The Daley Note: September 20, 2023

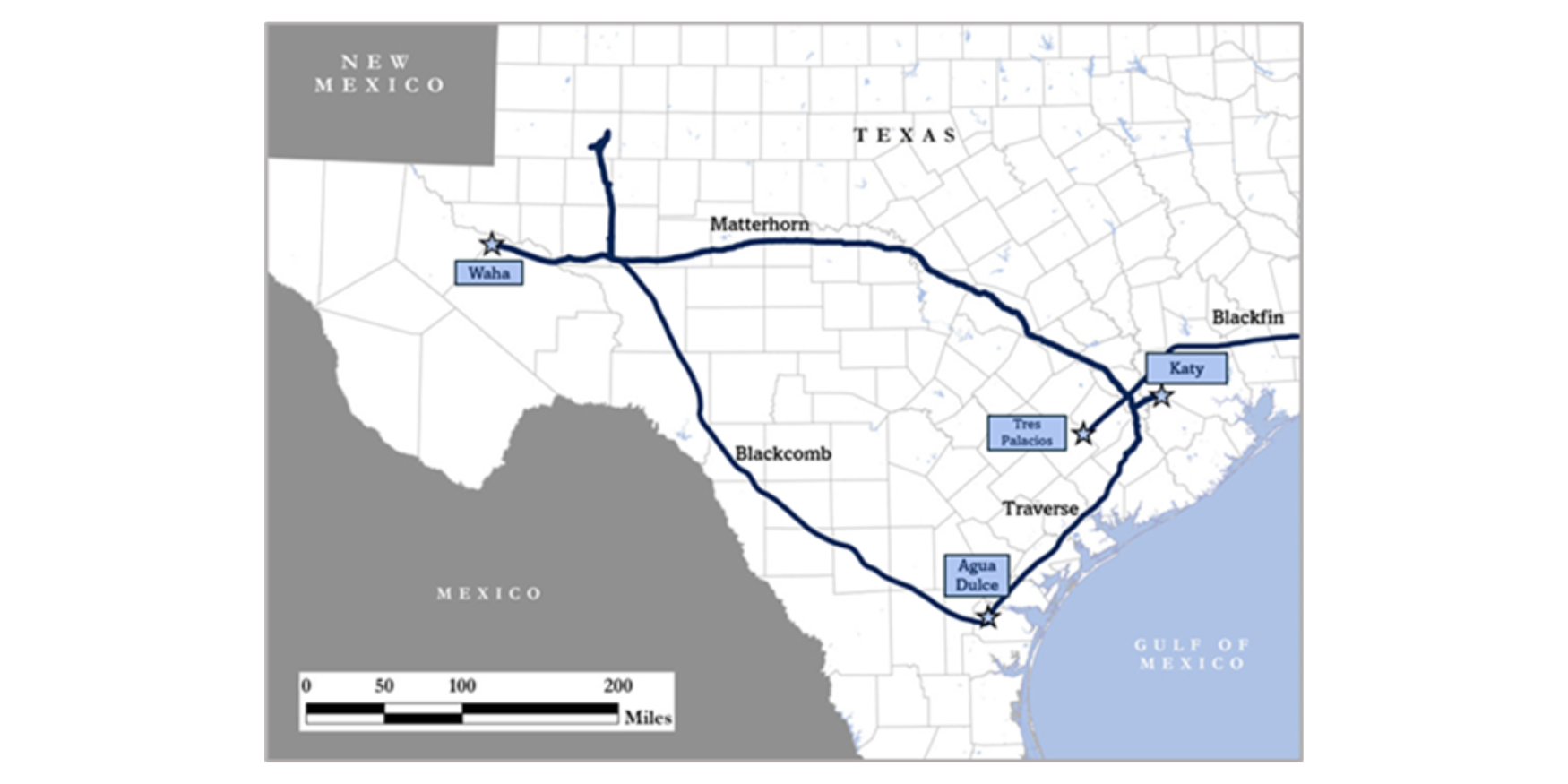

Mountain Valley Pipeline (MVP) has filed with regulators to increase maximum tariff rates by 80% or more. The request comes in response to massive cost increases absorbed by the project to battle legal and permitting issues.

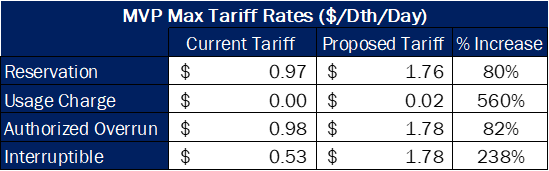

In a September 12 filing with the Federal Energy Regulatory Commission (FERC), MVP proposes to raise the daily capacity reservation charge to $1.76/Dth from a current rate of $0.97/Dth for the maximum tariff, along with other rate increases (see table). The request comes as project costs for the pipeline have ballooned from $3.7B to $6.7B, according to the filing. The revised rates would bring ROI to 12.35%, MVP said.

East Daley Analytics view these proposed recourse shipping rates, even if accepted by FERC, as more symbolic than material for MVP and operator Equitrans Midstream (ETRN). As reflected in the ETRN Financial Blueprint, the 2 Bcf/d MVP is fully subscribed under negotiated contracts with 20-year terms; any change to the maximum tariff would not apply to these negotiated rates. These contracts also insulate ETRN from downside if MVP runs under capacity, as EDA expects is likely when the pipeline starts up.

These negotiated contracts do include a cost overrun sharing mechanism, however, and the cap in these contracts has already been hit. This conclusion was backed by our friends and regulatory experts at ARBO, as well as ETRN Investor Relations.

The proposed rate changes can still provide some minor upside to ETRN, allowing the company to charge higher fees for interruptible shippers. MVP under optimal operating conditions can transport more than its contracted capacity, and the pipeline could contract this extra space to other shippers. The revised tariffs also create a unique scenario where a counterparty default may actually provide upside and allow MVP to recontract that space at higher rates.

From a broader view, the filing with FERC highlights the exorbitant cost to build a greenfield pipeline out of Appalachia and earn a reasonable return. MVP has fought adverse legal rulings since 2018 and racked up $3B in additional costs, according to the filing. A rate of ~$1.80/Dth would be prohibitive for Marcellus and Utica shale gas producers, equal to 150% of current commodity prices in the basin. The high bar shows why another big pipeline project out of the Northeast is unlikely. – Alex Gafford Tickers: ETRN.

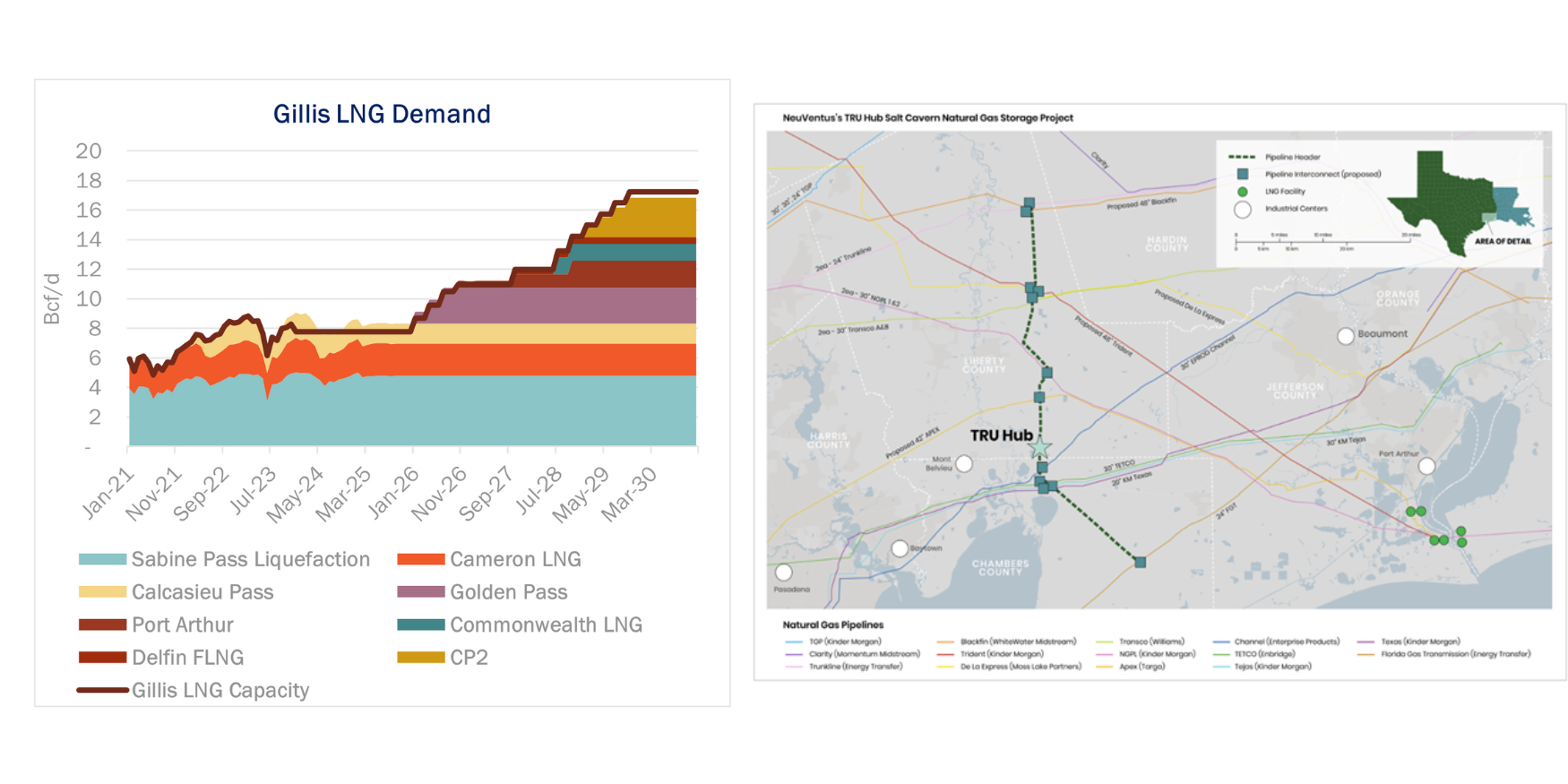

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides bi-monthly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

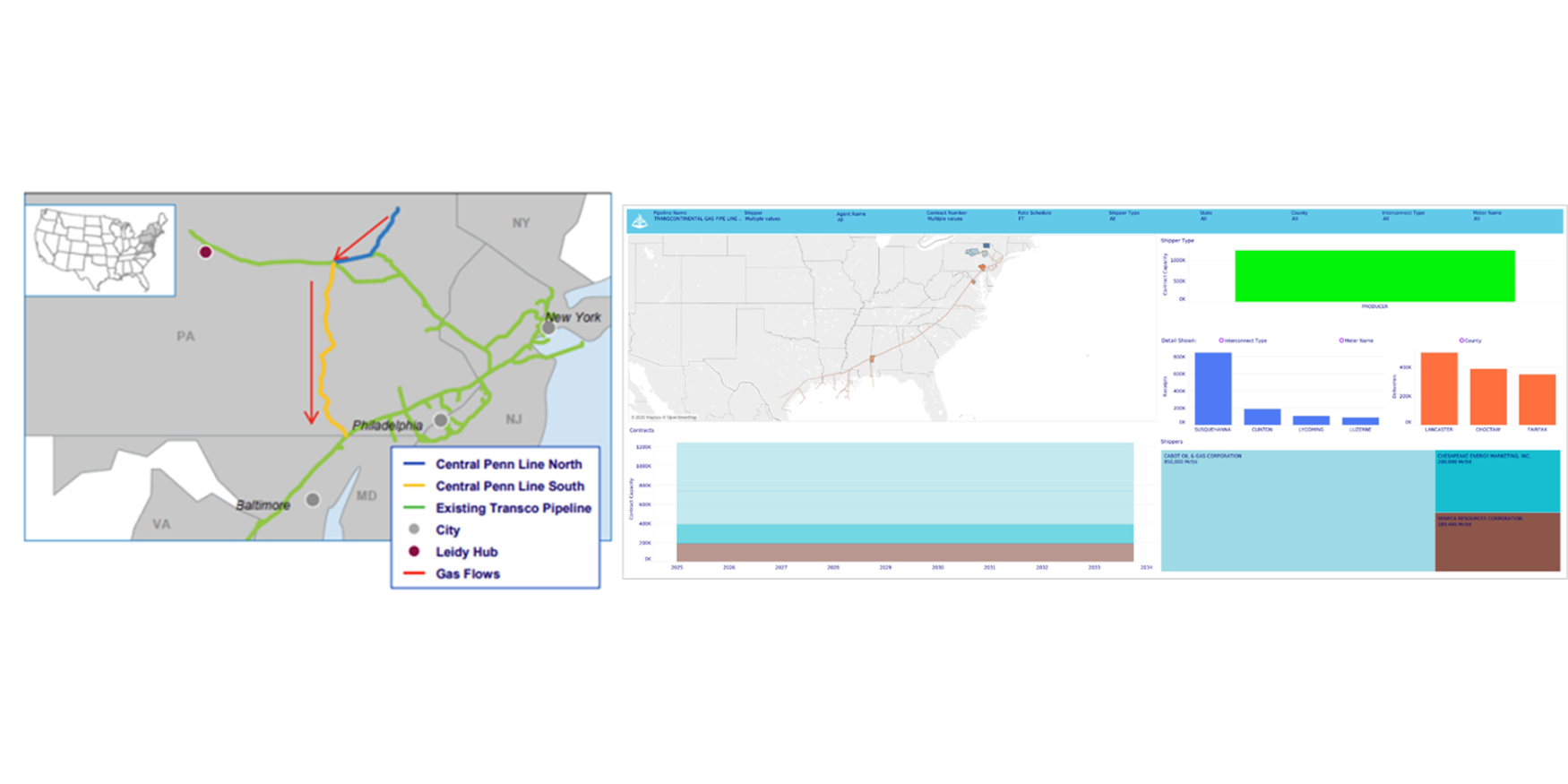

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)