The Daley Note: November 9, 2022

Strong drilling activity in South Texas is lifting the outlook for Enterprise Products (EPD). Since early 2022, East Daley has seen a notable jump in rig counts on EPD's Eagle Ford system according to our Midstream Activity Tracker, leading to supply growth in our asset forecast.

EPD's Eagle Ford system is the company's third largest by earnings; we model $270 million of operating margin for 2022 in our company Blueprint Financial Model. EPD - Eagle Ford includes six operating plants with more than 2.1 Bcf/d of natural gas processing capacity, as well as two idled gas plants with 500 MMcf/d of combined capacity. The processing facilities are fed by a vast network of gathering lines including EPD’s South Texas system, the Delmita system, and EPD’s 6,900-mile Texas intrastate system.

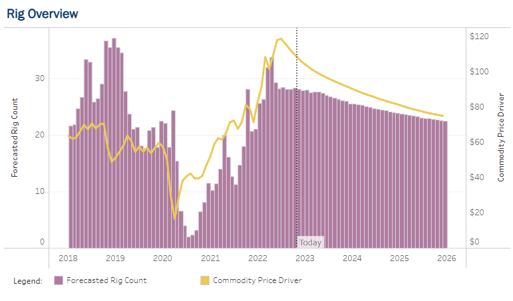

East Daley's Midstream Activity Tracker counted 26 rigs on EPD - Eagle Ford for the Oct. 23 week, up from 20 rigs at the start of 2021. Activity hit a peak of 37 rigs in late May as WTI prices surged past $100/bbl, according to rig allocations in the MAT (see figure). The increased activity on EPD - Eagle Ford tracks with overall growth in South Texas; regional rig counts totaled 92 at the end of October, up 24 rigs this year.

Clients can review historical rigs and volumes by producer on EPD - Eagle Ford in East Daley's Energy Data Studio, as well as our system-level outlook for rigs and supply. Please log in here for access to Energy Data Studio. EOG Resources (EOG) and private operator Lewis have been the main counterparties on EPD - Eagle Ford, accounting for ~40% of system supply. EOG and Lewis were recently running 3 and 2 rigs, respectively.

With the higher rig counts, our model shows steady growth in gas volumes gathered and processed by EPD - Eagle Ford. We forecast gas throughput on the EPD system to average 1.73 Bcf/d in November 2022, up 10% Y-o-Y. Our view is consistent with 3Q22 results reported by Enterprise on Nov. 1. The company said fee-based gas processing volumes rose by 64 MMcf/d from its South Texas facilities. EPD reported at $12 million Y-o-Y gain from the South Texas assets in 3Q, primarily due to higher processing margins.

Our latest system-level forecast anticipates rigs on EPD - Eagle Ford will hold at 28 until mid-2023, when we expect overall Eagle Ford activity drops due to lower forward prices on the WTI curve (see figure). Based on our forecast, gas supply on EPD - Eagle Ford continues to climb, reaching a peak of 1.95 Bcf/d in our outlook. Please contact us for more information on the Midstream Activity Tracker, Energy Data Studio, or company Blueprint Financial Models. – AJ O'Donnell Tickers: EOG, EPD.

Dirty Little Secrets 2023 – Is Another Infrastructure Wave Ahead?

Is Midstream on the cusp of another infrastructure wave? East Daley will explore the potential in our annual Dirty Little Secrets market report in early December. Click here to receive updates on the 2023 Dirty Little Secrets report.

The Russia-Ukraine conflict has pushed commodity prices higher and spurred greater global demand for US energy products. Meanwhile, more disciplined growth from the upstream has infrastructure finally filling up across commodities. Will exports power the next infrastructure boom?

Dirty Little Secrets is East Daley’s annual report on energy markets and the road ahead for Midstream. We share our macroeconomic outlooks for US oil, natural gas and NGLs, highlight key infrastructure opportunities, update on the state of the Energy Transition, and share our view on Midstream’s future role in energy.

For updates on the 2023 Dirty Little Secrets report, please click here.

East Daley, RBN Spotlight Targa in New Webinar

East Daley teamed up with RBN Energy on Monday (Nov. 7) to discuss the new Spotlight Report on Targa Resources (TRGP). Rob Wilson, East Daley VP Capital Markets, joined RBN CEO David Braziel in a Spotlight Live Session webinar to review the outlook for Targa and the key takeaways from the Spotlight Report.

Miss Monday's Spotlight Live Session webinar? Click here to review the event.

3Q22 Earnings Previews Now Available

East Daley has published a complete group of 3Q22 Earnings Previews and Blueprint Financial Models for midstream companies within our coverage. Quarterly Earnings Previews and Blueprints are now available for Antero Midstream (AM), Crestwood Equity (CEQP), Enbridge (ENB), EnLink Midstream (ENLC), Enterprise Products (EPD), Energy Transfer (ET), Equitrans Midstream (ETRN), Kinder Morgan (KMI), Kinetik Holdings (KNTK), Magellan Midstream (MMP), MPLX (MPLX), ONEOK (OKE), Plains All American (PAA), Summit Midstream (SMLP), Targa Resources (TRGP), TC Pipelines (TRP), Western Midstream (WES) and Williams (WMB).

Our Earnings Previews include quarterly earnings forecasts compared to Street consensus, a detailed list of the top assets that will impact the quarter, analysis of near- and long-term risks to future earnings, along with forecasts for Adj. EBITDA by segments. Please log in to access these reports.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.