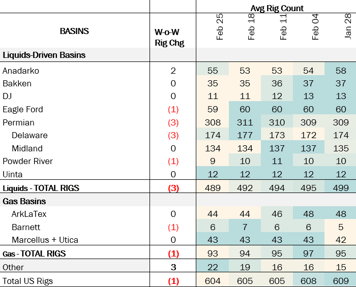

Executive Summary: Rigs: W-o-w the total US rig count decreased by 1 rig and liquids-driven basins decreased by 3 rigs for the February 25 week. Infrastructure: Enbridge (ENB) is making moves to solidify its position as the leading midstream operator for crude oil exports from the Corpus Christi market. Storage: East Daley expects a build of 2.975 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 8.

Rigs:

W-o-w the total US rig count decreased by 1 rig and liquids-driven basins decreased by 3 rigs for the February 25 week. The Permian Basin saw the most activity with the Delaware Basin losing 3 rigs, while the Powder River and Eagle Ford each lost 1 rig. The Anadarko Basin was the only basin to see an increase, gaining 2 rigs.

In the Anadarko Bain, Castle Resources and Mack Energy each added 1 rig. EOG dropped a rig in the Powder River Basin, and Blackbrush Oil & Gas shed 1 rig in the Anadarko. In the Delaware, Permian Resources, Devon and APA Corp. each dropped 1 rig.

Infrastructure:

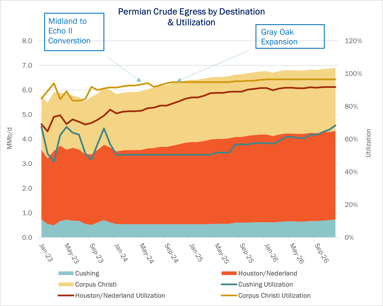

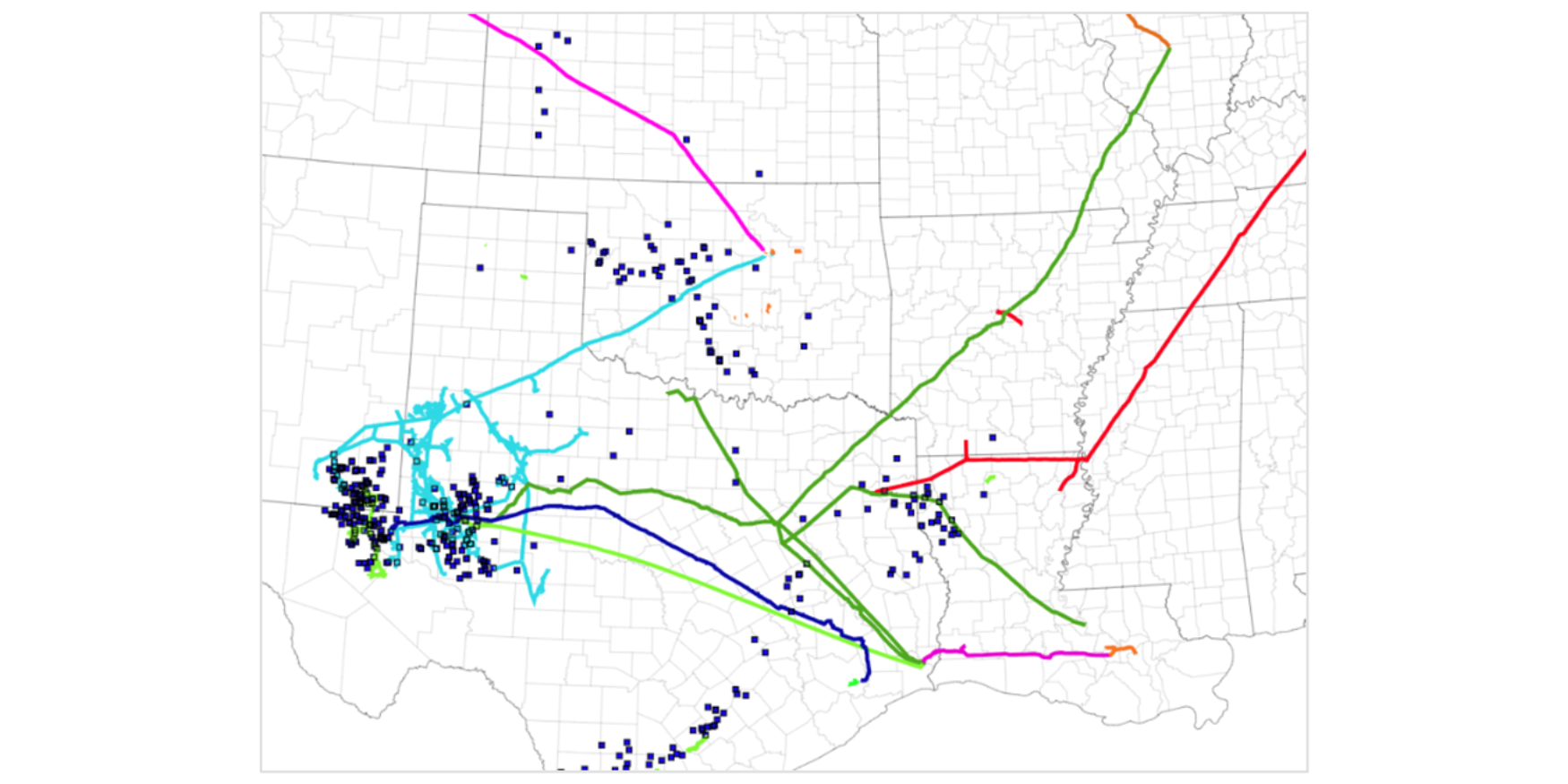

Enbridge (ENB) is making moves to solidify its position as the leading midstream operator for crude oil exports from the Corpus Christi market.

In a March 6 update, Enbridge announced it will hold an open season to add 120 Mb/d of capacity to Gray Oak Pipeline. The company is also building out its Enbridge Ingleside Energy Center (EIEC), reaching a deal to buy two adjacent docks from Flint Hills Resources. ENB plans to add 2.5 MMbbl of storage capacity at the newly acquired assets.

East Daley expects a relatively quick turnaround for the open season and Gray Oak expansion. We believe ENB plans to use drag-reducing agents (DRAs) to increase pipeline volumes. These expansions involve injecting chemicals to lower friction in flowing oil, and take little time to implement.

The project would take Gray Oak capacity to 1,020 Mb/d and make it the largest pipeline moving Permian Basin production to Corpus Christi. Gray Oak also moves the most crude oil to ENB’s docks at EIEC.

The Gray Oak expansion will be necessary for Corpus Christi to maintain its share of the Permian market. East Daley’s Crude Hub Model forecasts 245 Mb/d of production growth from the Permian Basin between July 2024 and YE24, which would easily fill the Gray Oak expansion. Assuming the Gray Oak Pipeline expansion were to come online in 2Q24, the additional egress could be filled in one quarter with new Permian growth.

Even with the added Gray Oak capacity, pipelines moving crude oil from the Permian Basin to the Gulf Coast will continue to run near capacity, reaching ~90% utilization by YE24, according to the Crude Hub Model. Total Permian Basin pipeline egress, including destinations to Cushing, would hit 80% utilization by the end of 2024.

Enbridge’s EIEC currently exports ~925 Mb/d, or ~40% of all production leaving Corpus Christi docks. The two additional docks will boost ENB’s market share to ~55%+ of all Corpus Christi exports. East Daley believes Enbridge will use the Gray Oak expansion to optimize volumes moved at the new docks. The acquisition also gives ENB optionality to move other products through the company’s docks.

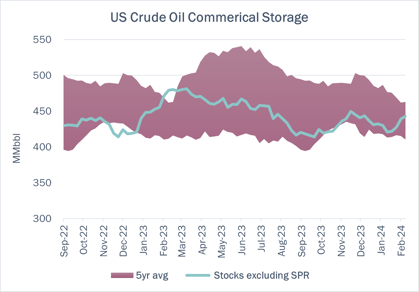

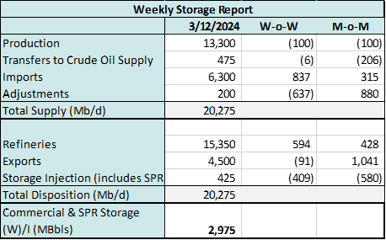

Storage:

East Daley expects a build of 2.975 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending March 8. We expect total US stocks, including the SPR, will close at 812.475 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, stayed flat across all liquids-focused basins, but rose ~6% in the Permian. We expect US crude production to grow to 13.3 MMb/d, up from 13.2 MMb/d W-o-W.

According to US bill of lading data, US crude imports decreased by ~922 Mb/d W-o-W to 6.3 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Nigeria and South America.

As of March 8, refiners had ~768 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~82 Mb/d W-o-W, coming in at 15.35 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 27 vessels loaded for the week ending March 9, and 24 vessels in the prior week. EDA expects US exports to be 4.5 MMb/d.

The SPR awarded contracts for 2.99 MMbbl to be delivered in March 2024. The SPR has 361.0 MMbbl in storage as of March 1, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Plains Oryx Permian Basin Pipeline LLC established initial rates for a gathering location at Flaming Snails Gathering in Eddy County, NM and associated rates with the agreement of at least one non-affiliated shipper. (FERC No 12.5.0 IS24- 189, filed January 31, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)