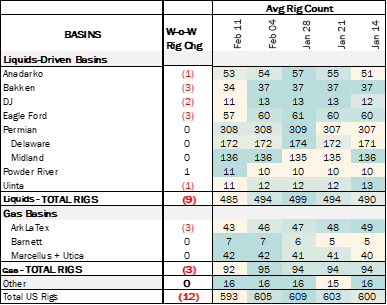

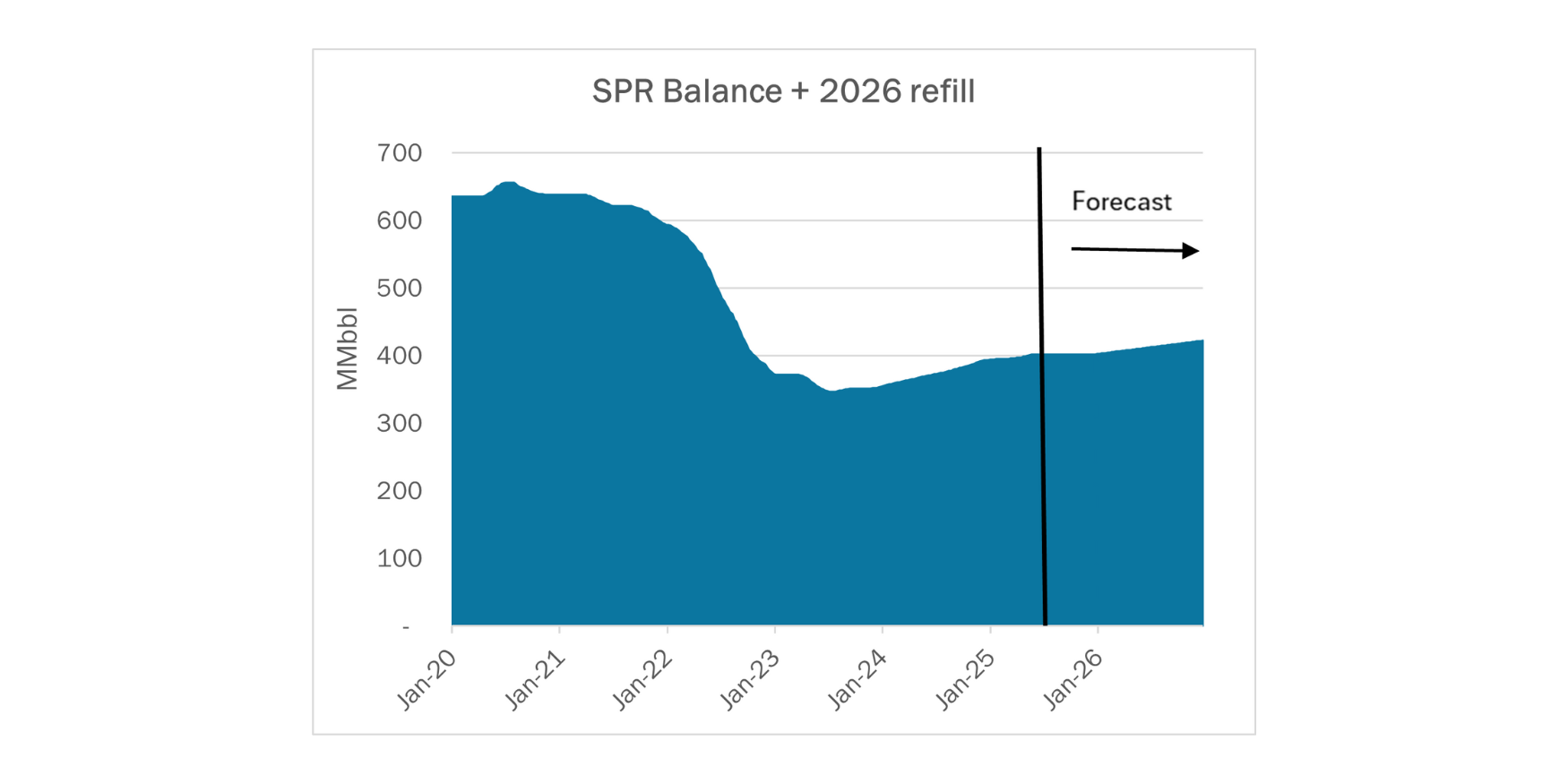

Executive Summary: Rigs: US rig activity declined sharply W-o-W due to a loss of 9 rigs in liquids-driven basins for the February 11 week. Infrastructure: Chord Energy (CHRD) and Enerplus (ERF) announced plans to merge last week in an $11B transaction creating an E&P focused on the Williston Basin. Storage: East Daley expects a build of 3.5 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending February 23. We expect total US stocks, including the SPR, will close at 810.876 MMbbl.

Rigs:

US rig activity declined sharply W-o-W due to a loss of 9 rigs in liquids-driven basins for the February 11 week. The Anadarko and Eagle Ford basins have remained on a steady decline, with operators in the Eagle Ford losing 3 rigs W-o-W. The Bakken and Denver-Julesburg experienced abrupt losses W-o-W after rigs had remained constant for several weeks. The Bakken lost 3 rigs and the DJ declined 2 rigs W-o-W.

Operators contributing to W-o-W rig loss in the Bakken were Grayson Mill Operating, Stephens Williston, and Neptune Operating, each dropping 1 rig. In the DJ, large operator Chevron (CVX) was behind the decline, dropping 2 rigs.

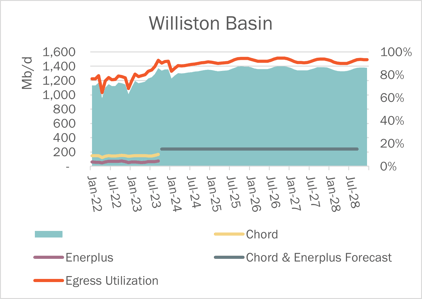

Infrastructure:

Chord Energy (CHRD) and Enerplus (ERF) announced plans to merge last week in an $11B transaction creating an E&P focused on the Williston Basin.

At a combined count of 7 rigs and crude oil volumes of ~167 Mb/d, CHRD-ERF would be one of the top Bakken producers. The two producers currently operate 1 rig in McKenzie County, 2 in Dunn County, and 4 rigs in Montrail County. The companies plan to close the merger in mid-2024.

The Williston Basin saw a significant uptick in volume in 3Q23 to 1.3 MMb/d, a gain of 147 Mb/d, or 12.7%. East Daley’s Crude Hub Model forecasts Williston Basin effective pipeline egress utilization at 83% in 2023. East Daley’s Production Scenario Tools forecast production to grow 65 Mb/d on average in 2024, increasing egress utilization to 88% on pipelines leaving the basin. At the close of 2024, EDA forecasts Enbridge North Dakota Pipeline (NDPL) and Dakota Access Pipeline (DAPL) to be running at 88% utilization.

Chord and Enerplus both have guided to hold production flat in 2024 at 91–101 Mb/d and 64 Mb/d, respectively. Between the two companies they have 1.3 million net acres and foresee 10 years of development opportunities at their current pace.

From September 2022 to September 2023, Chord’s volume grew by 26.4% or 18.8 Mb/d whereas Enerplus saw a 1.1% volume reduction, down -1.1 Mb/d.

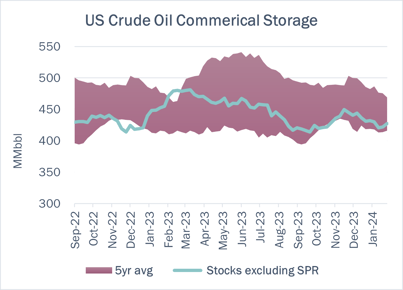

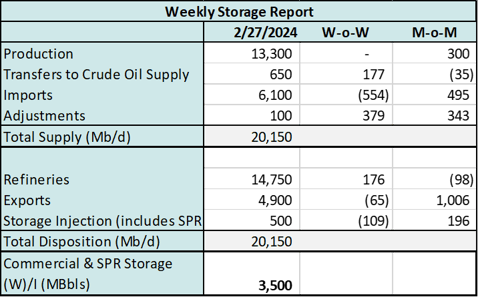

Storage:

East Daley expects a build of 3.5 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending February 23. We expect total US stocks, including the SPR, will close at 810.876 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased by 0.44% in liquids-focused basins. The Rockies saw a 0.25% decrease W-o-W. The Permian Basin saw a decrease of .9% W-o-W. The Rockies has excellent pipeline sample coverage at ~92%, whereas the Permian Basin does not have good pipeline sample coverage at ~40%. We expect US crude production to remain at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by ~550 Mb/d W-o-W to 6.1 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Nigeria and Argentina.

As of February 16, there was ~707 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase 185 Mb/d W-o-W, coming in at 14.75 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 27 vessels loaded for the week ending February 23 and 34 vessels the prior week. EDA expects US exports to be 4.9 MMb/d.

The SPR awarded contracts for 2.1 MMbbl to be delivered in February 2024. The SPR has 360.112 MMbbl in storage as of February 16, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

NuStar Logistics L.P. NuStar Logistics, L.P. raised its Base Transportation Fee on the West Leg – South Texas Crude by ~$0.10 or ~6.78% on shipments from Cushing, OK to Port Arthur or Houston, TX effective 1, 2024. (FERC No 3.22.0 IS24- 176, filed January 30, 2024)

White Cliffs Pipeline L.L.C White Cliffs announced a joint tariff from Platteville, CO to Nederland, TX via Centurion, ETP and Permian Express Pipelines. Uncommitted and committed rates, MVC of 10,000+b/d, have been established. Effective February 1, 2024. (FERC No 8.0.0 IS24- 192, filed January 31, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)