Crude Oil Edge: September 5, 2023

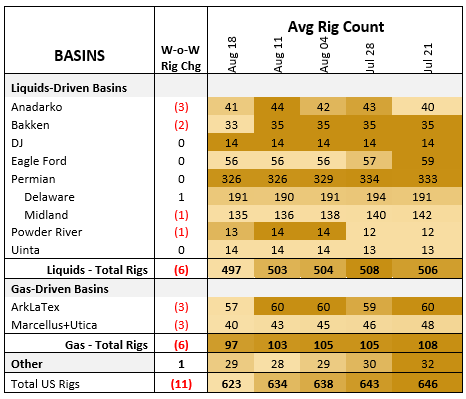

Rigs - The US rig count decreased by 11 W-o-W to bring the total count to 623. Liquids basins lost 3 rigs in the Anadarko, 2 in the Bakken, and 1 in the Powder River Basin. The Permian Basin held steady, losing 1 rig in the Midland but gaining 1 rig in the Delaware sub-basin.

Rigs - The US rig count decreased by 11 W-o-W to bring the total count to 623. Liquids basins lost 3 rigs in the Anadarko, 2 in the Bakken, and 1 in the Powder River Basin. The Permian Basin held steady, losing 1 rig in the Midland but gaining 1 rig in the Delaware sub-basin.

The total rig count is in line with East Daley Analytics’ forecast of 619 rigs. The Permian Basin has lost 7 rigs since mid-July, in line with our models.

EDA attributes the decline in Permian rigs in part to mergers and acquisitions (M&A) and overall capital discipline strategies in the upstream. As producers merge, rigs are cut on the combined properties to lower costs and demonstrate returns to investors. A recent review by East Daley found Permian producers involved in recent M&A deals have cut rigs by 30% since the start of 2023.

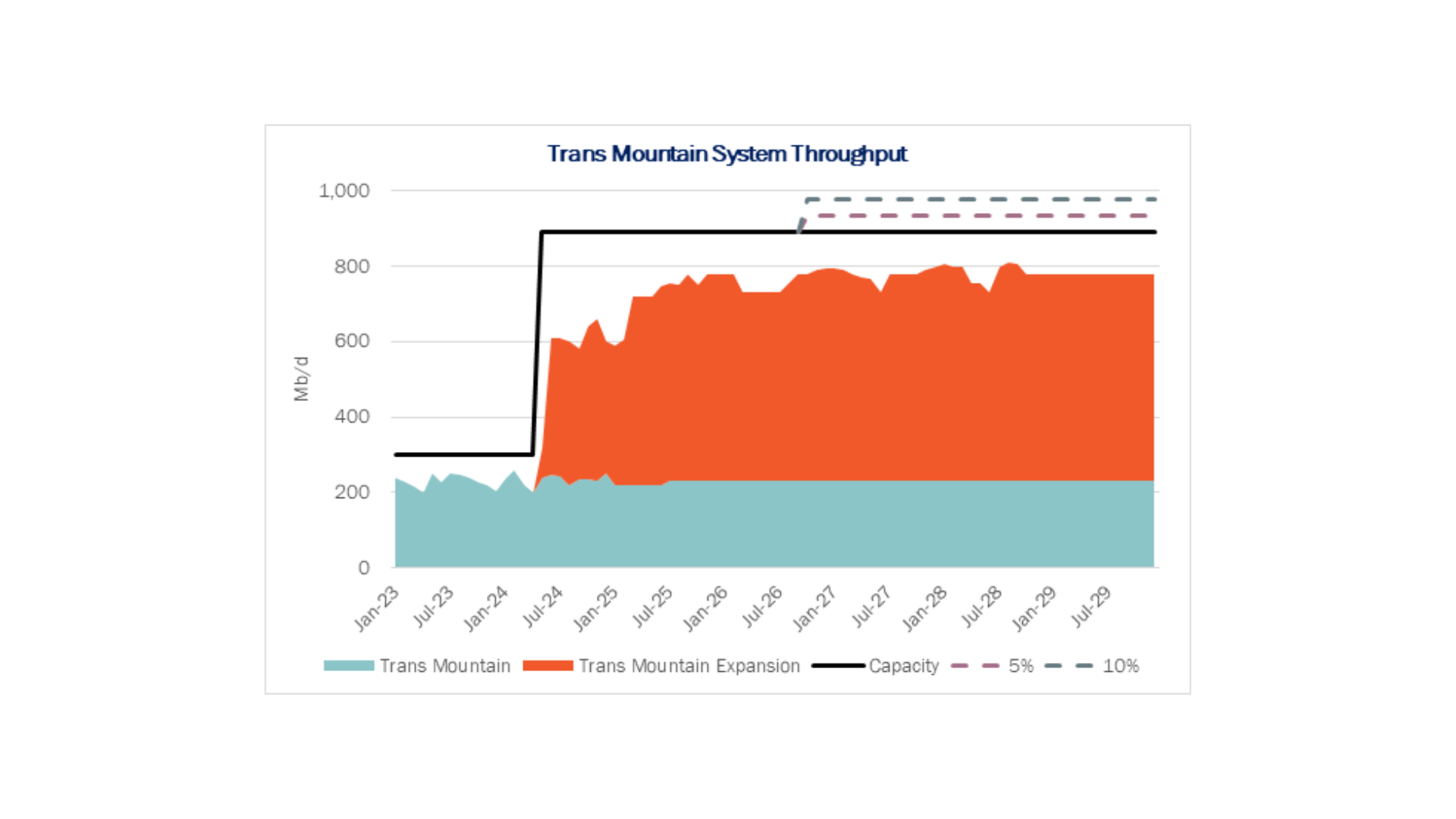

Infrastructure - East Daley models current Permian Basin crude oil production at 6.1 MMb/d. We forecast supply to grow 2.5% through the end of 2023 and 6% in 2024, according to our Crude Hub Model. YE23 production reaches 6.27 MMb/d and 6.67 MMb/d by YE24.

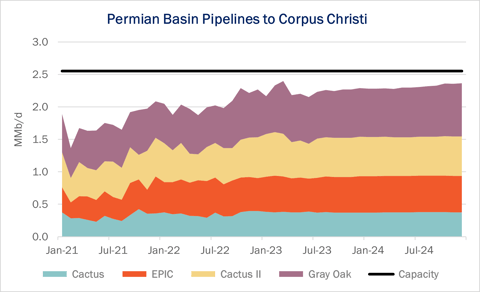

As Permian production grows, US crude oil exports will expand in tandem. Corpus Christi is the preferred Gulf Coast export hub, but the four main pipelines transporting crude (Epic, Cactus I, Cactus II and Grey Oak) are 90% utilized. While export docks have spare capacity, the pipelines to Corpus Christi are running nearly full, which means additional Permian barrels are being diverted to terminals in Houston and the Louisiana Offshore Oil Port (LOOP).

As Permian production grows, US crude oil exports will expand in tandem. Corpus Christi is the preferred Gulf Coast export hub, but the four main pipelines transporting crude (Epic, Cactus I, Cactus II and Grey Oak) are 90% utilized. While export docks have spare capacity, the pipelines to Corpus Christi are running nearly full, which means additional Permian barrels are being diverted to terminals in Houston and the Louisiana Offshore Oil Port (LOOP).

To ease the egress constraints, Enbridge (ENB) is considering expanding the Gray Oak Pipeline by 200 Mb/d, bringing the pipeline’s capacity to 1.1 MMb/d. The project could have compounding effects for Enbridge as the company could leverage the capacity to increase volume through its Ingleside terminal in Corpus Christi. We estimate the Ingleside terminal is currently at 70% utilization and exports ~1.1 MMb/d, according to the Crude Hub Model.

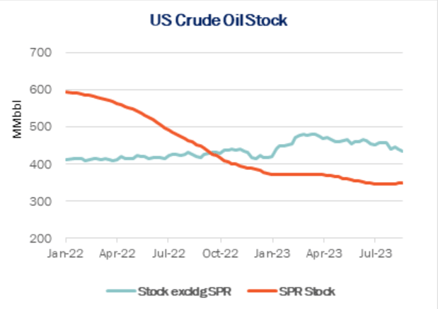

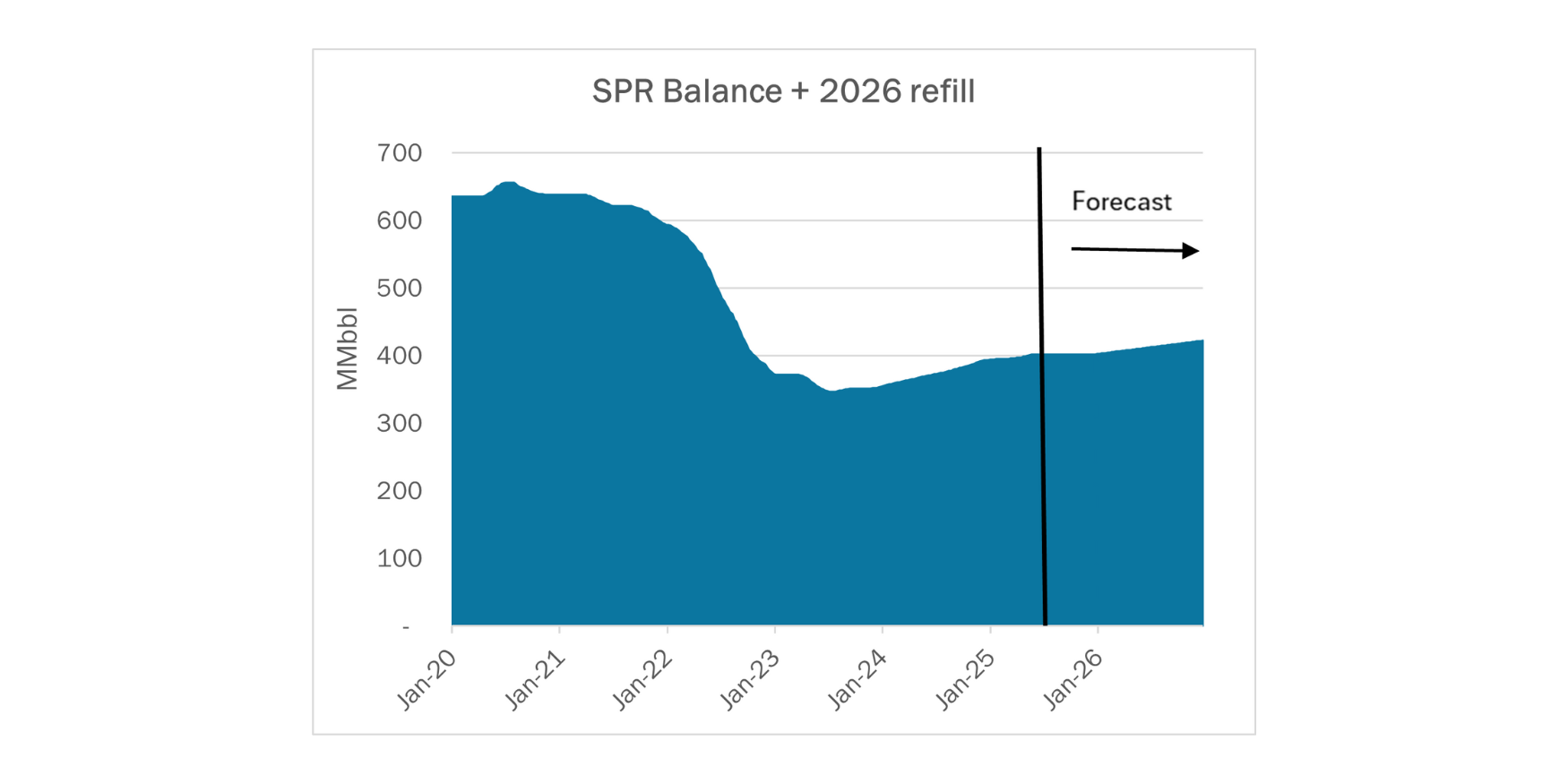

Storage - US crude oil commercial stocks (excluding SPR stocks) in 2023 have vacillated within 10% of the rolling eight-month average, indicating a stable industry environment. By contrast, the Strategic Petroleum Reserve (SPR) has declined by ~300 MMbbl since January 2020 and is at a 50-year low.

The Department of Energy (DOE) has committed to restocking the SPR and presented three bid proposals for ~12 MMbbl. The first installment delivered 3.1 MMbbl in August, and the second installment will deliver 3.2 MMbbl in September. A third installment to deliver 6 MMbbl in November and December was canceled once WTI prices rose above $80/bbl. The DOE has committed to restocking the SPR in a price range of $72-73/bbl.

Crude Oil Edge

East Daley Analytics' Crude Oil Edge provides bi-monthly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We will explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export flows. Subscribe to Crude Oil Edge.

-1.png)