The Daley Note: February 22, 2023

Don’t lay the blame on Old Man Winter for falling natural gas prices.

Analysts and investors are pointing to an unseasonably mild winter in key regions for plummeting natural gas prices. The Henry Hub front-month contract is down about 70% from the $7 price level at the start of December 2022. On Tuesday, the March 2023 contract fell 19.7c to settle at $2.076/MMBtu, according to CME price data.

The Midwest and Northeast have seen mostly above-average temperatures since the calendar flipped to 2023. The Northeast in particular has been balmy, with record-breaking warmth across the region in January. New York City, for example, saw no snow in January and 31 consecutive days of above-average temperatures for the first time in history, according to local meteorologists.

No doubt, above-average temperatures during peak seasonal demand is bad for the bulls. However, East Daley contends the problems in natural gas go deeper, and could last much longer.

A year ago, our Macro Supply & Demand Forecast identified a growing market imbalance through 2023 caused by rapid production growth. We’ve been warning ever since of the likelihood of lower natural gas prices through the 2023 calendar. In our view, month-to-month temperature swings are less concerning than these structural forces in setting prices.

But don’t take our word for it. Take a look at storage activity this winter compared to previous seasons. After adjusting for weather, we find storage activity have been consistently weak this heating season.

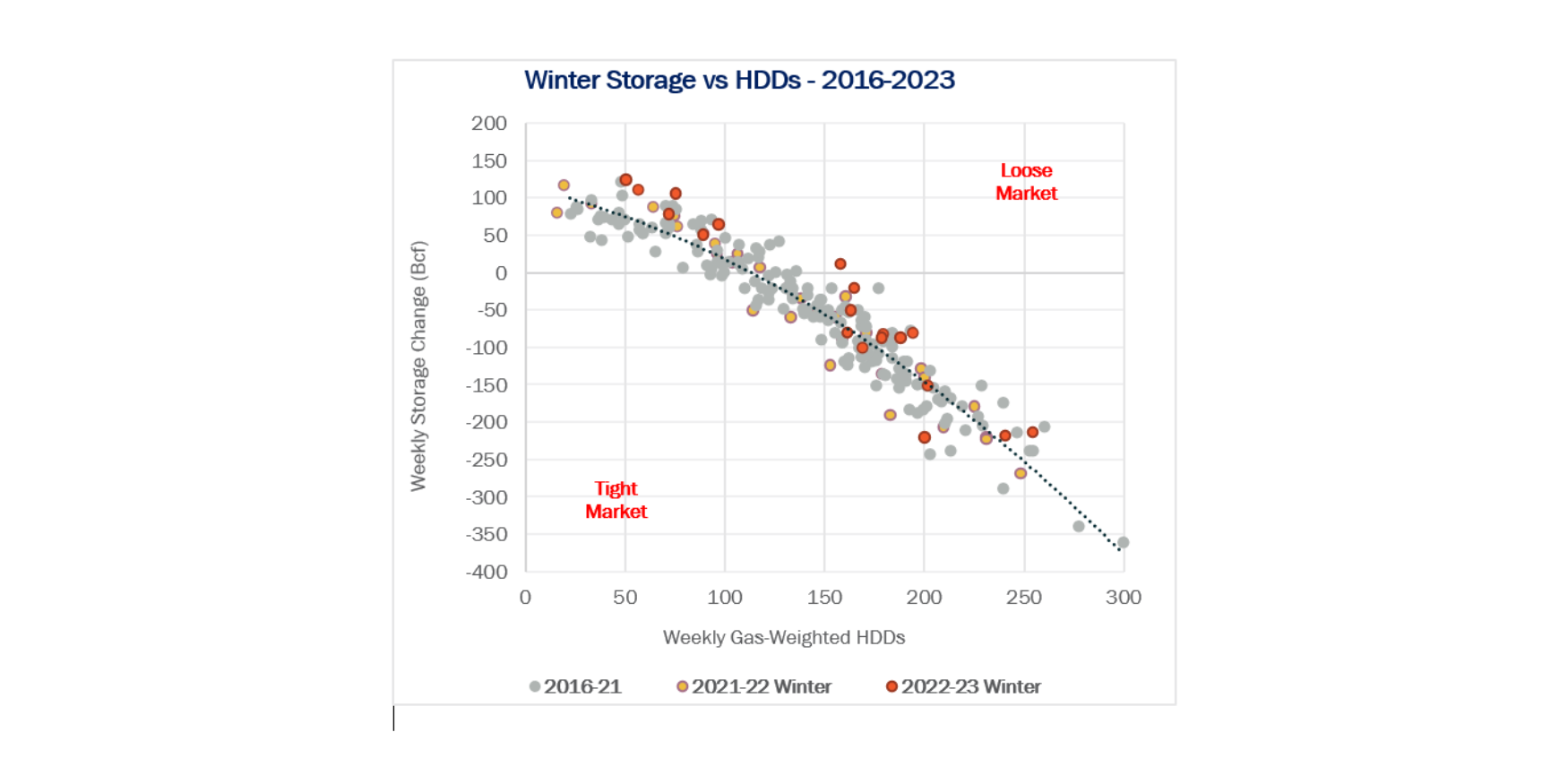

The figure shows historical gas-weighted heating degree days (HDDs) from the National Weather Service (NWS) for the October-April period. We plot HDDs to the underground storage activity reported by the Energy Information Administration (EIA) for the corresponding weeks. Natural gas inventory changes are highly correlated to temperatures, as more gas is pulled from storage to meet demand when the mercury drops.

As the figure shows, the 2022-23 winter hasn’t been a total bust. Bitterly cold Arctic blasts moved through the Lower 48 in late December and at the end of January, resulting in two of the 10 coldest weeks in the historical NWS data sample dating to 2016 (shown in the lower right quadrant of the figure).

The problem is storage withdrawals have been underwhelming compared to activity in past winters with similar temperatures. Weak storage pulls have has been a consistent feature of the market recently, regardless if the winter has trended bullish or bearish. In our weather-adjusted model, 15 of 19 weeks this winter have featured below-normal storage withdrawals. By contrast, the market was much tighter last winter. We count 11 weeks during the 2021-22 heating season when storage withdrawals beat expectations based on prevailing temperatures (HDDs).

East Daley recently predicted natural gas prices would fall below $2 this year due to oversupply. We can’t pinpoint the exact cause from the EIA storage data, but the loose underlying market balance this winter supports our thesis. We will further explore these dynamics in our latest market update for clients, “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” scheduled on Thursday, Feb. 23. Sign up to attend this webinar. – Andrew Ware.

Dirty Little Secrets: After Hours – The Natural Gas Undoing Project

East Daley will host a webinar on Thursday, Feb. 23 at 1 PM EST to look deeper into the natural gas story. In “Dirty Little Secrets: After Hours – The Natural Gas Undoing Project,” East Daley explores the short- and long-term supply and demand factors driving natural gas prices. Are market risks being accurately priced in the forward curve? East Daley explores the short- and long-term dynamics driving the natural gas market. Sign up to attend our latest webinar.

Stay Ahead of the Market with Natural Gas Weekly

East Daley Analytics’ Natural Gas Weekly provides a weekly update to our monthly Macro Supply and Demand Forecast. The update covers rigs, flows, production, prices and capacity constraints that materially change our view on supply and demand. This update highlights what investors and traders need to monitor in natural gas to ensure they are on the right side of the market. Contact us for more information on Natural Gas Weekly.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.