Chesapeake Energy (CHK) will pull back on drilling and starting new wells in response to low natural gas prices. CHK is one of several producers indicating plans to slow gas output, prompting East Daley Analytics to revise our Haynesville supply forecast.

In the company’s 4Q23 earnings call, CHK said it will defer turning on new wells in its operating areas in the Northeast and Haynesville, putting ~1 Bcf/d of potential production on hold by 4Q24. The producer will also limit the number of turned-in-line wells (TILs) to 30-40 for the year, after already starting 25 TILs in January and February, executives said.

The large number of new producing wells from CHK would help explain why East Daley’s Haynesville gas sample has been on the rise in 2024 despite falling gas prices. East Daley’s ArkLaTex Basin sample for February gained 487 MMcf/d over January (the January flows were skewed by freeze-offs) and rose 354 MMcf/d over December ’23 flows.

Chesapeake also guided to a slowdown in drilling and well completions. The producer plans to drop a rig and frac crew from both the Northeast and ArkLaTex. The changes are expected to reduce 2024 capital spend by nearly 20% and lower production by ~15%, executives said, while maintaining productive capacity at around 1.18 Bcf/d in the Haynesville. CHK expects to see a ~30% decline in quarterly volumes from 4Q23 to 4Q24.

Southwestern Energy (SWN) did not provide 2024 guidance due to the pending merger with Chesapeake. In its 4Q23 earnings, SWN said its Haynesville production averaged ~1.6 Bcf/d, down slightly from full-year production of 1.74 Bcf/d. SWN reported 13 drilled but uncompleted wells (DUCs) at YE23. We expect SWN to follow CHK’s lead in 2024 and possibly drop a rig or two and defer completions until gas prices rebound.

East Daley counts 5 CHK rigs in the Haynesville, including 2 rigs on Williams’ (WMB) Louisiana/Magnolia system and 3 on Energy Transfer’s (ET) Enable Haynesville system. We also count 8 SWN rigs in the Haynesville as of February 23, split 5-3 between DT Midstream’s (DTM) Blue Union and ET’s Enable systems.

Comstock Resources (CRK) is also responding to low prices. CRK ran 7 rigs through February but expects to drop to 5 rigs for the rest of 2024. The producer said it will release the 2 rigs from its core Haynesville acreage this month. CRK had previously planned to use 7 rigs this year. Comstock expects to see a 6-7 month lag between activity reduction and production, with volumes flat in 1H24 and declining in 2H24.

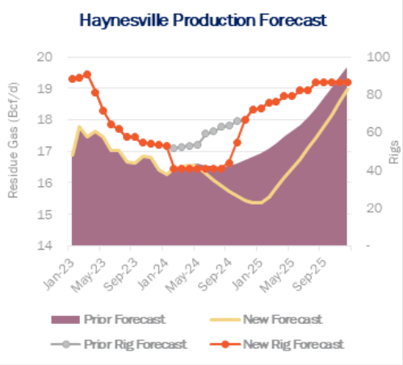

EDA’s latest ArkLaTex Basin Supply and Demand Forecast, released prior to the latest producer guidance, models flat Haynesville gas production through August 2024 and expects producers to add rigs back starting in June ’24 (see gray line in figure). We are revising our outlook lower for 2024 rigs and production given the latest guidance. We now forecast Haynesville gas production to average 16 Bcf/d in 2024, reaching a low in December 2024 of 15.3 Bcf/d (see yellow line in figure). - Oren Pilant Tickers: CHK, CRK, DTM, ET, SWN, WMB.

New Webinar: Big Picture and Bottom Line – Q1 Market Update

Join East Daley CCO Justin Carlson on Wednesday, March 10 for a new webinar reviewing market developments from 1Q24. In “Big Picture and Bottom Line – Q1 Market Update,” EDA will look at market trends in crude, gas and NGLs since our Dirty Little Secrets report. Topics include Permian growth or slowdown, the big picture on Louisiana and ripple effects on gas, the LNG pause, and midstream M&A. Join us March 10 for the 1Q23 Market Update.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)