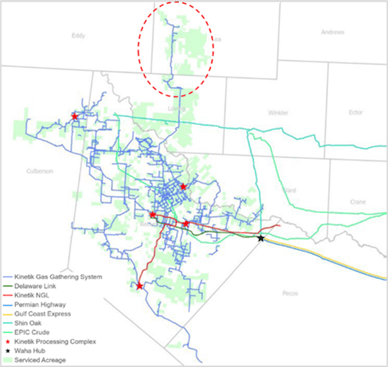

Kinetik (KNTK) has started service on a new pipeline that extends the company’s West Texas G&P system into New Mexico, posing new competition for some midstream names in the heart of the Delaware Basin.

During the company’s 4Q23 earnings call, executives revealed KNTK completed the pipeline extension on January 18, 2024. The new rich-gas pipeline runs 20 miles north into Lea County, NM.

KNTK will gather volumes on its G&P “super-system” in West Texas, comprised of the Raptor and Alpine High systems. The two gathering systems combined have 2.0 Bcf/d of processing capacity across five complexes. According to KNTK, the expansion is backed by a long-term gathering and processing agreement with a large-cap counterparty that includes a significant minimum volume commitment.

East Daley Analytics has tracked Kinetik since the company went public in February 2022, combining the former Altus Midstream with BCP Raptor, the owner of EagleClaw Midstream. We were bullish on the merger, which created the largest pure-play midstream company in the Permian Basin. Since forming the company, Kinetik has added new pipelines to interconnect the Raptor and Alpine High systems.

Kinetik also has built front-end amine treating at all its processing facilities, enabling the expansion into New Mexico. Much of the gas produced in the northern Delaware is “off-spec” due to high CO2 and H2S content.

According to system data in Energy Data Studio, Kinetik exited 2023 at flows of ~1.56 Bcf/d on its Delaware super-system, in line with our forecast in the KNTK Financial Blueprint. Assuming the new 20-inch pipe into New Mexico will bring 200-250 MMcf/d onto the system, KNTK is well situated to handle additional volumes using spare processing capacity.

The additional volumes and margin from treating fees will add to Kinetik’s bottom line. Based on the KNTK Financial Blueprint, EDA estimates the company would see a 5% lift to Adj. EBITDA in the Midstream Logistics segment and a 3% increase to total EBITDA from the extension project, assuming average volumes of 200 MMcf/d.

As a new entrant into southern Lea County, Kinetik could siphon volumes from established G&P systems in the area. Given its location, the pipeline extension will most likely impact volumes from Targa Resources’ (TRGP) Lucid and EnLink Midstream’s (ENLC) Delaware systems. Both gather substantial volumes from a diverse group of producers in southern Lea County, NM. Users in Energy Data Studio can screen these and other G&P systems in the Delaware Basin to better understand counterparty risk. –James Taylor Tickers: ENLC, KNTK, TRGP.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch our latest product, the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact insight@eastdaley.com.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.

-1.png)