

Annual Market Report

.png)