Executive Summary: Rigs: The total US rig count stayed flat W-o-W at 582 rigs for the March 31 week. Infrastructure: Enterprise Products (EPD) plans to convert its Seminole Pipeline back to crude oil service next year, part of a push by midstream companies that will add 320 Mb/d of Permian egress capacity over the next 12-16 months. Storage: East Daley expects an injection of 5.425 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 12.

Rigs:

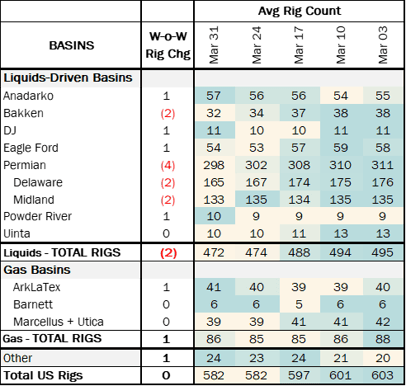

The total US rig count stayed flat W-o-W at 582 rigs for the March 31 week. However, liquids-driven basins did see rigs decline W-o-W to 472 rigs total, down 2 from 474 rigs the previous week. The Permian led the change by losing 4 rigs, 2 in the Delaware and 2 in the Midland. The Bakken also lost 2 rigs. The Anadarko, DJ, Eagle Ford and Powder River basins each added 1 rig W-o-W.

In the Delaware, Chevron (CVX) and Exxon (XOM) each dropped 1 rig W-o-W. Chevron now has 9 rigs in the Delaware and Exxon has 6. In the Midland, Diamondback Energy (FANG) and Pioneer Natural Resources (PXD) each shed 1 rig. Hess and Chord Energy each dropped 1 rig from systems in the Bakken.

Infrastructure:

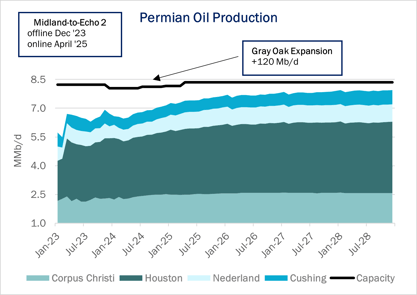

Enterprise Products (EPD) plans to convert its Seminole Pipeline back to crude oil service next year, part of a push by midstream companies that will add 320 Mb/d of Permian egress capacity over the next 12-16 months.

Earlier this week, EPD confirmed plans to return the 200 Mb/d Seminole (formerly known as Midland-to-Echo 2) back to crude oil service later in 2025. The project follows an announcement last month by Enbridge (ENB) to expand Gray Oak Pipeline by ~120 Mb/d from the Permian to Corpus Christi. The projects together will boost Permian Basin egress by 3% (+320 Mb/d), according to East Daley’s Crude Hub Model.

Since December 2023, Enterprise has been using Seminole to move NGLs from its Delaware and Midland gas processing facilities to its fractionator complex in Chambers County, TX. EPD is building a dedicated NGL line, the Bahia pipeline, and will no longer need Seminole to carry NGLs once Bahia is ready, executives said at EPD’s recent investor day presentation. EPD is targeting start-up of Bahia in 3Q25.

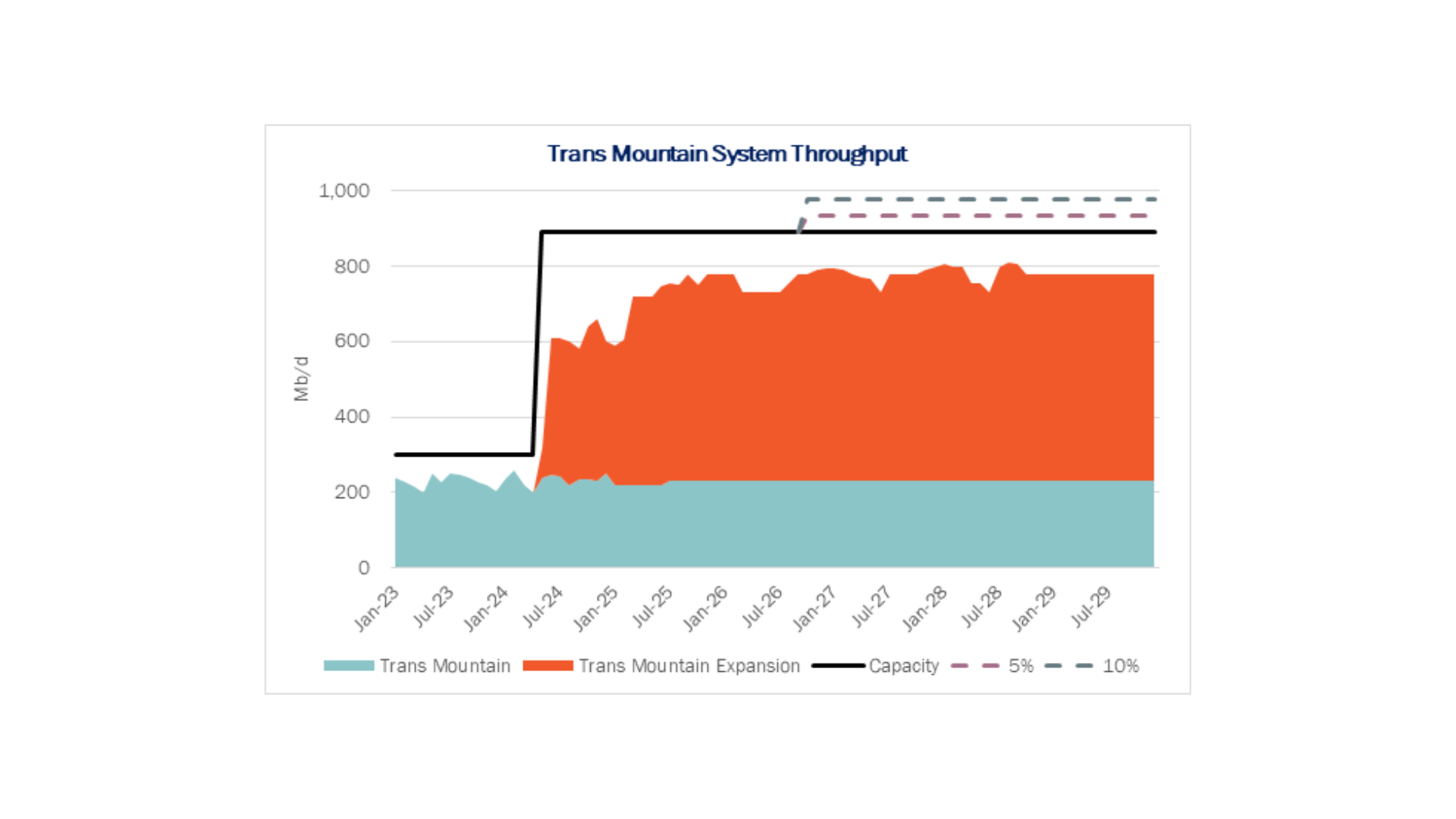

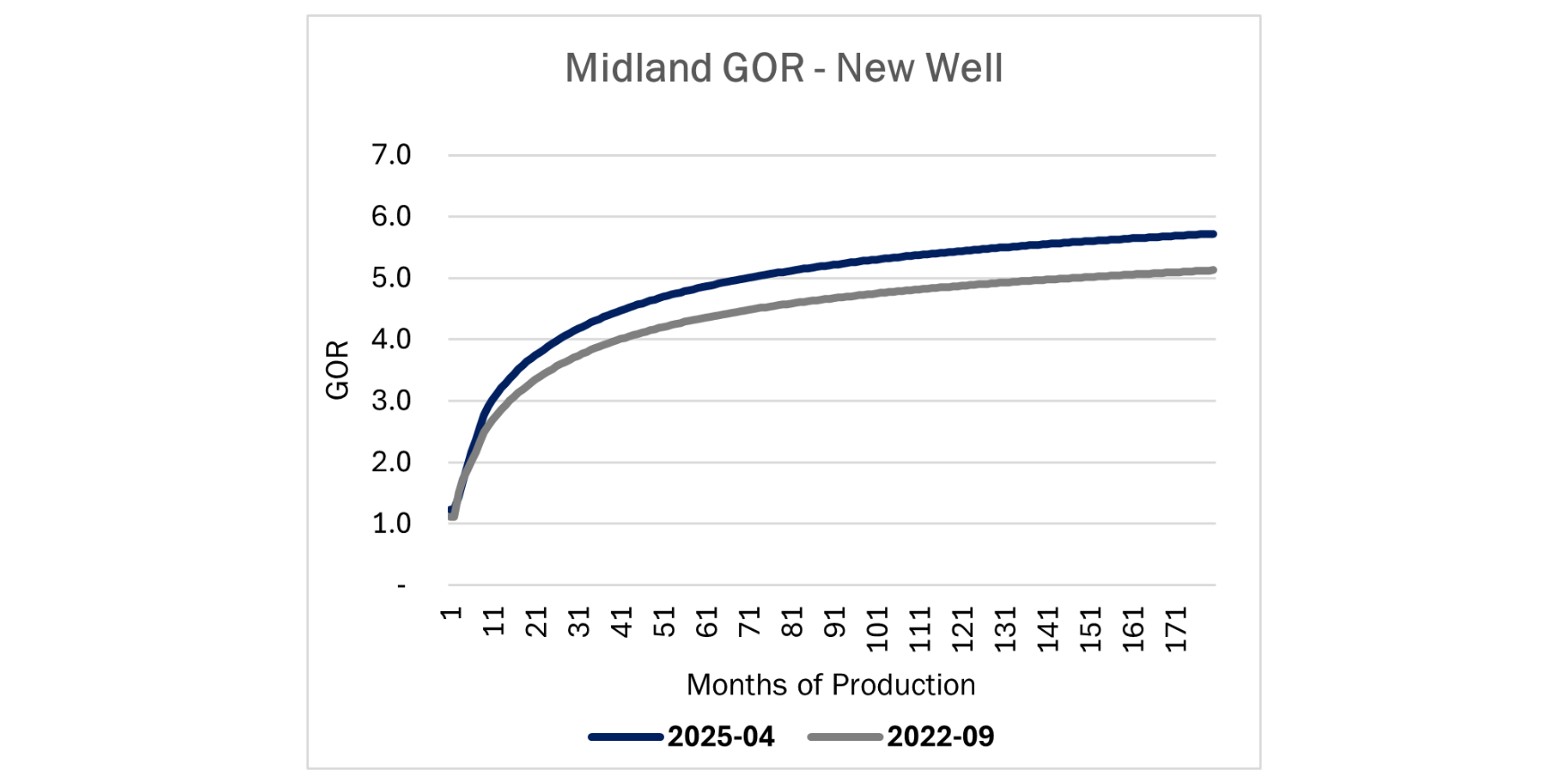

EDA’s Production Scenario Tools forecast Permian Basin crude oil production to grow 368 Mb/d from YE23 through 2024. With this growth, the Crude Hub Model shows Gray Oak will remain in the 85-90% utilization range as ENB increases egress by 80 Mb/d in 2H24 and another 40 Mb/d in 1H25, while Midland-to-Echo 2 reaches ~90% utilization within 12 months of returning to crude service (see figure). As Permian production grows 1.3 MMb/d through YE28, pipeline takeaway available today fills to 97% utilization out of the basin.

Storage:

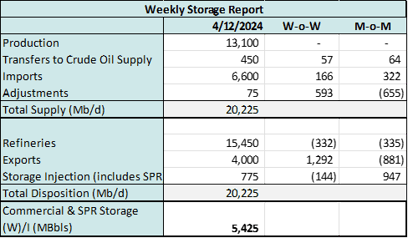

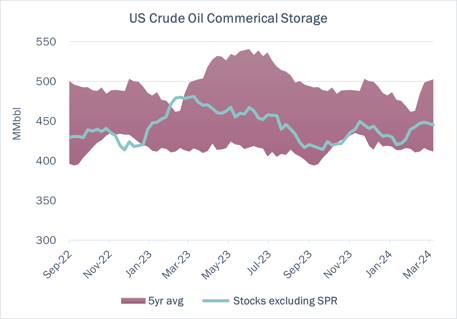

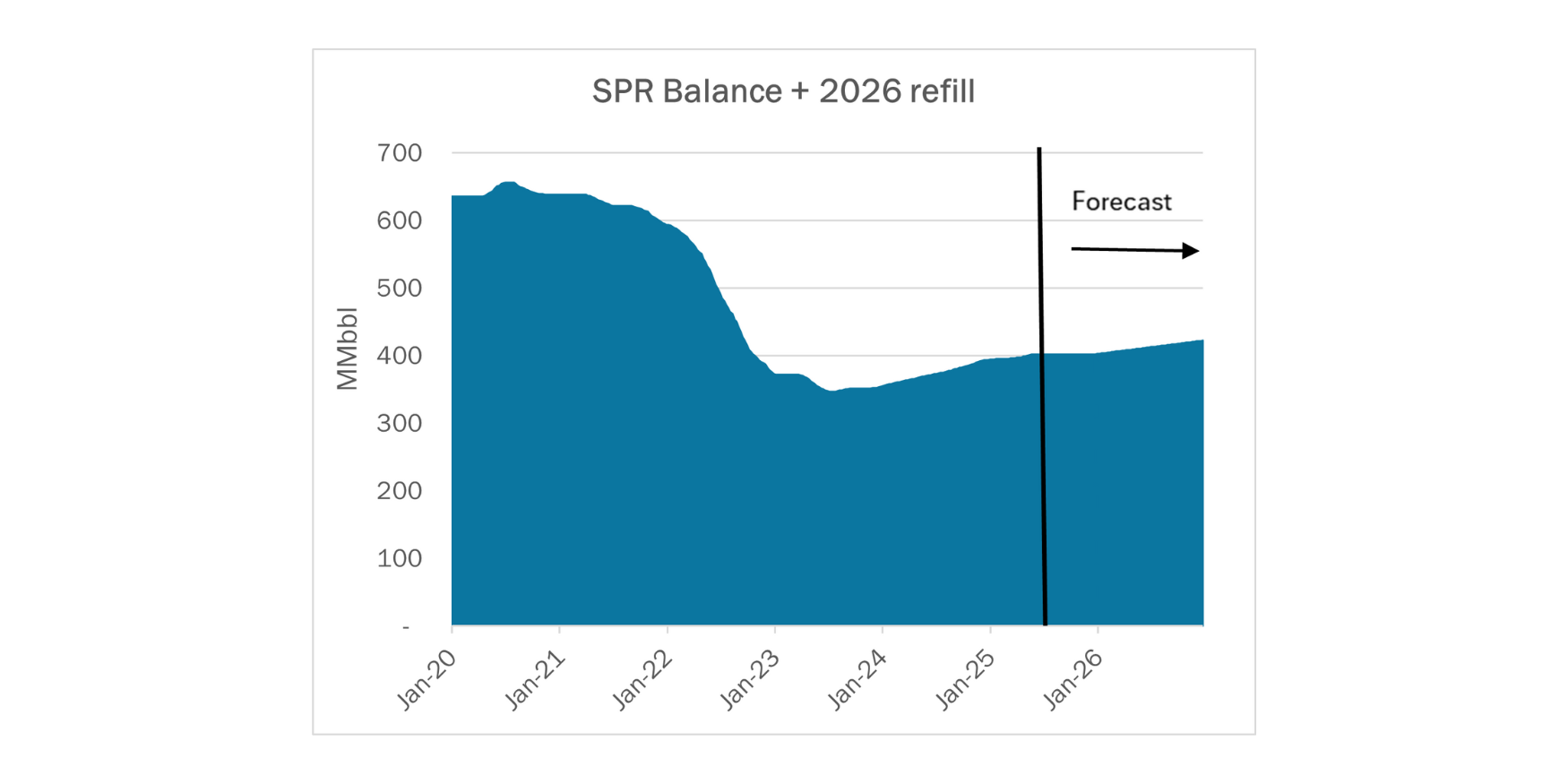

East Daley expects an injection of 5.425 MMbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 12. We expect total US stocks, including the SPR, will close at 826.919 MMbbl.

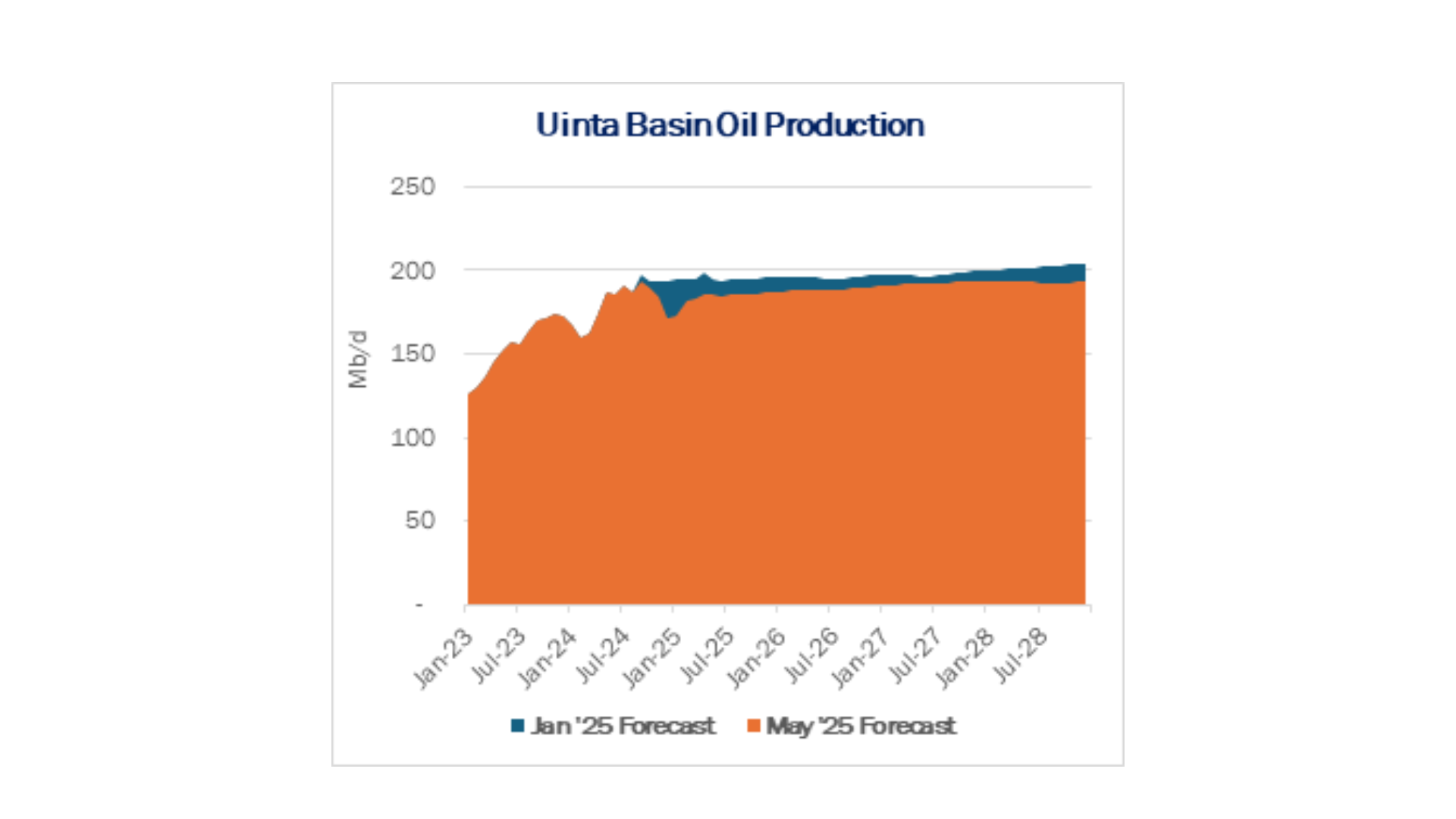

The US natural gas pipeline sample, a proxy for change in oil production, fell ~0.57% W-o-W across all liquids-focused basins. Samples increased 0.64% in the Williston Basin and 6.55% in the Gulf of Mexico. The declines were offset by a 0.57% decrease in the Rockies and 3.86% in the Permian. We expect US crude production to remain flat at 13.1 MMb/d.

According to US bill of lading data, US crude imports decreased by 166 Mb/d W-o-W to 6.6 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Brazil and Venezuela.

As of April 12, there was ~1,350 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~270 Mb/d W-o-W, coming in at 15.45 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 24 vessels loaded for the week ending April 13 and 18 the prior week. EDA expects US exports to be 4.0 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in April 2024. The SPR has 364.9 MMbbl in storage as of April 12, 2024.

Regulatory and Tariffs

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC A temporary uncommitted discount was established from existing Zena, Reeves County, TX to Mentone, Loving County, TX. The discount rate is effective May 1, 2024. (FERC No 2.18.0 IS24- 239, filed March 28, 2024)

Tesoro High Plains Pipeline Company LLC The North Dakota gathering line connecting production to Mandan refinery, rail facilities and interstate pipelines has canceled committed rates for expiring TSAs. Administrative changes for services in the tariff have been modified with no rate changes effective May 1, 2024. (FERC No. 6.97.0 IS24- 240, filed March 28, 2024

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at corey@goarbo.com or phone at 202-505-5296. https://www.goarbo.com/

-1.png)