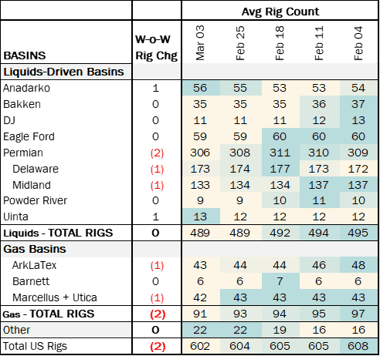

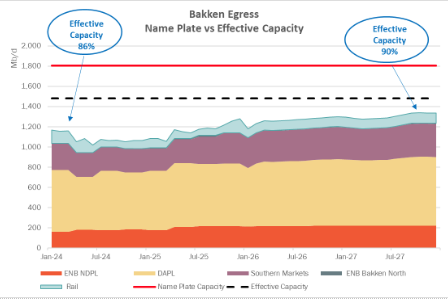

*UPDATED GRAPH FOR INFRASTRUCTURE* Executive Summary: Rigs: The total US rig count decreased by 2 rigs W-o-W and liquids-driven basins saw no change at 489 rigs for the week ending March 3. Infrastructure: Bakken pipeline takeaway is much tighter than it appears at first glance. Storage: East Daley expects a build of 1.526 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 15.

Rigs:

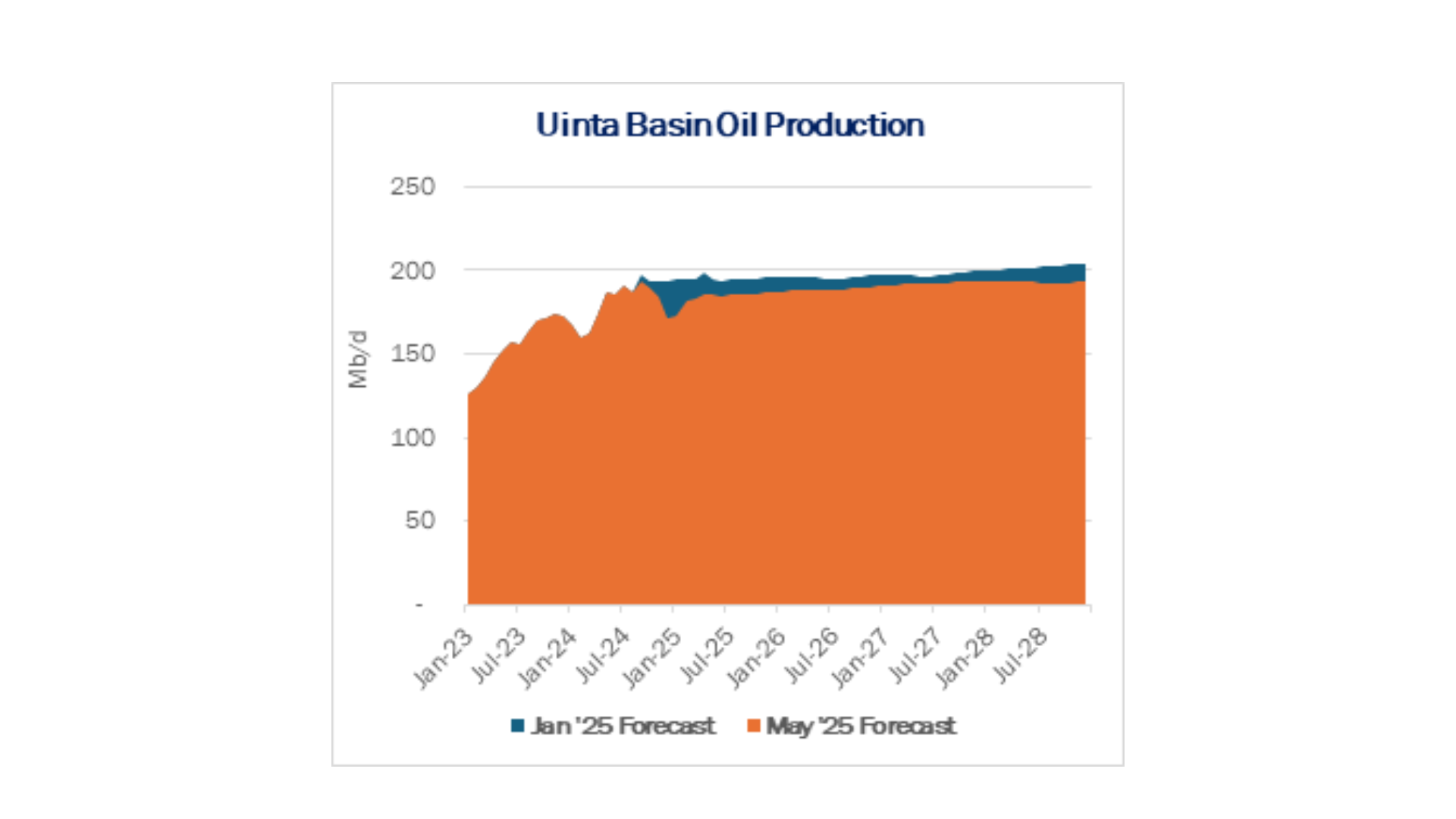

The total US rig count decreased by 2 rigs W-o-W and liquids-driven basins saw no change at 489 rigs for the week ending March 3. The Permian Basin lost 2 rigs, and the Anadarko and Unita each gained 1 rig. All other basins saw rig counts hold steady.

In the Midland Basin, Pioneer Resources and Birch Resources each dropped 1 rig for the March 3 week, whereas Ike Operating added 1 rig. In the Delaware, Petro-Hunt added 1 rig and Exxon and Devon each dropped 1 rig. In the Uinta, Blackstone Resources added 1 rig and Edison Operating added 1 rig in the Anadarko.

Infrastructure: *UPDATED GRAPH*

Bakken pipeline takeaway is much tighter than it appears at first glance. As Bakken production continues to grow, effective egress capacity will tighten, reaching 85% utilization in 2Q24 and 89% utilization by 4Q27 in East Daley’s Crude Hub Model.

The Bakken barrel has five avenues to reach crude markets: on Enbridge’s (ENB) North Dakota Pipeline (NDPL); on Dakota Access Pipeline (DAPL), operated by Energy Transfer (ET); south to the Denver-Julesburg Basin via Tallgrass’ Pony Express and Saddlehorn pipelines; north to the Canadian Mainline via Enbridge Bakken North Pipeline; or transport by rail.

EDA estimates Bakken shippers have 1,804 Mb/d of total nameplate capacity between these routes out of the Williston Basin. However, East Daley’s Crude Hub Model calculates ‘effective capacity’ of 1,480 Mb/d to show the primary routes where incremental production could move. To calculate effective capacity, we have adjusted railed capacity from a 2019 high of 280 Mb/d lower to 100 Mb/d. We also have revised capacity for Enbridge Bakken North Pipeline from nameplate of 149 Mb/d to only 5 Mb/d of effective capacity.

We believe both rail and the Bakken North line represent secondary market avenues out of the Williston. Rail has high transportation costs, and moving barrels via Enbridge Bakken North also incurs high tolls for shippers. To use the pipeline, shippers must move Bakken barrels north into the Canadian Mainline before traveling south to the Midwest market, effectively doubling the distance traveled. Moreover, the Bakken barrel is blended into Mainline volumes and loses any quality premium for the shipper.

East Daley’s Crude Hub Model forecasts NDPL to reach full capacity by 3Q24, while barrels traveling south on pipelines to the DJ Basin via Pony Express and Saddlehorn run into possible bottlenecks as soon as 4Q24. We expect DAPL to be the clear winner for moving new Bakken production. DAPL provides direct market access to Patoka and has capacity available for growth we forecast from the Bakken. East Daley forecasts DAPL is currently running at 82% utilization and expect throughput to climb to 91% by YE26.

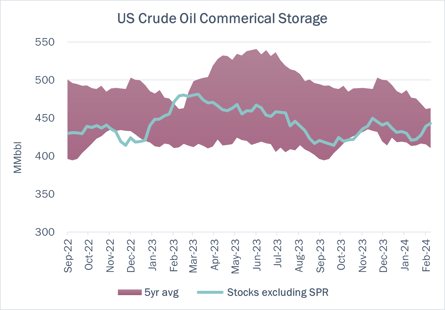

Storage:

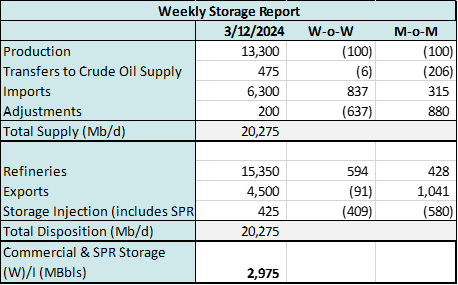

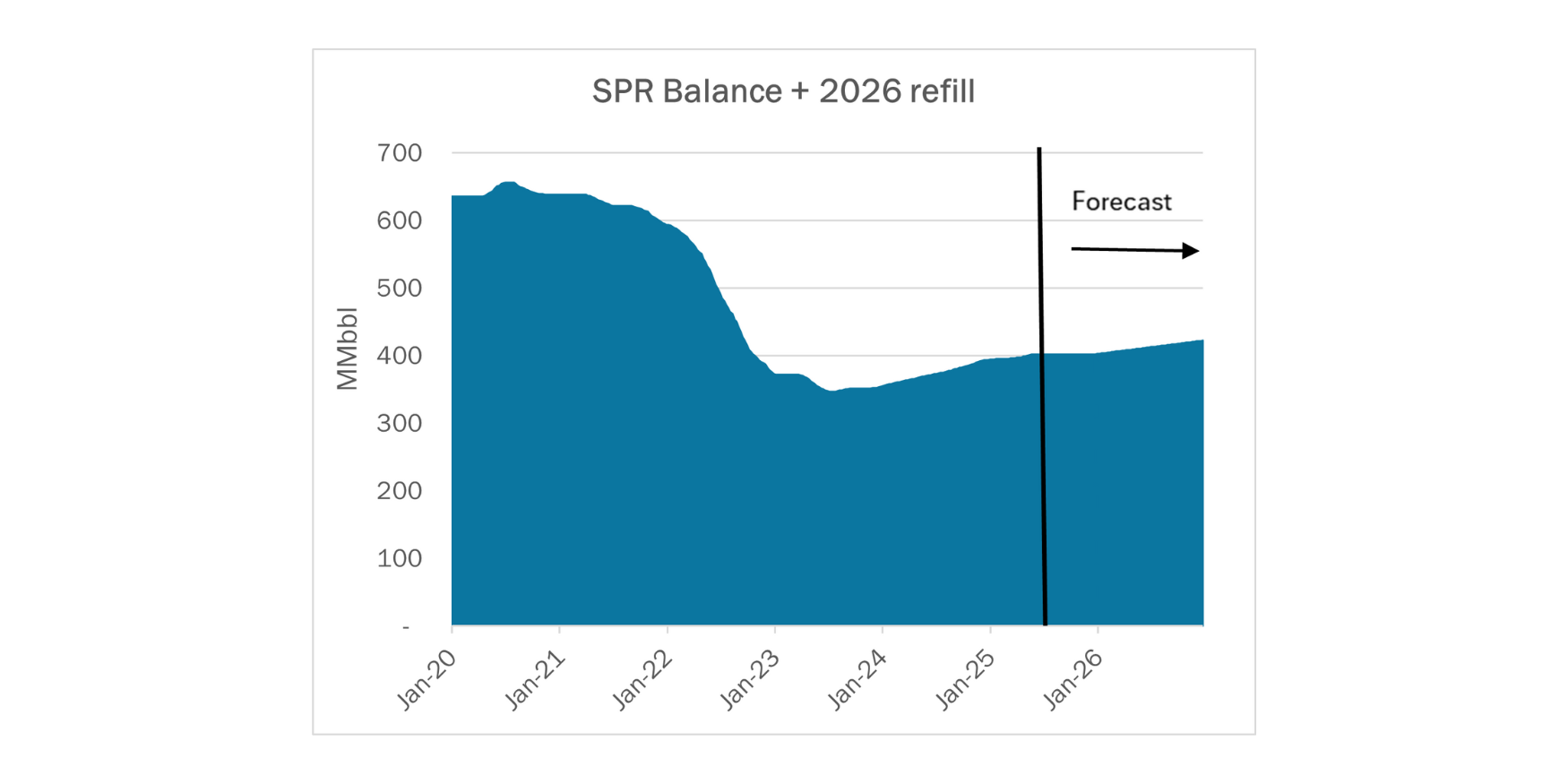

East Daley expects a build of 1.526 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 15. We expect total US stocks, including the SPR, will close at 810.076 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, fell by ~1% W-o-W in aggregate across all liquids-focused basins. Samples fell by 15% W-o-W in the Gulf of Mexico and 8% in the Eagle Ford, offset by ~6% increases in the Barnett and Williston. We expect US crude production to remain flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports increased by 909 Mb/d W-o-W to 6.4 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Nigeria and South America.

As of March 15, there was ~1381 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~26 Mb/d W-o-W, coming in at 15.63 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 31 vessels loaded for the week ending March 16 and 27 the prior week. EDA expects US exports to be 4.1 MMb/d.

The SPR awarded contracts for 2.99 MMbbl to be delivered in March 2024. The SPR has 361.556 MMbbl in storage as of March 12, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Pony Express Non-contract temporary volume incentive rates have been extended through June 30, 2024 on movements from Guernsey, WY or Sterling, CO to Butler and McPherson Counties KS and/or Kay County and Cushing, OK. (FERC No 2.60.0 IS24- 213, file February 29, 2024)

Enbridge Pipelines The uncommitted joint tariff rates from Clearbrook, MN to all delivery points on the Enbridge Flannigan South Pipeline were increased to reflect a corresponding increase in the rates of the upstream carrier, Enbridge Energy. The joint rates are equal to or less than the sum of the local rates. Committed rates are unchanged. (FERC No 4.3.0 IS24- 209, filed February 29, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)